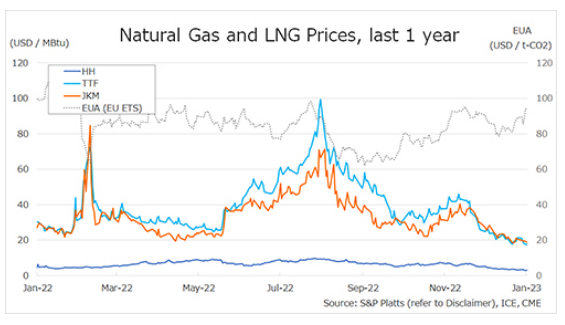

The Northeast Asian assessed spot LNG price JKM for the previous week (23 January – 27 January) fell for three consecutive business days to USD 18.9/MBtu on 27 January from USD 20.5/MBtu the previous week as China and Japan were reluctant to procure spot cargoes due to the Lunar New Year vacation and high inventories.

According to METI, Japan’s LNG inventories for power generation totaled 2.57 million tonnes as of 22 January, down 0.05 million tonnes from the previous week, up 0.77 million tonnes from the end of the same month last year and up 0.90 million tonnes from the average of the past five years.

The European gas price TTF fell for four consecutive business days to USD 17.5/MBtu on 26 January, from USD 21.2/MBtu the previous week, as underground storage level remained steady despite cold weather in Europe.

The following day, on 27 January, the price rose slightly to USD 17.6/MBtu due to expectations of continued cold weather and the outage of some gas processing plants in Norway.

According to ACER, the 27 January European Delivered Spot LNG Assessment Price (NEW) was announced at €54.77/MWh ($17.44/MBtu), down €2.24/MWh from the previous week. AGSI+ reported that the average European underground gas storage level as of 27 January was 73.87%, down from 78.88% the previous week.

The U.S. gas price HH rose from USD 3.2/MBtu the previous week to USD 3.4/MBtu on 23 January, supported by expectations for Freeport LNG’s restart, and remained at the USD 3s until 25 January.

On 26 January, HH fell to USD 2.9/MBtu, due to a tepid storage drawdown from gas inventories announced by the EIA and mild weather, but it rebounded the next day to USD 3.1/MBtu.

According to the EIA Weekly Natural Gas Storage Report released on 26 January, the U.S. natural gas underground storage on 20 January was 2,729 Bcf, down 91 Bcf from the previous week, up 4.1% from the same period last year, and up 4.9% from the historical five-year average.

Updated 30 January 2023

Source: JOGMEC