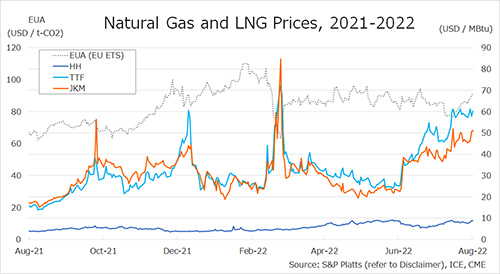

The Northeast Asian assessed spot LNG price JKM for the previous week (15 August-19 August) rose to USD 59/MBtu on 17 August from USD 51/MBtu the previous week due to strong gas demand in Northeast Asia for the winter season and higher TTF prices.

It then fell to USD 55/MBtu on 19 August on the limited demand for the prompt. The European gas price TTF rose to USD 67.4/MBtu on 16 August from USD 60.2/MBtu the previous week due to market concerns that European underground gas storage won’t be enough to satisfy peak winter demand.

It then fell to USD 67.0/MBtu on 17 August but rose to USD72.0/MBtu on 18 August. On 19 August, TTF declined slightly to USD 71.2/MBtu.

Gazprom announced on August 19 to halt gas supply via the Nord Stream pipeline for three days from August 31 to September 2, to carry out maintenance work on the only turbine in operation at the Portovaya compressor station.

The U.S. gas price HH fell to USD 8.7/MBtu on 15 August from USD 8.8/MBtu the previous week. It then rose to USD 9.3/MBtu on 18 August but fell to USD 9.2/MBtu on 18 August. On 19 August, HH increased slightly to USD 9.3/MBtu.

According to the EIA Weekly Natural Gas Storage Report released on 18 August, U.S. natural gas underground storage inventories for the week of August 12 totaled 2,519 Bcf, up 18 Bcf from the previous week, down 10.5% from the previous year, and down 12.7% from the historical five-year average.

Updated 22 August 2022

Source: JOGMEC