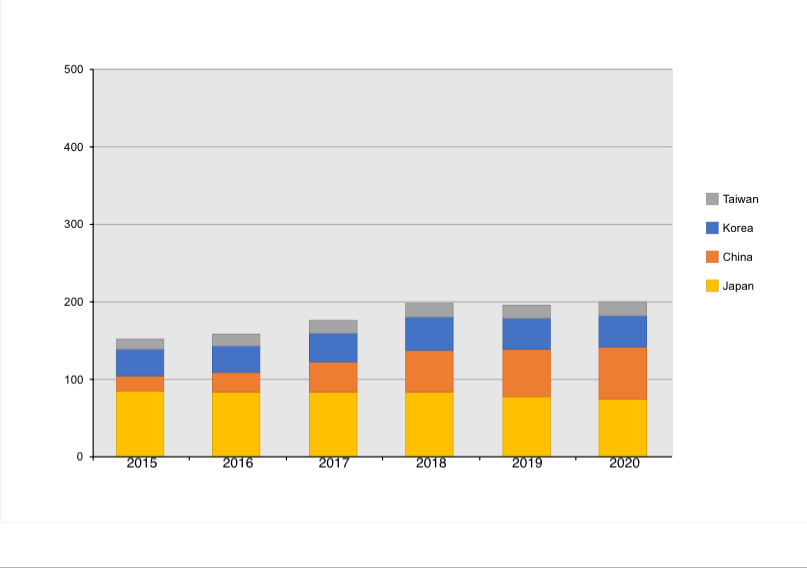

Notwithstanding COVID-19, LNG imports by North Asian countries, Japan, China, Korea and Taiwan, increased by 2.5% to a total of 200.3 million tonnes (Mt) of LNG in 2020, 4.8 Mt higher than in 2019 when 195.5 Mt was imported.

Import prices took a hit with the falling oil price. Average Asian import prices dropped 24.1% to $7.27/MMBtu in 2020 from $9.57/MMBtu in 2019.

China is far and away the world’s largest gas importer, well ahead of number two, Germany and number three, Japan. China saw the greatest increase in Asian LNG volumes during 2020, importing 67.4 Mt of LNG, up 11.1% on the 60.7 Mt imported in 2019. China’s pipeline gas imports fell 4.9% in 2020 to 34.5 Mt from 36.3 Mt in 2019.

Total Chinese gas imports were 101.9 Mt compared to 97.0 Mt in 2019, an increase of 9.5% year on year. However, natural gas still only constituted 8.8% of China’s primary energy consumption, well below the global average of 24%. Chinese gas demand is expected to continue to grow strongly, particularly replacing coal as the country moves towards its 2060 goal of net zero carbon emissions.

The growth in gas demand in China reflected the strong rebound in industrial activity following the first wave of COVID-19, together with the exceptionally cold winter. Beijing recorded its coldest December day in 42 years

Pipeline imports from Russia began in December 2019 and increased to 20% of total pipeline imports in December 2020. Russia had an average of 8.5% of the pipeline market share in 2020.

Turkmenistan remains by far the largest exporter of pipeline gas to China, exporting 20.7 Mt, 60% of the total market in 2020, compared to 24.1 Mt, 66% of the total market in 2019.

Although China is expected to overtake Japan as the world’s largest LNG importer, Japan remained the world’s largest LNG importer in 2020, even though the country recorded a fall in LNG import volumes in 2020 compared to 2019. Japan imported 74.5 Mt in 2020, 3.7% lower than 2019 when it imported 77.3 Mt.

EnergyQuest estimates Australia delivered a total of 78.7 Mt of LNG in 2020, up 2.2% from 77.0 Mt delivered in 2019. China and Japan were the equal top Australian destinations. Australia had by far the largest market share in China in 2020 with 29.1 Mt (43.3%) of the total LNG imports.

Australia also had the largest share of the Japanese market, with 29.1 Mt (39.1%) of the total LNG imports.

Source: Graeme Bethune, Chief Executive Officer, EnergyQuest

Follow on Twitter:

[tfws username=”EnergyQuest” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]