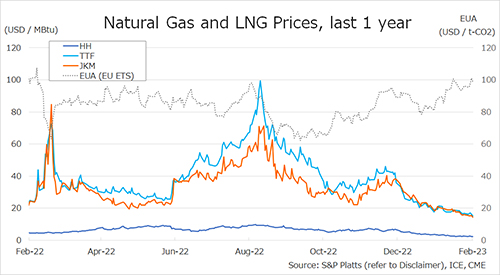

The Northeast Asian assessed spot LNG price JKM for the previous week (13 February – 17 February) fell for three consecutive business days from USD 16/MBtu the previous week to USD 15/MBtu on 15 February due to a lull in winter procurement, high inventory levels amid a mild winter and a few cargo shipments from U.S. Freeport LNG.

JKM then rose slightly to the high USD 15s on 16 February as buying interest increased due to the LNG price declining, but fell the next day to USD 14/MBtu before warm weather and the end of the winter procurement season.

According to METI, Japan’s LNG inventories for power generation totaled 2.56 million tonnes as of 13 February, up 0.14 million tonnes from the previous week, up 0.87 million tonnes from the end of the same month last year and up 0.58 million tonnes from the average of the past five years.

The European gas price TTF fell to USD 16.2/MBtu on 13 February from USD 16.9/MBtu the previous week due to high underground gas storage rates and reports related to the resumption of shipments from the U.S. Freeport LNG.

TTF then gained for two consecutive business days, reaching USD 17.2/MBtu on 15 February, on the back of a sense of increased LNG demand due to weak UK wind power generation, extended shutdowns of Norwegian gas fields and French nuclear power plants, and other factors.

The next day, the price fell back to USD 16.3/MBtu on the back of a mild winter, high underground gas storage rates, and strong UK wind power output, and dropped to USD 15.3/Mbtu on 17 February.

ACER published the 17 February spot LNG assessment price for delivery in Northwest Europe at EUR 47.88/MWh (USD 14.91/MBtu), down EUR 5.97/MWh from the previous week. According to AGSI+, the average European underground gas storage rate as of 17 February was 64.22%, down from 66.92% the previous week.

The U.S. gas price HH fell to USD 2.4/MBtu on 13 February from USD 2.5/MBtu the previous week due to weak weather demand.

The price then rose to USD 2.6/MBtu on 14 February on expectations of Freeport LNG restarting operations, but fell for three consecutive business days to USD 2.3/MBtu on 17 February due to weak demand caused by warmer weather and lower-than-expected natural gas inventory withdrawals.

Freeport LNG shipped one cargo each on 12 and 14 February. Both were offloaded from inventory stored prior to the accident.

According to the EIA Weekly Natural Gas Storage Report released on 16 February, the U.S. natural gas underground storage on 10 February was 2,266 Bcf, down 100 Bcf from the previous week, up 16.9% from the same period last year, and up 8.8% from the historical five-year average.

Updated 20 February 2023

Source: JOGMEC