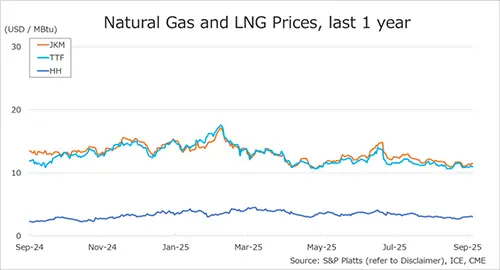

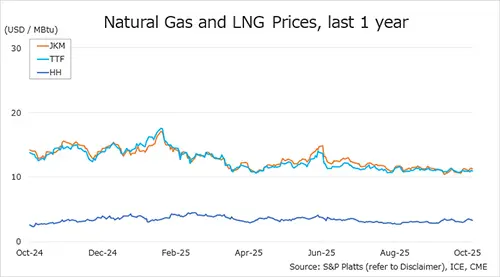

The Northeast Asian assessed spot LNG price JKM (October delivery) for last week (16 – 20 September) fell to high-USD 12s on 20 September from mid-USD 13s the previous weekend (13 September).

JKM fell to the low-USD 13s in the first half of the week amid low market participation and limited trading, but rose to mid-USD 13s on the 19th due to heightened geopolitical tensions between Russia and Ukraine following a drone attack in Tver, Russia, on the 18th, and then turned around and fell to high-USD 12s following a significant drop in European gas prices.

METI announced on 18 September that Japan’s LNG inventories for power generation as of 15 September stood at 1.88 million tonnes, down 0.21 million tonnes from the previous week.

The European gas price TTF (October delivery) for last week (16 – 20 September) fell to USD 11.3/MBtu on 20 September from USD 11.6/MBtu the previous weekend (13 September).

TTF was hovering in the mid-USD 11s range amid bearish fundamentals until mid-week, but fell sharply to USD 10.8/MBtu on 19 September following reports that Ukraine would allow Azerbaijani gas to pass through, and then returned to USD 11.3/MBtu on 20 September after the reports were denied.

According to AGSI+, the EU-wide underground gas storage slightly increased to 93.5% as of 20 September from 93.3% the previous weekend.

The U.S. gas price HH (October delivery) for last week (16 – 20 September) slightly increased to USD 2.4/MBtu on 13 September from USD 2.3/MBtu the previous weekend (6 September).

The EIA Weekly Natural Gas Storage Report released on 19 September showed U.S. natural gas inventories as of 13 September at 3,445 Bcf, up 58 Bcf from the previous week, up 6.0% from the same period last year, and 8.6% increase over the five-year average.

Updated: September 24

Source: JOGMEC