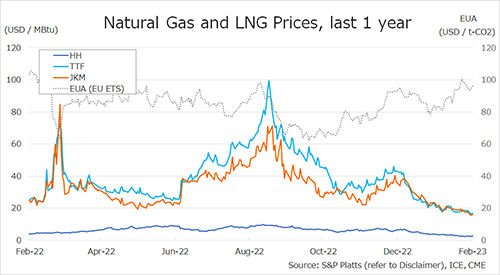

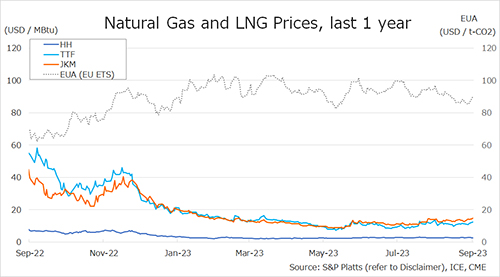

The Northeast Asian assessed spot LNG price JKM for the previous week (18 – 22 September) rose from the high USD 12s the previous week to USD 15/MBtu on 22 September due to supply concerns from strikes at Australian LNG liquefaction facilities while US Freeport resumed production after troubles and Northeast Asian buyers took a wait-and-see approach to winter procurement.

On 22 September, under the mediation of the Australian Fair Work Commission, it was decided to adjourn Chevron’s application for an intractable bargaining declaration for four weeks to finalize an enterprise agreement with the labor union. It was also confirmed that no further labor disputes took place during this period. METI announced on 20 September that Japan’s LNG inventories for power generation totaled 1.62 million tonnes as of 17 September, down 0.08 million tonnes from the previous week.

The European gas price TTF rose to USD 12.4/MBtu on 22 September from USD 11.4/MBtu the previous week following the Australian strike as well as a glitch in the resumption of production at the Troll gas field in Norway.

ACER published the 22 September spot LNG assessment price for delivery to the EU at EUR 36.7/MWh (equivalent to USD 11.5/MBtu). According to AGSI+, the European underground gas storage rate as of 22 September was 94.6%, up from 93.9% the previous week.

The U.S. gas price HH moved up and down from USD 2.6/MBtu the previous week before settling at USD 2.6/MBtu on 22 September. According to the EIA Weekly Natural Gas Storage Report released on 21 September, the U.S. natural gas underground storage on 15 September was 3,269 Bcf, up 64 Bcf from the previous week, up 14.3% from the same period last year, and up 5.9% from the average of the past five years.

Updated 25 September 2023

Source: JOGMEC