Global LNG FID activity remained strong in H1 2024, although no project took FID in the U.S., reflecting the regulatory uncertainty following the permitting pause.

The US was the single most important driving force behind global LNG supply growth, accounting for just over half of LNG capacity sanctioned through 2013-2023.

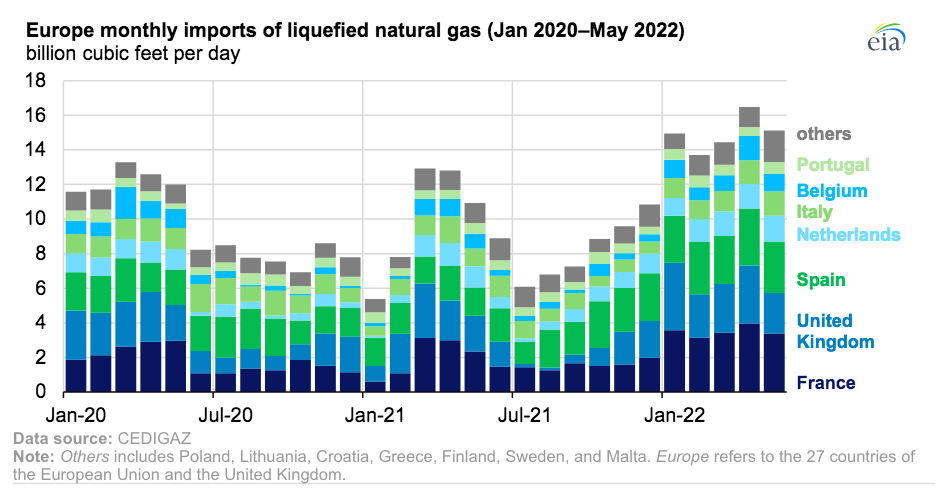

In contrast, no US LNG project reached FID so far this year, reflecting the regulatory uncertainty following the export permitting pause. this in turns allows non US LNG developers to advance more actively their projects.

In total, over 40 bcm/y of LNG capacity was sanctioned in the first half of 2024, with more than 80% in the Middle East. this includes Qatar’s North Field West project, the UAE’s Ruwais plant and Oman’s small-scale Marsa LNG facility.

In addition, Canada’s Cedar FLNG reached FID this week and in Indonesia’s the Papua West project awarded the construction contract for the FLNG facility.

What is your view? How will the permitting debate evolve in the U.S?

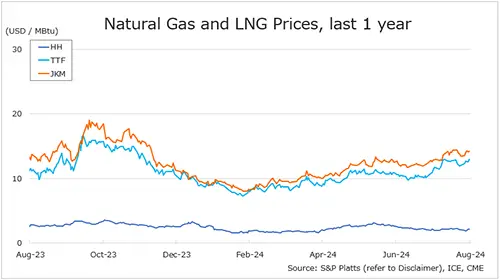

Yesterday’s news on the FERC permit for Venture Global’s CP2 project is certainly encouraging, but the non-FTA export permitting remains on hold, which could negatively distort global gas market dynamics if sustained for a longer time…

Source: Greg MOLNAR