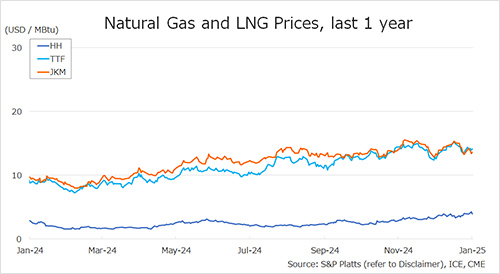

The Northeast Asian assessed spot LNG price JKM for last week (13 – 17 January) rose to mid-USD 13s on 17 January (March delivery) from low-USD 13s the previous weekend (February delivery, 10 January).

JKM rose to the low-USD 14s in the first half of the week due to rising supply uncertainties in Europe, including strengthening U.S. sanctions against Russia, but turned lower in the middle of the week with no change in sluggish demand in Northeast Asia.

METI announced on 15 January that Japan’s LNG inventories for power generation as of 12 January stood at 2.11 million tonnes, up 0.24 million tonnes from the previous week.

The European gas price TTF (February delivery) for last week (13 – 17 January) rose to USD 14.2/MBtu on 17 January from USD 13.6/MBtu the previous weekend (10 January).

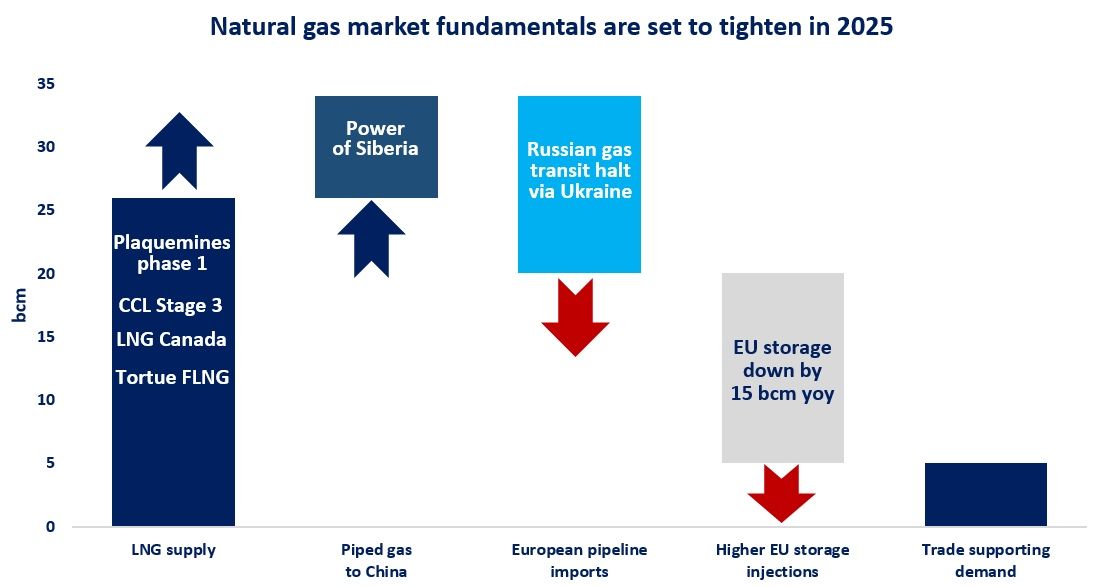

TTF rose early in the week, partly due to the attack on the TurkStream and the drop in temperatures in northwest Europe, but then weakened as temperatures eased and supplies from the Norwegian continental shelf remained relatively stable. According to AGSI+, the EU-wide underground gas storage was 61.7% on 17 January, down from 67.0% at the end of the previous weekend.

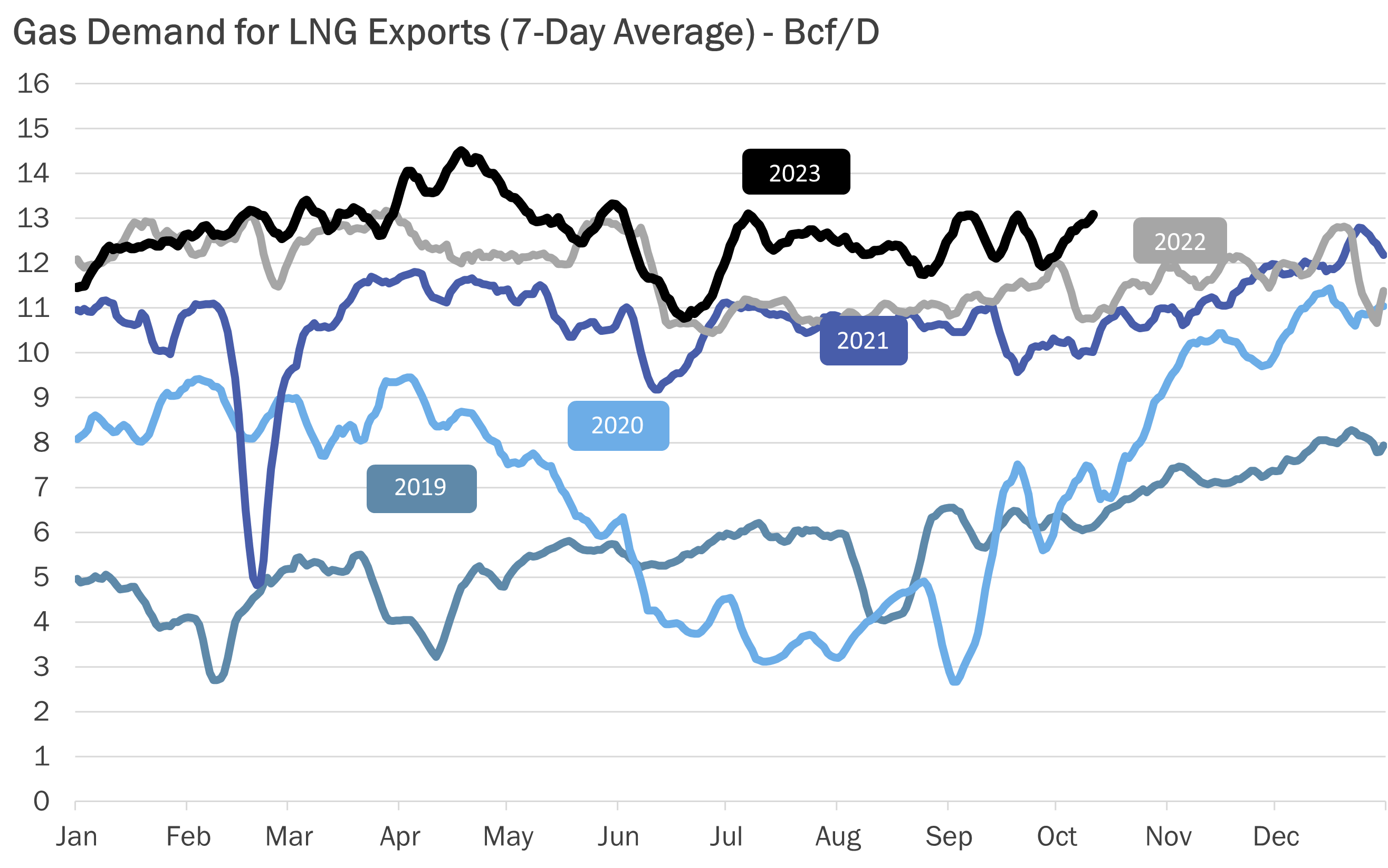

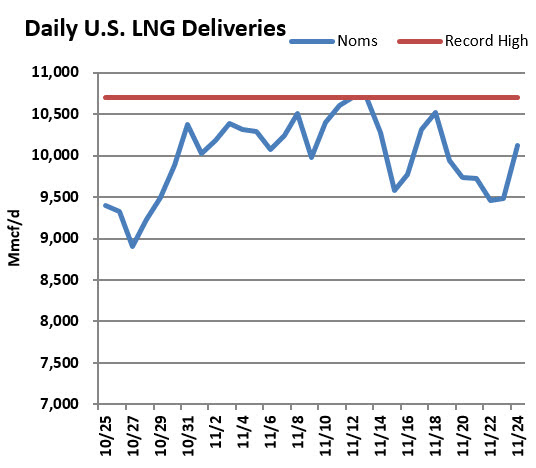

The U.S. gas price HH (February delivery) for last week (13 – 17 January) fell to USD 3.9/MBtu on 17 January from USD 4.0/MBtu the previous weekend (10 January). With the increased withdrawals from underground gas storage due to lower temperatures and record levels of feed gas supplies to major U.S. liquefaction terminals, HH was in the low-USD 4s on 16 January, the first time in two years since January 2023.

The EIA Weekly Natural Gas Storage Report released on 16 January showed U.S. natural gas inventories as of 10 January at 3,115 Bcf, down 258 Bcf from the previous week, down 3.4% from the same period last year, and 2.5% increase over the five-year average.

Updated: January 20

Source: JOGMEC