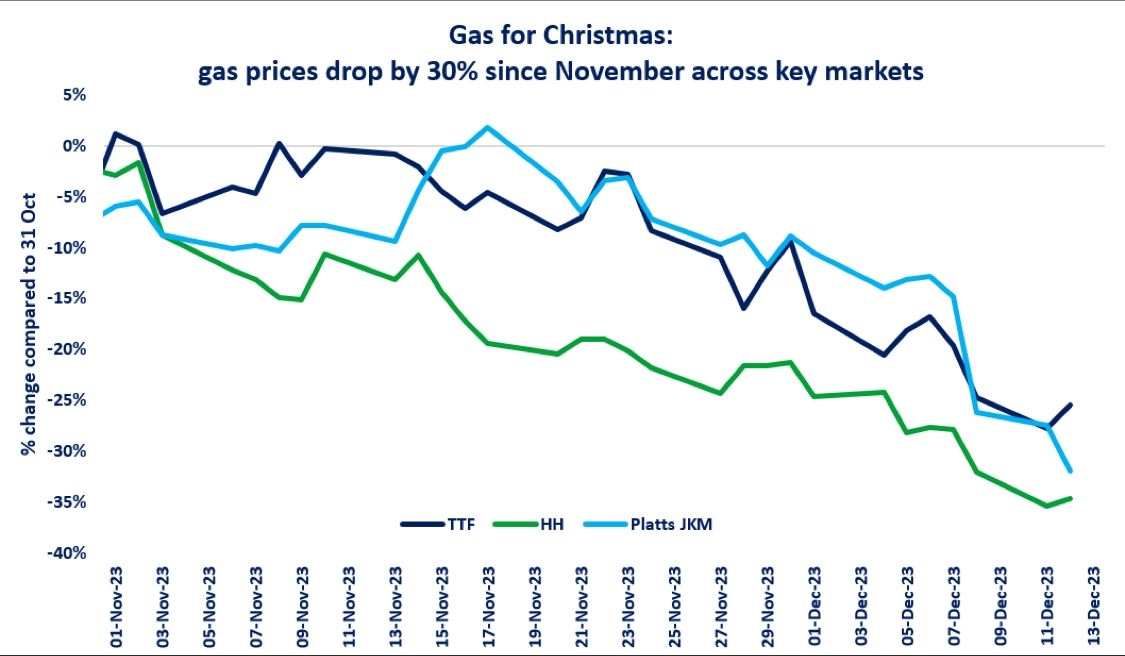

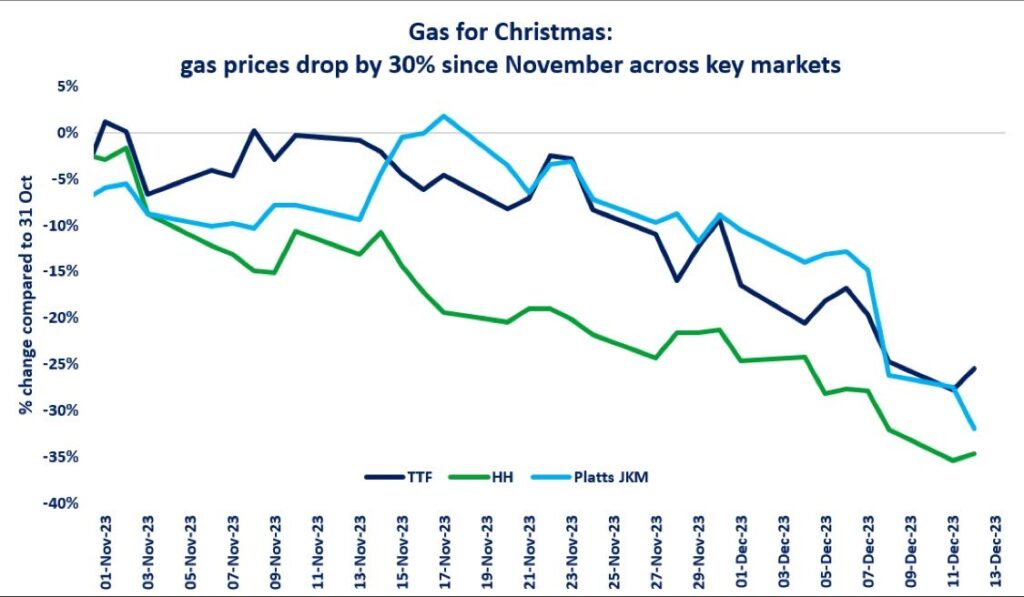

Natural gas prices fell by more than 30% since the start of November across all key gas markets, as mild weather conditions, high storage levels and healthy supply availability are weighing on gas prices.

In the US, Henry Hub prices plummeted by 35% to just $2.3/mmbtu -a six month low. a mild start of the heating season, together with robust domestic production and above-average storage levels (5 bcm

above 5y average) are keeping Henry depressed.

In Europe, TTF prices fell by 30%, as the short coldspell in late Nov/early Dec was not sufficient to change the overall direction of prices, looking for a winter floor. the ramp-up of Norwegian flows to 350 mcm/d, together with high storage levels (10 bcm above 5y average) and lower demand continue to weigh on European hub prices.

In Asia, JKM prices followed a similar trajectory and dropped by over 30% compared to end Oct. limited competition for spot LNG cargos, together with high storage levels and stronger nuclear power output in Japan are providing downward pressure on prices. JKM is now well within the range of oil-indexed LNG contracts, which could trigger some buying interest both from China and Emerging Asian markets.

Source: Greg MOLNAR