(Jessica Jaganathan, Reuters) Qatar Petroleum, the world’s top liquefied natural gas (LNG) producer, is cranking up the pressure on high-cost rivals with bold expansion plans that will boost supplies over the coming decade and potentially push prices down further.

As competitors struggle to break even due to lower prices, the Qatari firm last month announced it will boost LNG output by about 40% to 110 million tonnes per annum (mtpa) by 2026 in phase one of its expansion of North Field LNG, the largest single LNG project ever sanctioned.

The company is expected to announce second phase expansion plans this year which will lift LNG capacity by 2027 to 126 mtpa, enough to meet the total import needs of both Japan and South Korea – the world’s top and third largest LNG importers respectively.

Qatari marketing has the potential to undercut competing suppliers and has already helped put downward pressure on LNG contract prices over the last two years, Credit Suisse analyst Saul Kavonic said.

“With this decision, (Qatar) will once again reaffirm its dominance as the largest LNG supplier in the world,” said Chong Zhi Xin, a director at research firm IHS Markit.

“This decision to move ahead has definitely crowded out other players. We anticipate that companies will need to take a long hard look at their projects to determine if they are able to find a competitive advantage versus this field of competition.”

Qatar, which accounts for a fifth of global LNG supplies, is already by far the lowest cost LNG producer.

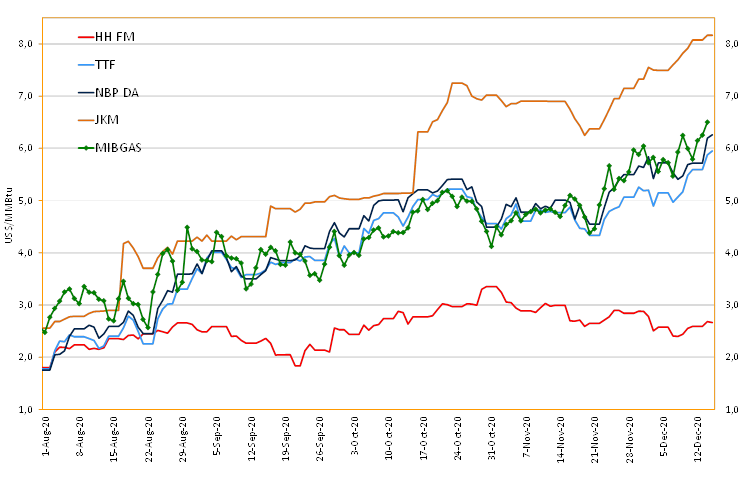

Its breakeven price for a cargo shipped to top market Northeast Asia is estimated at around $4 per million British thermal units (mmBtu), compared with around $5 to $8 per mmBtu from Russia, Mozambique and the United States, said Alex Dewar, senior director at the centre for energy impact at Boston Consulting Group (BCG).

Australia pre-FID capacity breakevens are in the $7 to $11 per mmbtu range, he added.

The combination of the North Field expansion, expiring contracts with existing buyers, and its planned joint-venture Golden Pass terminal in the United States will mean the gas giant will likely have about 70 to 75 mtpa of uncontracted LNG volumes to sell by 2027, analysts estimated.

Qatar Petroleum has already shown a preparedness to cut prices to secure deals, as seen last month when a new 10-year deal with Pakistan was priced at a 10.2% ‘slope’ of Brent crude oil compared with a 13.37% Brent slope for a 15-year deal signed in 2016, and is one of the lowest-priced deals ever signed.

LNG contract prices are typically expressed as a “slope” against Brent prices, meaning a percentage of that price.

“It’s going to be hard to compete with them at these prices, so what the other sellers might be able to compete on is offering more flexibility,” a source with a competing supplier told Reuters on condition of anonymity as he was not authorised to speak with media.

For instance, Qatar Petroleum typically sells its cargoes on a delivered ex-ship (DES) basis, which makes it difficult for buyers to re-direct cargoes if they suddenly don’t need them. So competitors who do offer on-selling or offer options enabling buyers to cancel purchases within a specified period might win business.

The firm also signed a long-term deal with Vitol to supply LNG to Bangladesh last month, and has been active in the spot market by offering competitive prices, several traders said.

Its newly formed trading unit Qatar Petroleum Trading has won several tenders to supply spot cargoes into Pakistan, India and Taiwan since it was set up late last year, the traders said.

Qatari volumes into Northwest Europe are also expected to rise, after Qatar in the last year secured regasification capacity at terminals at the Isle of Grain in the United Kingdom and Montoir in France, said Wood Mackenzie’s Giles Farrer.

Qatar Petroleum is also targeting buyers seeking more transparency on carbon emissions.

Still, the firm will be forced to find new sources of demand for its large uncontracted volumes, analysts said.

“China is likely to be a key focus as it remains generally under-represented in their portfolio and is set to remain the fastest growing market for LNG imports,” said Dewar, adding that Qatar might also target more sales into India and Southeast Asia.

For other suppliers, Qatar’s aggressive marketing may not be good news, analysts said.

“The Qatari expansion should extend the period in which the market may need more new supply to beyond 2028,” Credit Suisse’s Kavonic said.

“Given the Qatari volumes have not yet locked away a home, if other projects take a final investment decision (FID) near term, it risks creating an over-supply in the 2026-2028 window that could put downward pressure on spot prices during that period.”

Source: (Jessica Jaganathan, Reuters) See original article plus charts HERE