Over the weekend, natural gas futures witnessed an 8% surge, leading to the current prompt month price of $2.28/MMbtu. The rally was primarily driven by the anticipated rise in heating demand in conjunction with record-high LNG export demand.

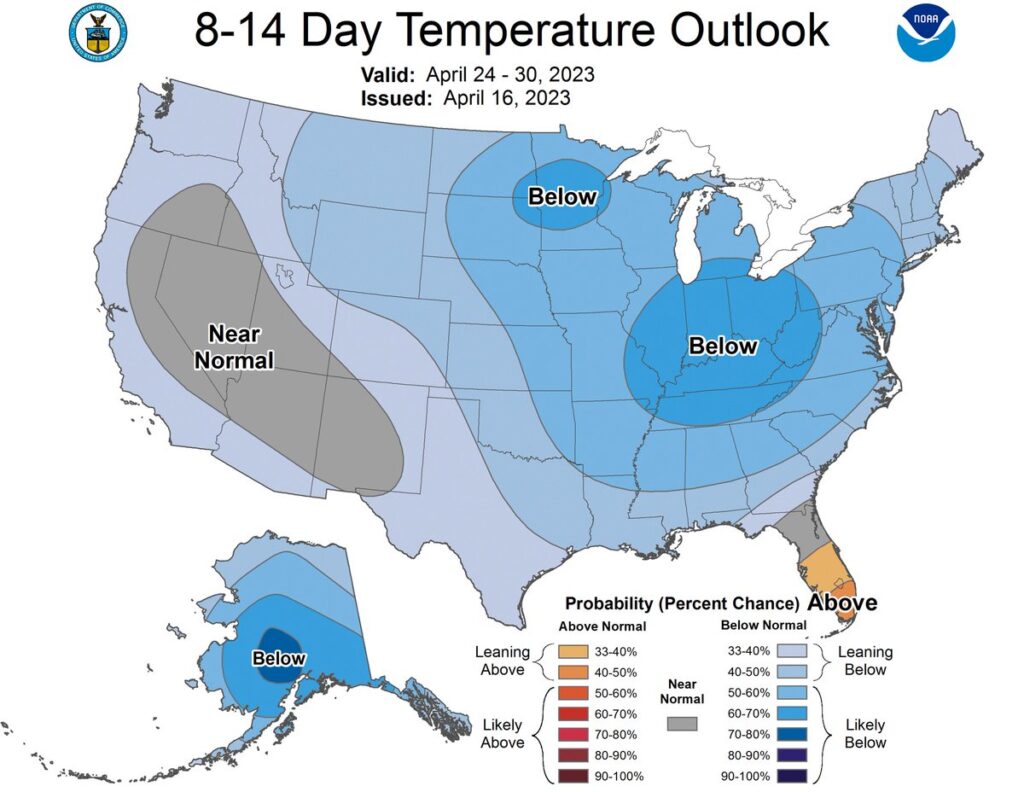

The short-term weather forecasts indicate an increase in heating demand for the next two weeks, with a jump of approximately 20 Bcf/D. The northeast US is expected to experience temperatures 60-70% below normal from April 24th to April 30th, extending to the great plains and areas of the south. Despite the shoulder season, the market is closely watching any indication of a strong pricing trend.

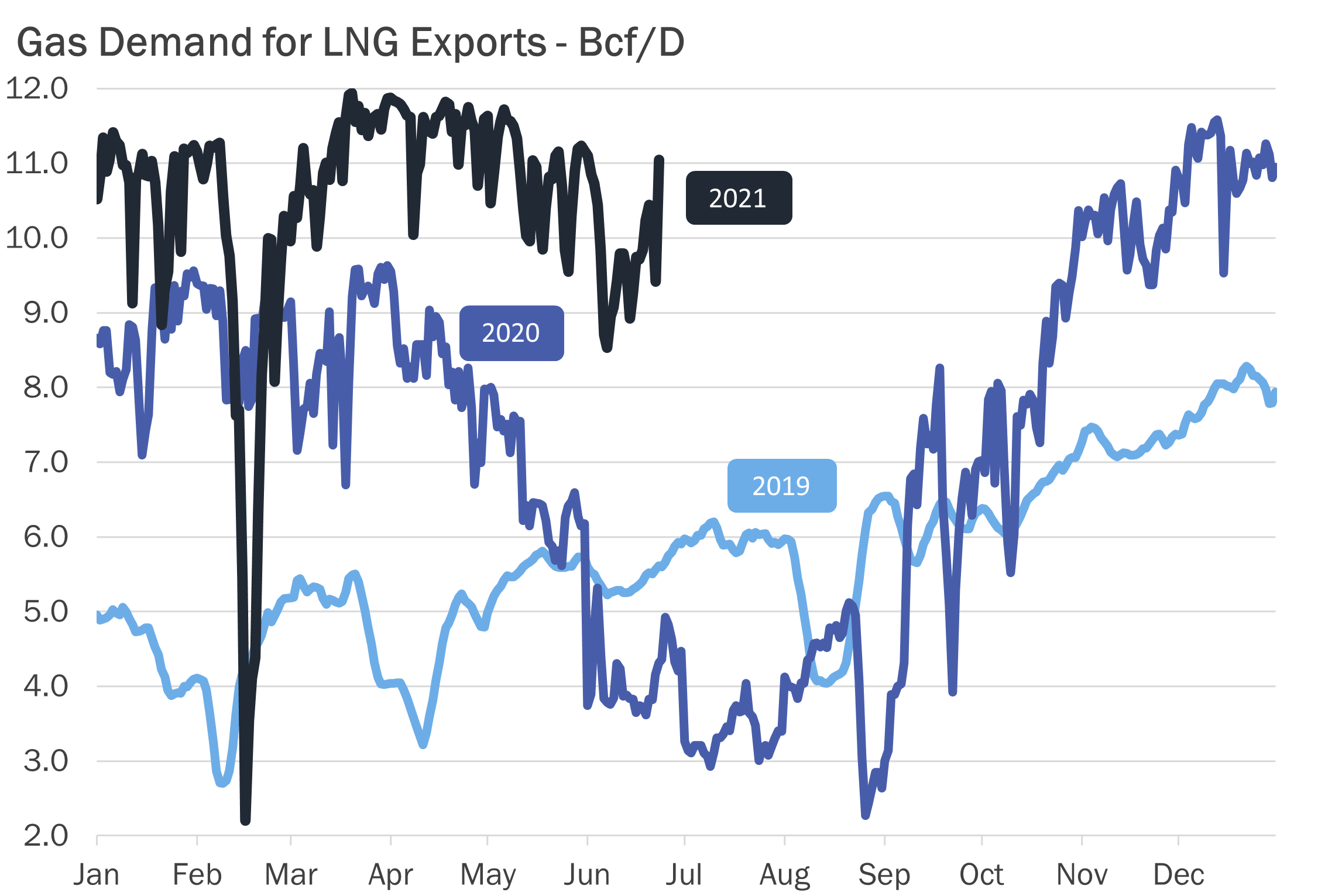

The demand for feedgas volumes in LNG exports reached an all-time high this past Sunday, with 14.85 Bcf/D, accounting for 97.2% of the available export capacity in the US. This high utilization rate is a positive development for market bulls, especially after almost half a year of supply-heavy market conditions caused by Freeport LNG. Presently, demand is steady at 14.7 Bcf/D.

Source: Gelber and Associates