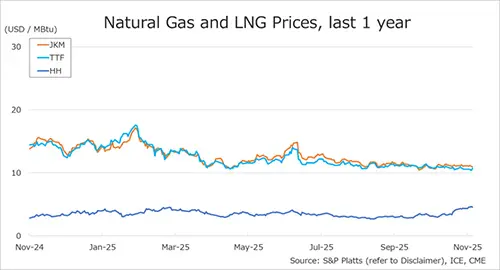

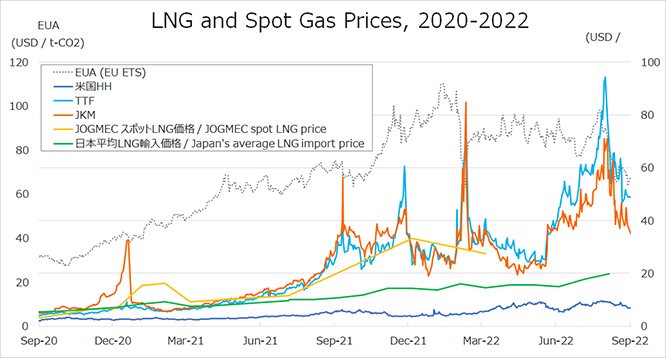

The assessed spot LNG price for near-month delivery to Northeast Asia, JKM rose to USD 63 per million Btu on 5 September due to supply concerns in Europe, but fell to USD 46 on the following day as demand declined.

JKM further fell sharply to USD 39 on 8 September on sluggish demand and talks in Europe on measures to curb gas price hikes.

The following week, JKM hovered in the low USD 30s or low 40s, but rose to USD 47 on 15 September on the back of higher European gas prices, before falling to USD 42 on 16 September.

Thereafter, JKM hovered in the high USD 30s amid generally stagnant spot market activity, reaching USD 45 on 21 September but falling back to USD 38 on 23 September and USD 35 the following week on 26 September against a backdrop of weak demand and abundant inventories.

The recovery of LNG demand in China has stalled due to a switch from gas to coal caused by LNG price hikes, and the lockdown. China’s LNG imports in August were down 28% year on year. On the other hand, LNG inventories in Japan were reported to be above record levels.

JKM’s price reversal with TTF continued, with the largest price differential in September at USD 22.

On the other hand, JKM’s near-term cargoes fell in the second half of September and December-delivery cargoes became more expensive, widening the price gap.

JOGMEC announced in its monthly report of spot LNG prices for delivery to Japan that the average price of spot LNG cargoes for delivery to Japan contracted in August 2022 and scheduled to be delivered from the month onward (contract-based price) was not disclosed as only one or less company submitted the report for the month.

The average price of spot LNG cargoes that were contracted and delivered in Japan within the month (arrival-based price) was not disclosed, either for the same reason.

The Henry Hub Natural Gas Futures price declined after reaching USD 9.3 on 1 September and hovered in the high USD 7s to high USD 8s in the first half of September. It declined again after reaching USD 9.1 on 14 September, to USD 6.8 as of 23 September and USD 6.9 the following week on 26 September.

U.S. natural gas underground storage inventories remained low at 2,874 bcf as of 16 September, down 6.4% from the previous year and down 10.4% from the five-year average.

According to the U.S. Energy Information Administration’s 7 September Short-Term Energy Outlook, the average natural gas spot price forecast for the fourth quarter of 2022 is USD 9.00, and the average forecast for 2023 is USD 6.00, down due to increased natural gas production.

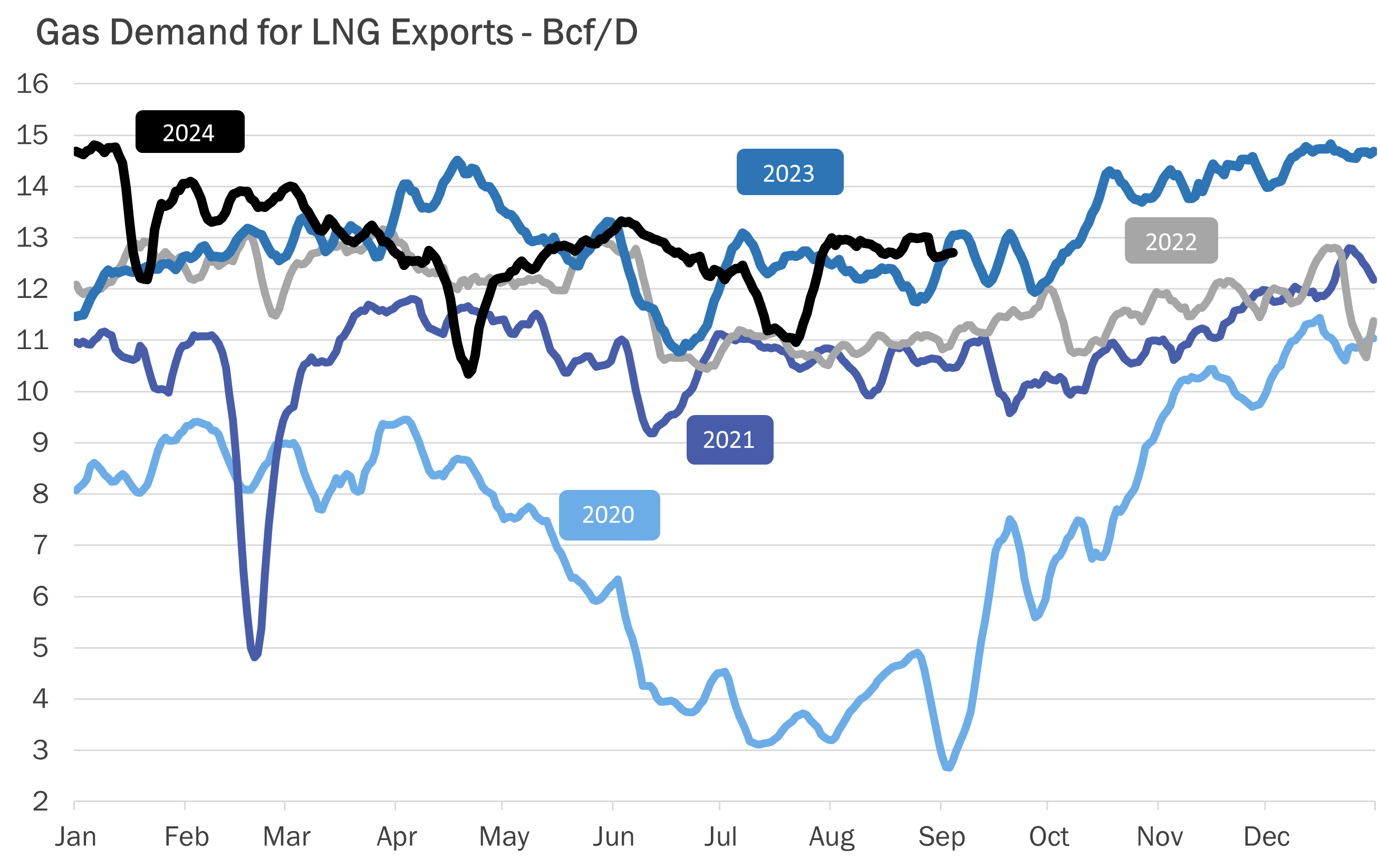

For U.S. LNG exports, the outlook for the fourth quarter of 2022 is for an average of 11.7 bcf/d, an increase of 1.7 Bcf/d from the third quarter average. For 2023, the U.S. LNG exports are forecast to average 12.3 bcf/d according to the outlook.

The Dutch TTF Gas Futures price fell sharply from USD 66.6 on 1 September to USD 53.7 after European natural gas underground storage achieved 80% of its target ahead of schedule.

With Nord Stream’s outage after its scheduled maintenance, and also due to lower UK wind generation, TTF rose again the following week, reaching USD 65.6 on 6 September.

On 7 September, the European Commission’s measures on energy price hikes were presented, and the TTF fell to USD 60.3 and further to USD 56.8 on 9 September. TTF hovered in the high USD 50s the following week, but rose to USD 63.7 when it was reported at the 14 September Energy Ministerial that the proposed price hike measures would not include a price cap.

In the second half of September, the TTF was hovering in the high USD 40s to low USD 50s, partly due to a strong buildup of the European natural gas underground storage and oversupply of LNG cargoes.

The reduction in gas flows to Nord Stream since mid-June, supply outages since early September, and supply concerns during the winter months have resulted in a significant premium to TTF, with the UK gas price NBP discount to TTF at a September maximum of USD 17.4.

Based on the preliminary figures from Japan’s customs statistics of the Ministry of Finance, the country’s average LNG import price was USD 19.88 per million Btu and JPY 139,380 per tonne in August 2022, both the highest ever recorded.

The average landed prices of LNG in Japan from the United States, the ASEAN region, the Middle East, and Russia in August were USD 19.22, USD 18.26, USD 25.50, and USD 14.97, respectively.

Elsewhere in Asia, average import prices in August were USD 17.00 in China, USD 23.04 in Korea, and USD 24.60 in Chinese Taipei. Japan’s average landed crude oil import price (JCC: Japan crude cocktail) was USD 112.41 per barrel in August 2022.

The Japanese yen denominated price stood at JPY 95,607 per kilolitre, remaining at high levels. Japan’s average LNG import price, which accounts for 70%-80% of long-term contracts linked to JCC prices, is expected to continue to be affected by current crude oil prices.

Japan imported 6.27 million tonnes of LNG in August 2022, 0.4% lower than the same month of 2021. The total import volume during the first eight months of 2022 was 49.98 million tonnes, a decrease of 3% from the same period of 2021.

China imported 4.72 million tonnes of LNG in August 2022, 28% less than the same month of 2021. China’s total LNG import volume during the first eight months of 2022 was 40.64 million tonnes, a decrease of 21% from the same period of the previous year.

While Korea imported 3.83 million tonnes in August 2022, an increase of 10% from the same month of 2021, Chinese Taipei imported 1.65 million tonnes, 2% lower than one year earlier.

LNG import volume from these four markets was 133.92 million tonnes during the first eight months of 2022, a decrease of 8% year-on-year.

Updated 28 September 2022

Source: JOGMEC