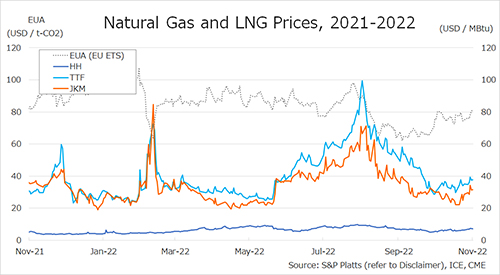

The Northeast Asian assessed spot LNG price JKM for the previous week (21 November-25 November) rose to USD 30/MBtu on 21 November from USD 29/MBtu the previous week as winter heating demand in Asia strengthened.

It then fell to USD 29/MBtu on 22 November due to high inventories across Northeast Asia and as the market remained quiet, searching for price direction. On 23 November, JKM reached USD 34/MBtu on the back of limited trading due to a holiday in Japan and higher European gas prices.

Spot demand was weak on 24 November due to mild weather in Asian countries and fell to USD 31/MBtu, and on 25 November it stayed at USD 32/MBtu. According to METI, Japan’s LNG inventories for power generation were 2.61 million tonnes as of 20 November, up 0.1 million tonnes from the end of the same month last year and up 0.45 million tonnes from the average of the past five years, which remains a high level.

The European gas price TTF declined slightly to USD 34.9/MBtu on 21 November from USD 35.1/MBtu the previous week. It then rose for two consecutive days to hit USD 39.2/MBtu on 23 November due to increased heating demand from colder weather in Europe and the European Commission’s proposal to limit excessive gas price spikes.

It fell back to USD 37.5/MBtu on 24 November due to continued nearly full gas storage rates and low liquidity in the market, and remained flat at USD 37.6/MBtu on the following day. According to AGSI+, the EU average underground gas storage on 25 November was 94.01%.

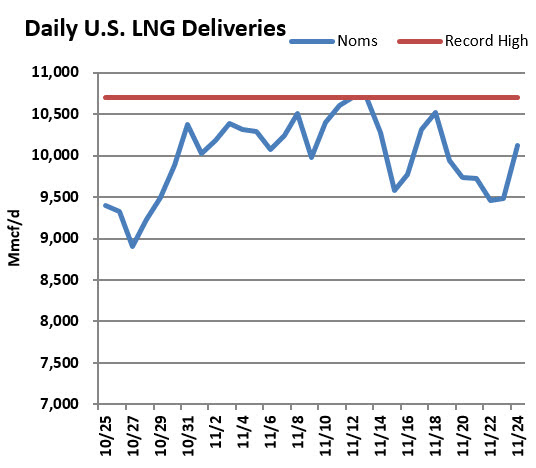

The U.S. gas price HH rose to USD 6.8/MBtu on 21 November from USD 6.3/MBtu the previous week and remained flat on 22 November, but rose to USD 7.3/MBtu on 23 November. After a holiday closure on 24 November, HH fell to USD 7.0/MBtu on 25 November.

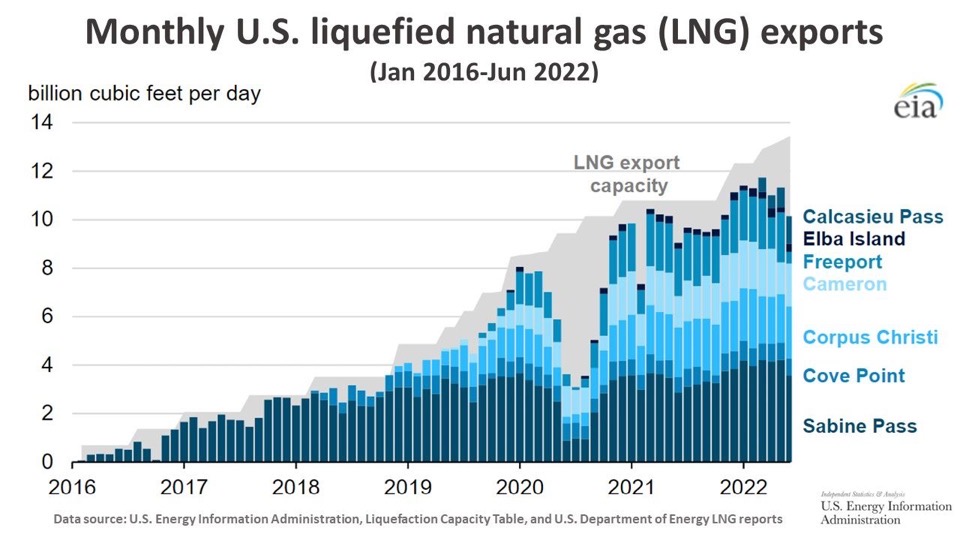

Freeport LNG announced on 18 November that it plans to resume initial production in mid-December, rather than the originally planned mid-November, subject to regulatory approval.

According to the EIA Weekly Natural Gas Storage Report released on 23 November, the US natural gas underground storage on 18 November was 3,564 Bcf, an increase of 80 Bcf from the previous week, down 1.7% from the same period last year and down 1.1% from the historical five-year average.

Updated 28 November 2022

Source: JOGMEC