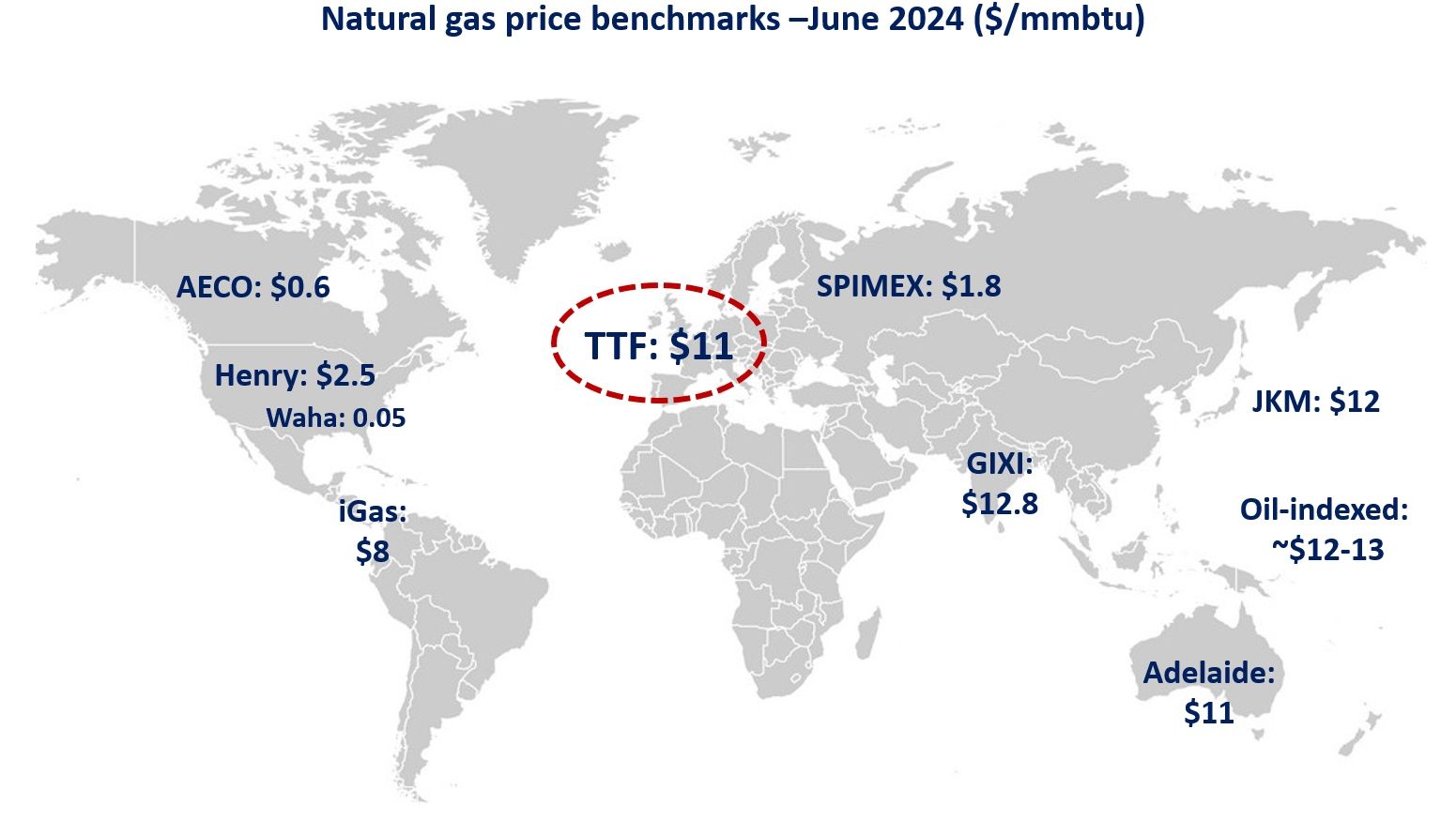

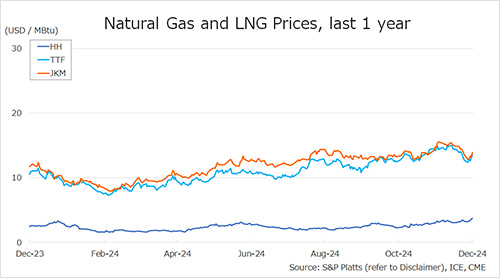

(Greg Molnar) The undisputed champion was TTF, jumping by an impressive 50% on the month, driven by a particularly strong demand recovery (5% yoy mainly due to powergen) and lower LNG influx (down by 3% yoy).

In Asia, JKM MA prices gained 45% on the back of higher demand from China (up by 10%), supply issues at Gorgon T2 and upward pressure from TTF (the Asian spot premium now recovered to $1/mmbtu).

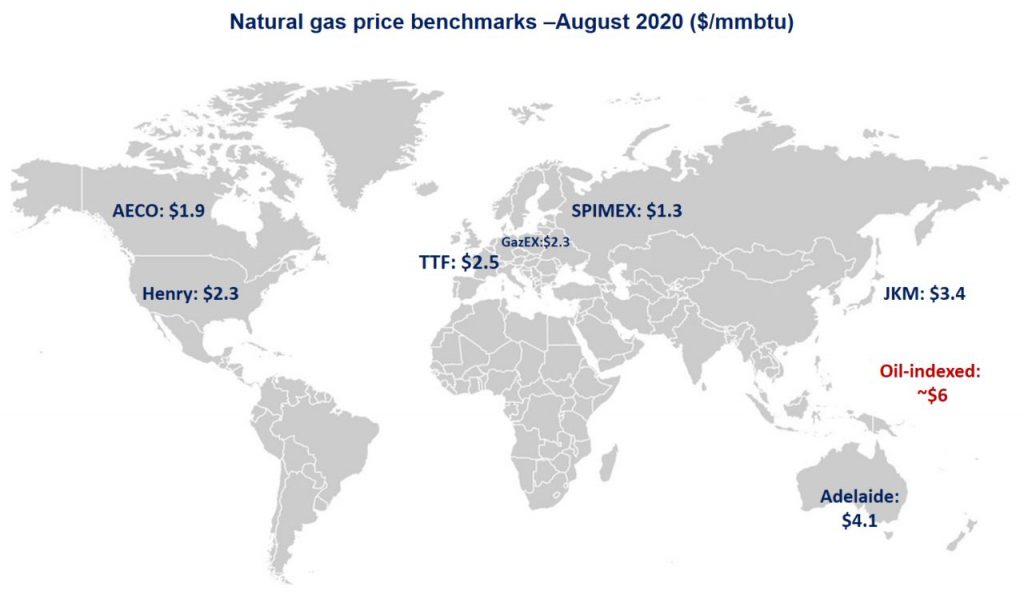

Meanwhile, oil-indexed prices are moving in the opposite direction, softening towards ~$6/mmbtu as the lower oil prices of Q2 are filtering through the long-term import contracts.

In the US, Henry Hub rose by 30%, as production is now falling more sharply (-4%) than demand (-2%) partly due to lower supply from associated gas in the Permian. meanwhile, net imports from Canada jumped by 10% providing upward pressure for AECO (up by 27% mom and almost three-fold yoy).

What is your view? Will the August bull run continue through September? Or there are some bears on the horizon?

See original post by Greg Molnar on LinkedIn