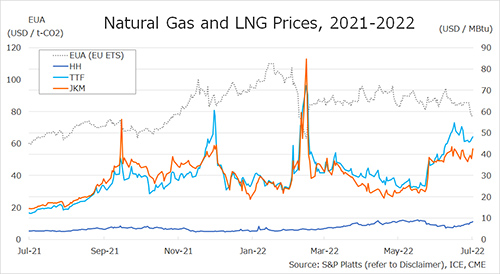

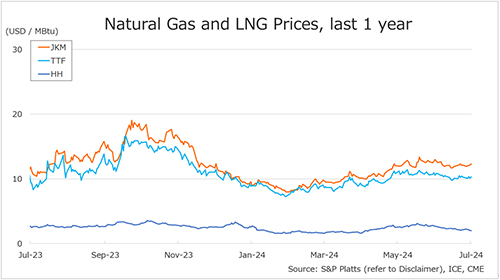

The Northeast Asian assessed spot LNG price JKM for last week (22 July – 26 July) remained almost unchanged at low-USD 12s on 26 July from low-USD 12s the previous weekend (19 July). JKM fell to high-USD 11s on 22 July but then rose for four consecutive days, reaching the same level on 26 July as the previous week.

Buying interest in the Asian region remained subdued due to sufficient inventory levels, resulting in modest overall movement, although there was some information on increased demand in the Indian market on Friday.

METI announced on 24 July that Japan’s LNG inventories for power generation as of 21 July stood at 2.35 million tonnes, up 0.15 million tonnes from the previous week.

The European gas price TTF for last week (22 July – 26 July) remained almost unchanged at USD 10.3/MBtu on 26 July from USD 10.3/MBtu the previous weekend (19 July).

In the first half of the week, TTF fell to USD 10.1/MBtu due to firm supplies from Norway and high underground gas storage rates, but the price rose amid reports of possible delays in the restoration of Freeport LNG, eventually reaching USD 10.3/MBtu, the same level as the previous week.

Freeport LNG is expected to be fully restored in early August. According to AGSI+, the EU-wide underground gas storage increased to 83.9% as of 26 July from 82.3% the previous weekend.

The U.S. gas price HH for last week (22 July – 26 July) fell to USD 2.0/MBtu on 26 July from USD 2.1/MBtu the previous weekend (19 July).

The EIA Weekly Natural Gas Storage Report released on 25 July showed U.S. natural gas inventories as of 19 July at 3,231 Bcf, up 22 Bcf from the previous week, up 8.4% from the same period last year, and 16.4% increase over the five-year average.

Updated: July 29

Source: JOGMEC