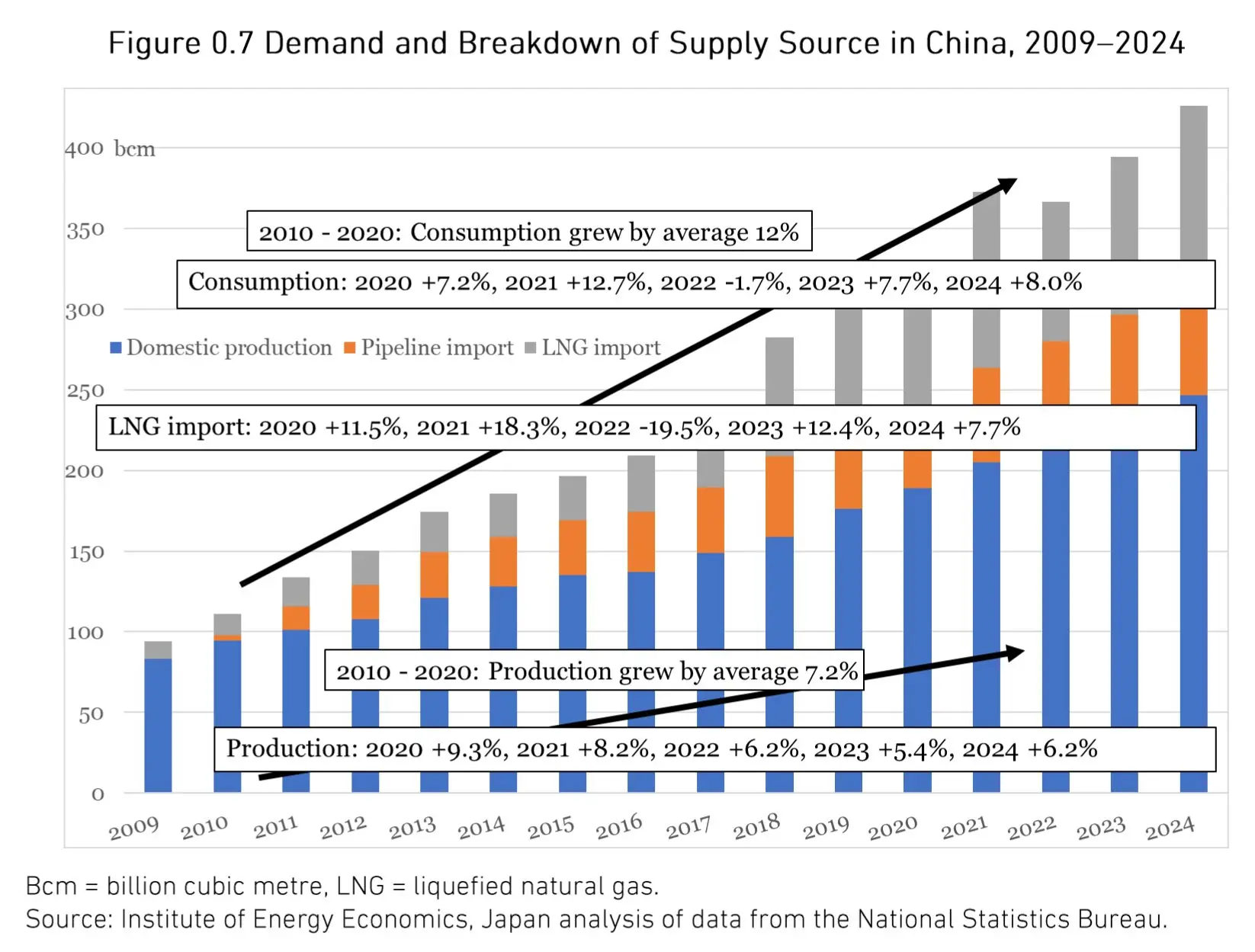

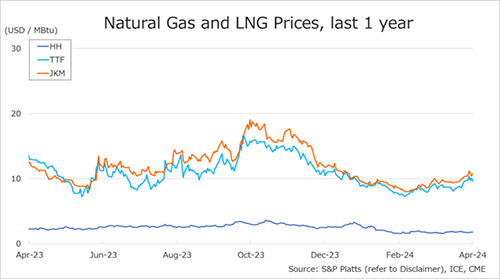

In our view, the question today is more how much the hubs have effect on LNG trade than the opposite

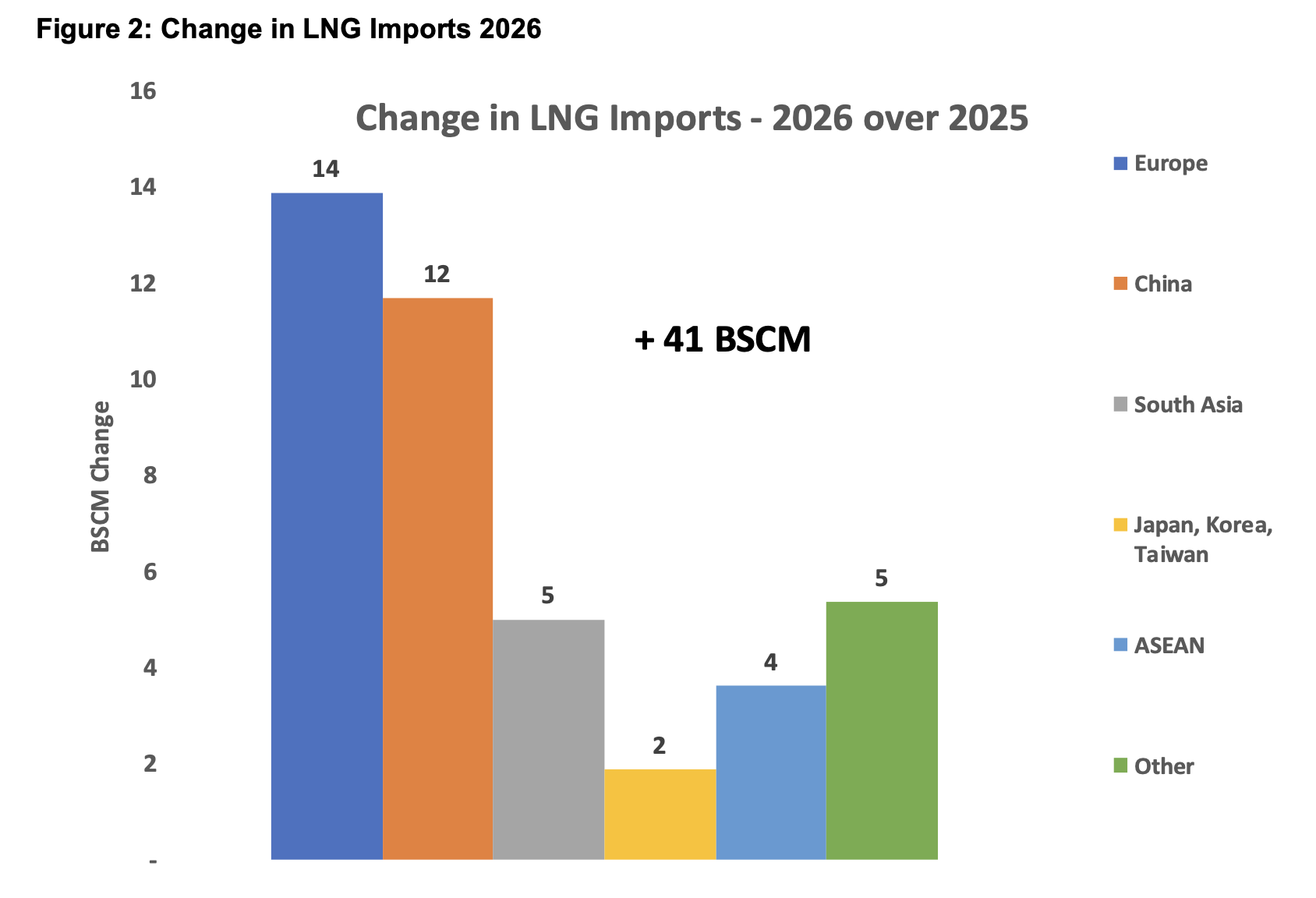

In a market where increased flexibility and uncommitted LNG contributes in a 2030% of the total LNG trade, gas Hub prices are one of the key elements that can attract flexible LNG around the world.

LNG short term pricing is driven by the forces of supply and demand of different regions, and it is increasingly disconnected from long-term contracts prices

Neither the markets nor the suppliers are driving the industry towards full “commoditization”, nonetheless, some convergence of LNG pricing may occur.

We still have a long way to reach a level of total “globalization”, comparable to oil markets… … but are we in the process of slowly and gradually breaking away LNG Oil indexation to some LNG Gas Price?