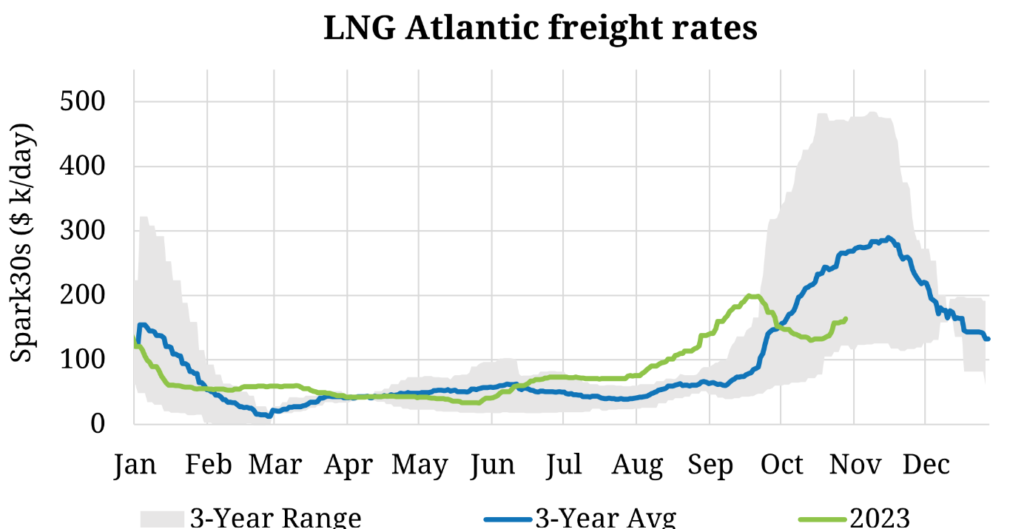

LNG spot charter rates are climbing higher, with the Spark Atlantic spot freight assessment up ~26% since mid-October. The rally is the second this winter, coming after rates rose to ~$200k/day across September (for reasons we discussed in a recent snapshot).

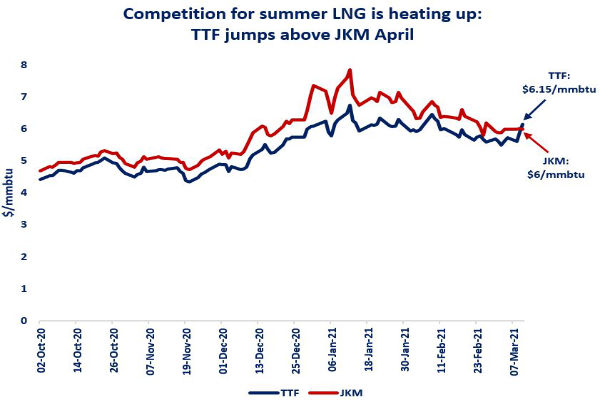

The initial rally was interrupted by a counter seasonal fall to lows of $130k/day through the first half of October, after a rally in TTF incentivised a partial unwinding of the Oct-Nov float.

The rebound over the past fortnight can be attributed to a combination of factors:

Source: Timera Energy