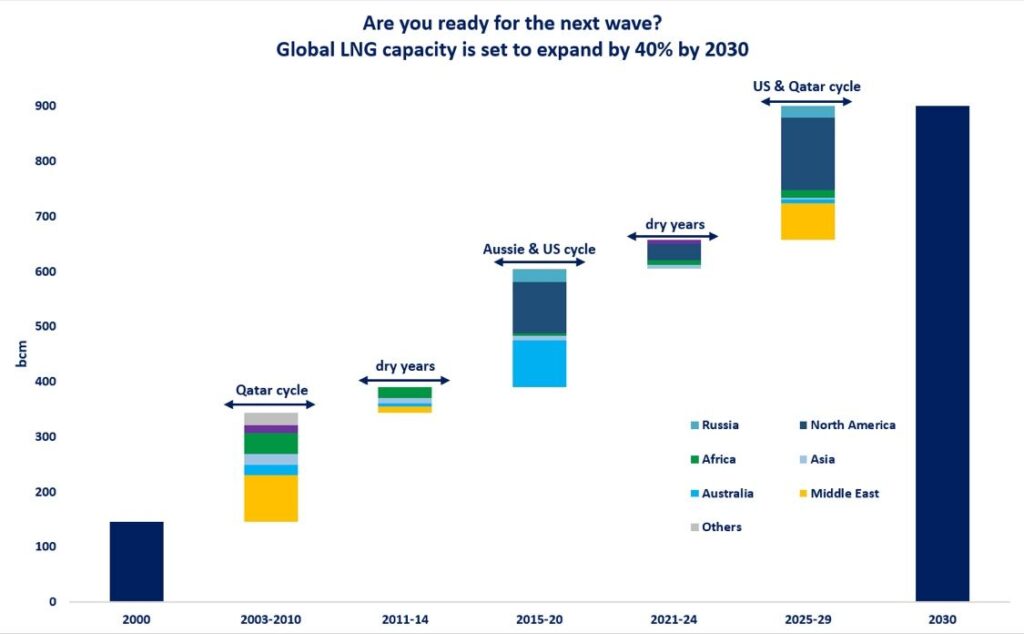

Global LNG capacity is set to expand by 40% by 2030, with the new megacycle driven by Qatar and the US. never so much LNG was added to the market in such a short time.

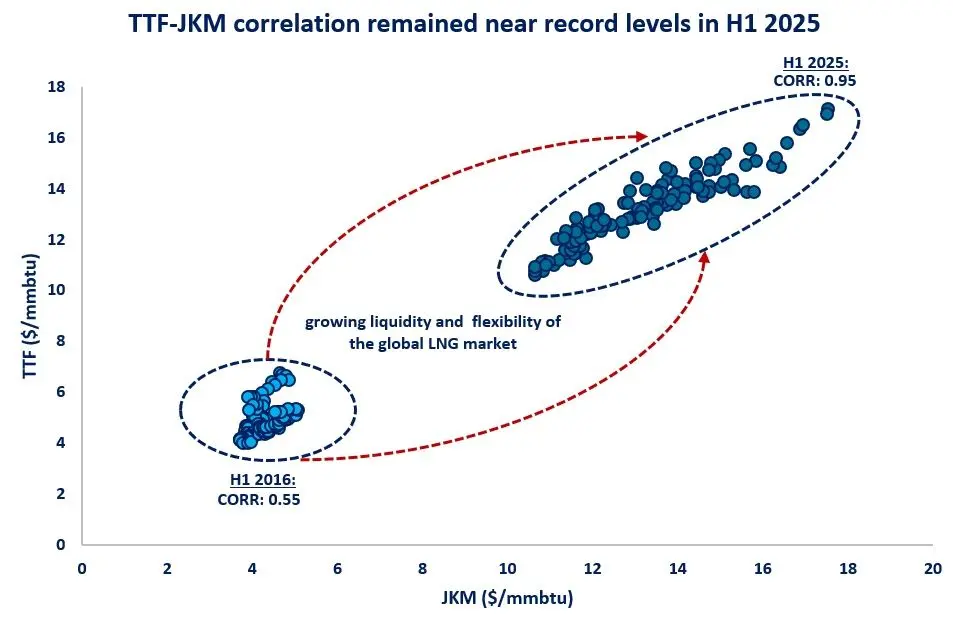

The LNG industry is cyclical by nature: since the start of the decade, global LNG liquefaction capacity more than quadruped and became a truly global commodity.

This strong expansion came in waves: in the 2000s Qatar built-out its world class LNG liquefaction fleet, and fuelled gas demand growth both in Asia and Europe (including via coal-to-gas switching).

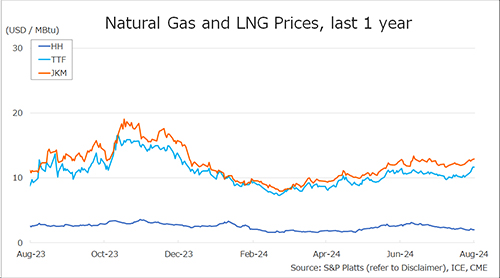

This was followed by the dry years of the 2011-14, when low liquefaction capacity additions coincided with the Fukushima accident, which consequently drove-up gas prices to (at the time) record high levels.

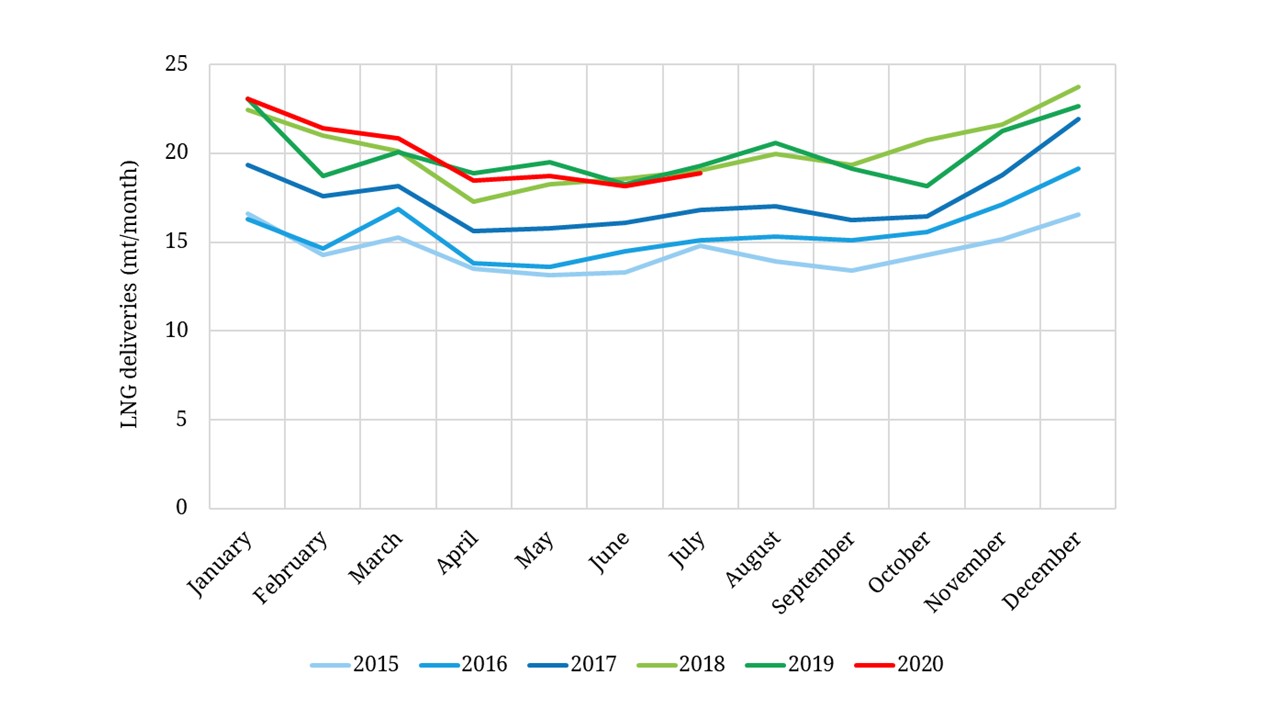

The next wave came from Australia and the US, with over 200 bcm/y LNG liquefaction capacity added to the market between 2015-20. this strong growth in LNG supply rebalanced the market after the Fukushima tightness and supported strong demand growth, primarily in China and the emerging Asian markets.

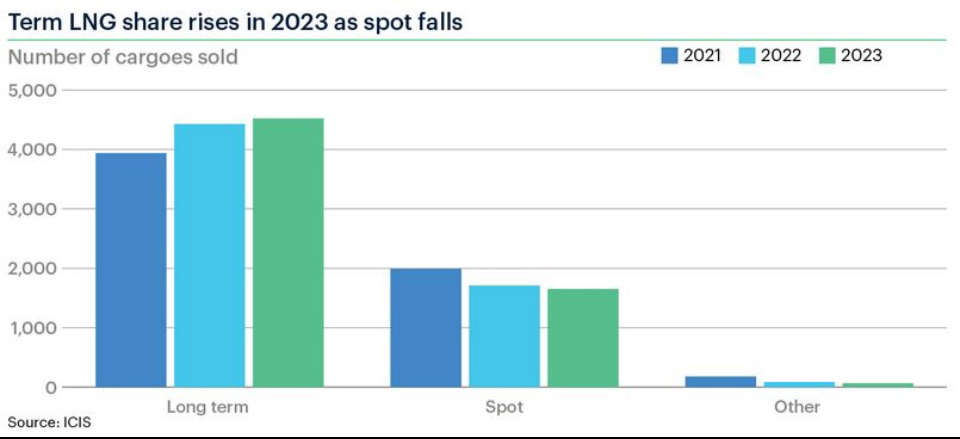

Once again, this was followed by dry years, with limited additions coming from the US and coinciding with the 2022/23 gas supply shock -when Russian piped gas deliveries to Europe dropped by 120 bcm. this led to all-time high gas prices and a painful readjustment in gas demand (with Europe’s gas consumption dropping by 20% in just two years).

Now, the next megawave is set to start in 2025, with almost 250 bcm/y of LNG liquefaction capacity is expected to be added in the next 5 years. this should bring global LNG capacity to around 900

bcm.

Source: Greg Molnar