We previously covered the potential effects of strikes at key LNG facilities in Australia and how they would affect global prices as well as how the Asian market would respond.1 Woodside Energy has since been able to come to an agreement with the union representing workers at the North West Shelf facility which will certainly help to lessen the impact of an Australian LNG supply disruption.2

However, Chevron has still yet to come to an agreement with workers at their Australian LNG plants and thus with industrial action imminent, a new analysis was done with a data set which includes shutdowns of Chevron’s Gorgon and Wheatstone facilities as Woodside’s North West Shelf facility is no longer at risk of a strike.

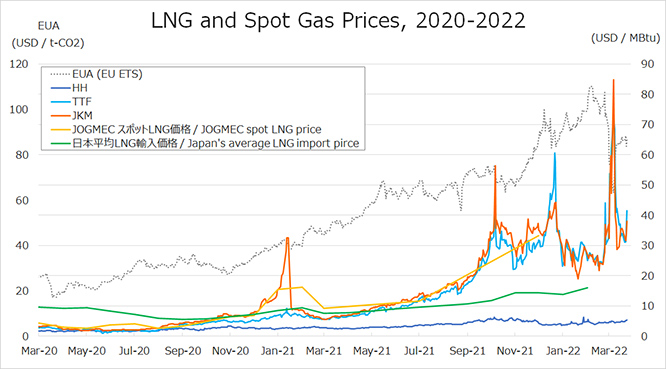

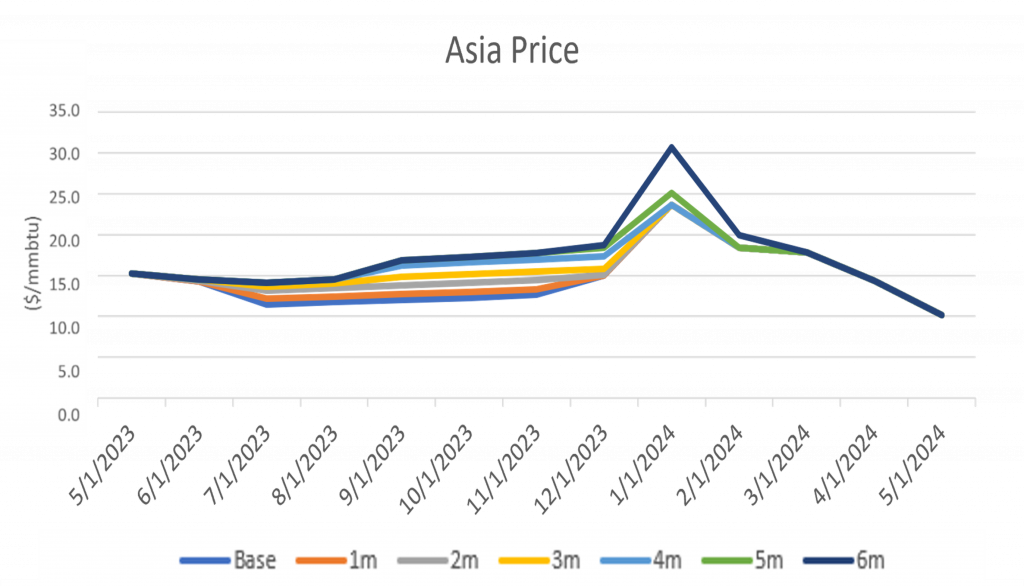

Just like the previous scenario, prices at TTF and HH would not see much change in the event of a strike, but the Asian markets would, although not as drastic as the previous forecast. Gorgon, Wheatstone, and the North West Shelf account for 36.35 mtpa worth of export capacity with North West Shelf making up 16.3 mtpa of that total. This means that instead of the original 10% of global LNG supply capacity potentially being disrupted, it would only be around 5.5% in this scenario.

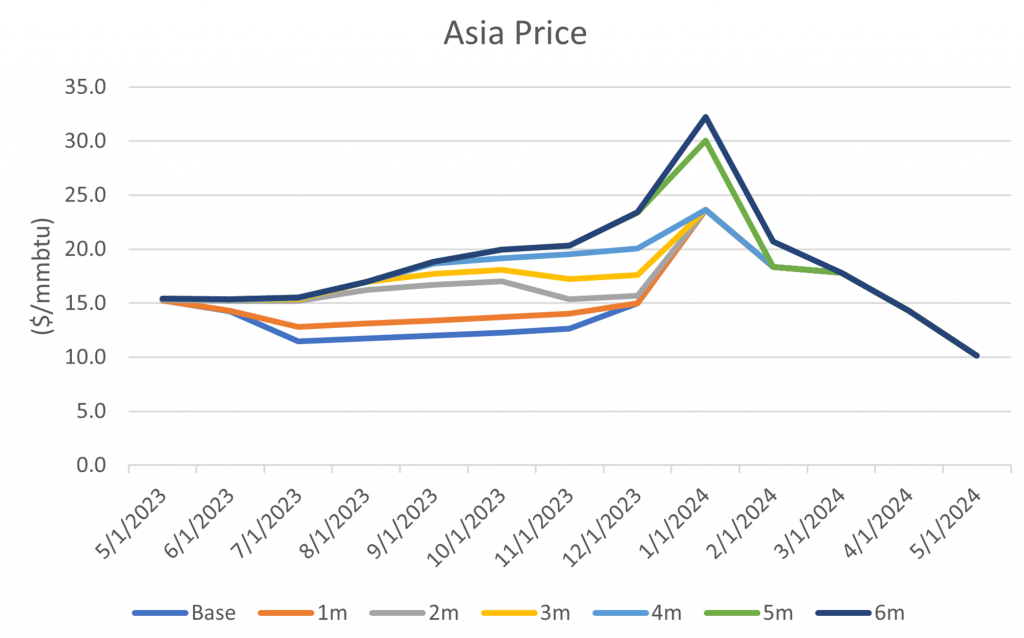

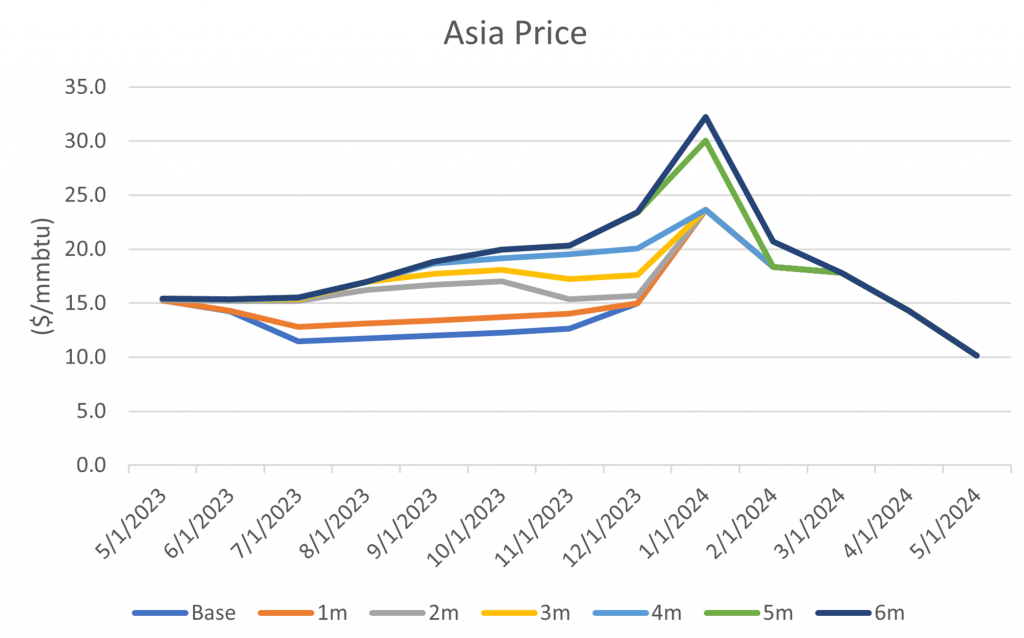

The smaller potential disruption has a more muted effect on prices. For frame of reference, if everything was business as usual with no threat of impending strike, the price in Asia would hover between $11.70 and $15.00/mmbtu until January 2024 in which it would peak at $23.60/mmbtu. Figure 1 shows the previous scenario with both Woodside and Chevron facilities shut down whereas Figure 2 shows only Chevron’s.

Assuming the strike would only last between 1 to 4 months, Figure 1 shows prices increasing to between $13.40/mmbtu and $20.00/mmbtu through September and December.

However, Figure 2 shows only an increase to between $12.70/mmbtu and $17.30/mmbtu within the same timeframe. Both graphs tell a similar tell of how prices would rise in the event of a disruption, but at very different degrees.

However, Figure 2 shows only an increase to between $12.70/mmbtu and $17.30/mmbtu within the same timeframe. Both graphs tell a similar tell of how prices would rise in the event of a disruption, but at very different degrees.

How LNG Exports are Affected

How LNG Exports are Affected

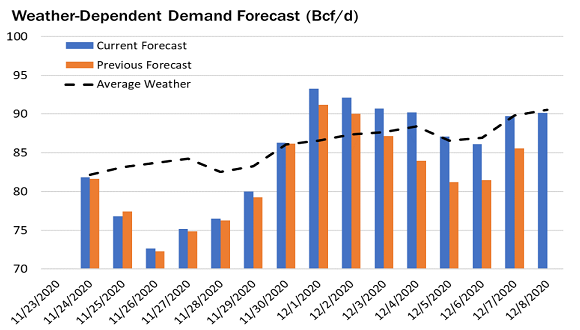

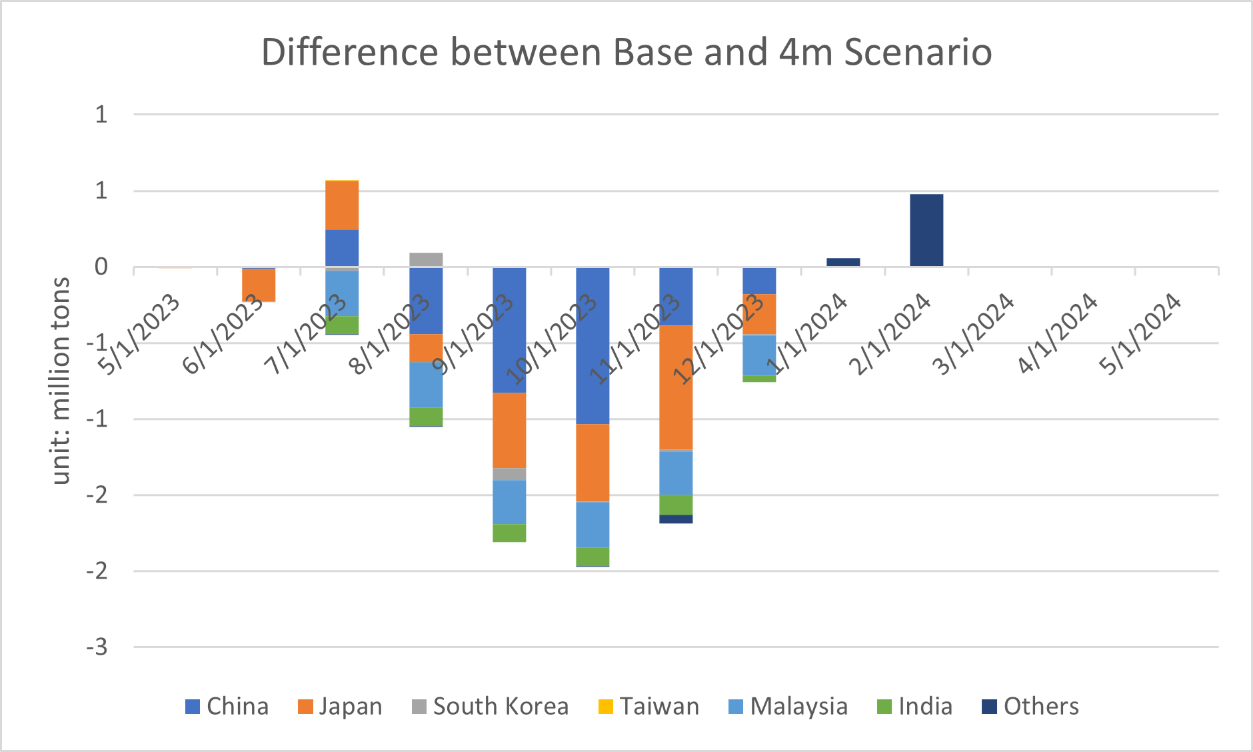

As the impact on prices is expected to be less due to the lower amount of supply being affected, the countries who rely on Australian LNG would also experience less of a hit to their supply. If all 3 facilities had shutdown, China would have suffered a loss of 1 to 2 million tons of LNG per month and Japan would have lost about 1 million per month, the total losses depend on how many months the facilities would have been out of commission.

Under the new scenario, there would be no meaningful losses in LNG imports if the strikes only lasted for a month. Both China and Japan would suffer losses of 1 million tons per month for each month of shutdown after the first month. Operating under the prior assumption of a 1-to-4-month strike, the total combined losses could be between 1.08 to 5.35 million tons (Figure 3).

As it is in the interest of the company and the workers to resolve issues as quickly as possible, we don’t anticipate a strike lasting long enough to have a significant impact on the market, however, it is always important to be able to simulate all kinds of scenarios, including supply disruptions in order to see where the market will go to understand more clearly potential market impacts, and what could be done about them.

As it is in the interest of the company and the workers to resolve issues as quickly as possible, we don’t anticipate a strike lasting long enough to have a significant impact on the market, however, it is always important to be able to simulate all kinds of scenarios, including supply disruptions in order to see where the market will go to understand more clearly potential market impacts, and what could be done about them.

With G2M2® Market Simulator for Global Gas and LNG™ determining the effects of a supply disruption on prices and LNG exports is but one of a complete range of scenarios that could be run. Other such scenarios could include the impact of severe weather events, new LNG import/export terminals, new pipelines or expansions on existing ones, and many more.

Source: RBAC