Winter is coming: spot LNG charter rates hit over $250k/day last week, their highest level since the Jan21 cold spell, amidst an increasingly tight shipping market.

Spot charter rates both in the Atlantic and the Pacific basin more than tripled in a month by the beginning of November, and rising up by twofold compared to the same period of last year.

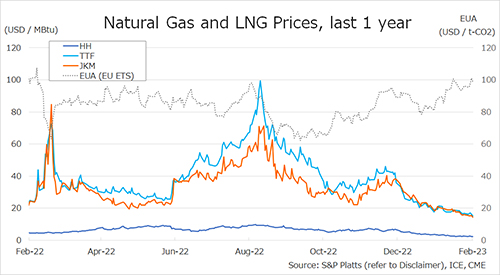

This strong growth comes despite a record number of new LNG carriers delivered this year and has continued despite the recent softening of gas and LNG prices.

Besides the gas price rally, three main factors are contributing:

1. Tonne-mile demand is growing more quickly than LNG trade (10% vs 6%) supported by the rapid expansion of US exports to the Asia Pacific (up by 33% yoy), which is driving up shipping distances;

2. Panama Canal congestion here we again: spot cargoes without booked transit slots are now reportedly waiting for over 10 days;

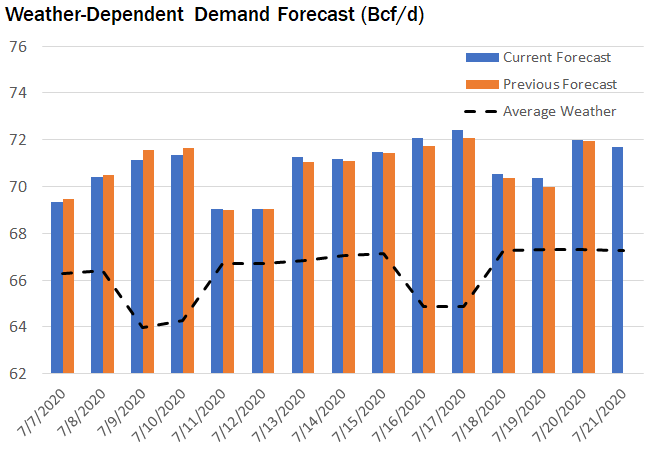

3. higher spot deliveries are driving up demand for spot charter rates: first estimates shows that spot deliveries continued to increase this year, mainly driven by demand from China.

What is your view? How will charter rates evolve this winter? Could we see some further winter spikes? What is your feel about Panama congestion? And could La Niña spice up things?

Source: Greg Molnar (LinkedIn)