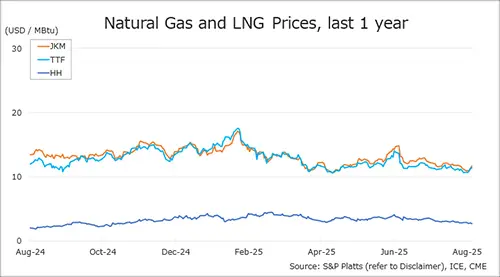

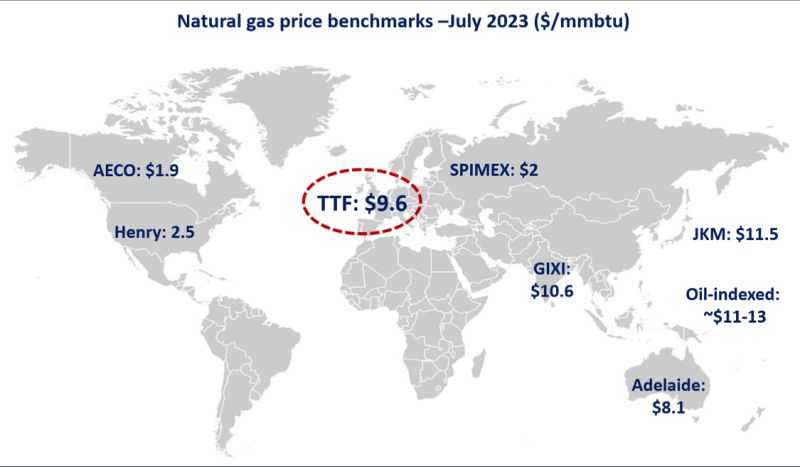

Summer heatwaves provided some support for Asia and North American prices in July, while TTF continued its downward trend, falling below $10/mmbtu mark for the first time since May 2021.

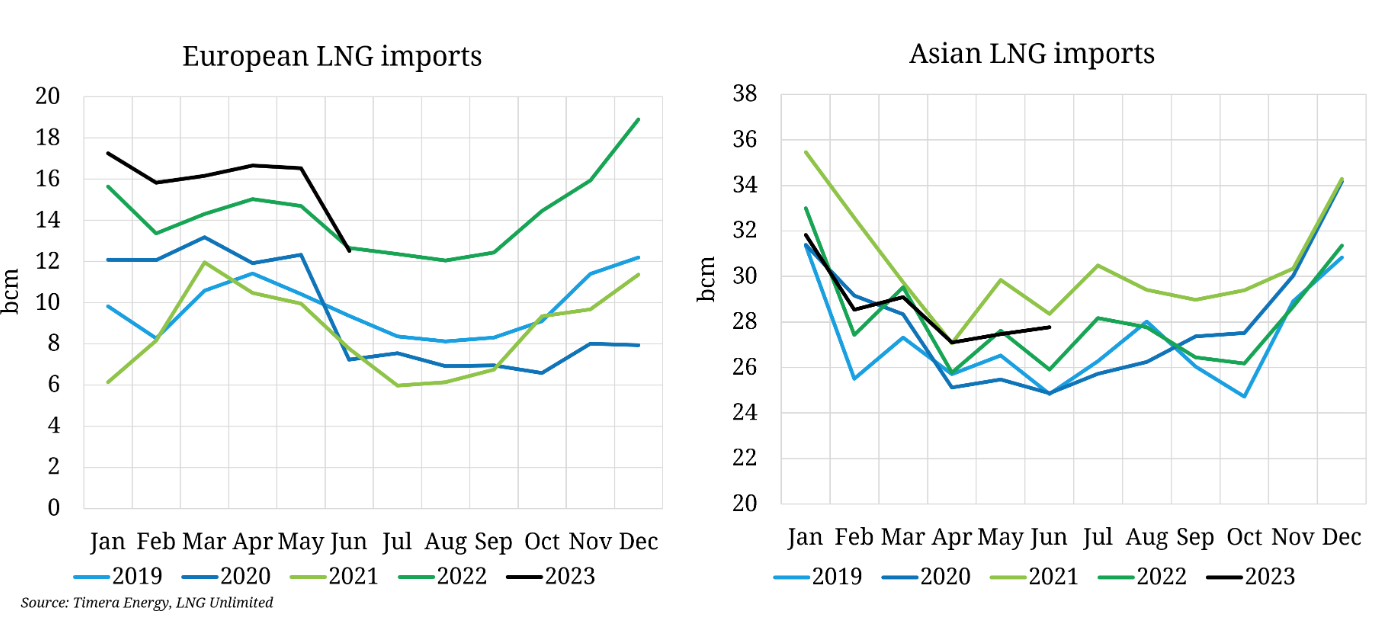

In Europe, TTF month-ahead prices dropped by 8% compared to June to $9.5/mmbtu and down by 80% compared to last year. Continued demand decline (down by 8% yoy), healthy LNG inflow and very high storage levels (86% full), continue to put downward pressure on European prices.

In contrast, in Asia JKM prices rose by 8% compared to June amidst emerging buying interest. Gas demand recovery in China, summer heatwaves and lower LNG stocks in Japan (now standing below their 5y average) provided some support for Asian spot LNG prices.

JKM traded at an almost $2/mmbtu premium compared to TTF in July. If this is maintained, Europe might see its LNG cargoes pulled away towards Asian shores in the coming months.

In the US, Henry Hub prices gained 18% compared to June and averaged at $2.5/mmbtu. sizzling heatwaves supported higher gas burn in the power sector amidst stronger cooling demand. lower piped imports from Canada, together with higher LNG exports and stronger pipe deliveries to Mexico put additional upward pressure on Henry.

High storage levels across Europe and North America will be a key determining factor for price movements in the remainder of the injection season, but the supply side can always bring up some surprises…

What is your view? How will gas markets evolve in the coming months? Do you see any further downside potential or on the contrary, some upside risks?

Source: Greg Molnar