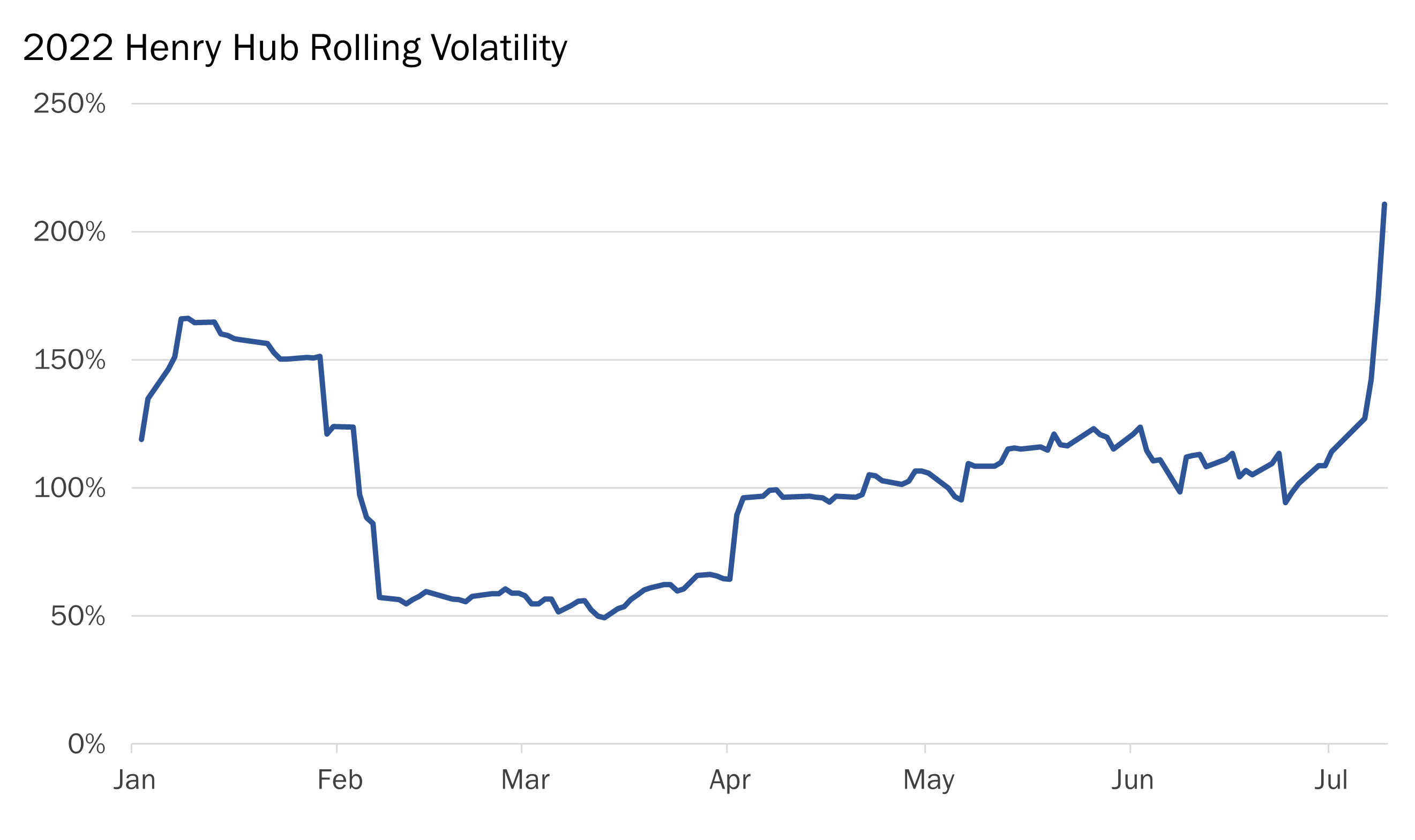

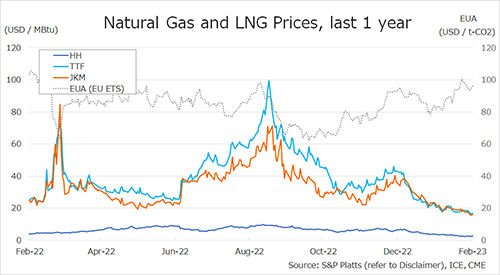

Looming liquidity: gas trading and hub liquidity declined across all key gas markets in 2022, amidst record price volatility and rapidly rising margin calls.

Hub liquidity is key to ensure the cost- and time-efficient functioning of gas markets. in general, greater liquidity improves allocation efficiency, price signals and ultimately supply security.

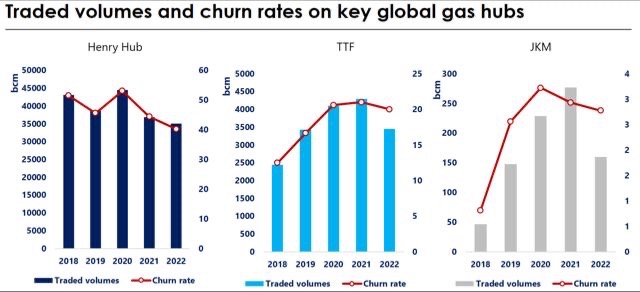

It is typically measured by the churn rate, showing how many times a gas molecule was exchanged before delivered to the end-user.

While the last decade was characterised by an exponential growth in gas trading and rapidly

improving liquidity, this trend was cut short in 2022, when both trading volumes and liquidity fell sharply compared to previous years.

The most dramatic drop was on TTF, where gas traded volumes fell by 25% in 2022. This was partly driven by the steep decline in EU gas demand (-13%) and partly by the increasing margining costs, which pushed away market players with weaker “financial muscles”.

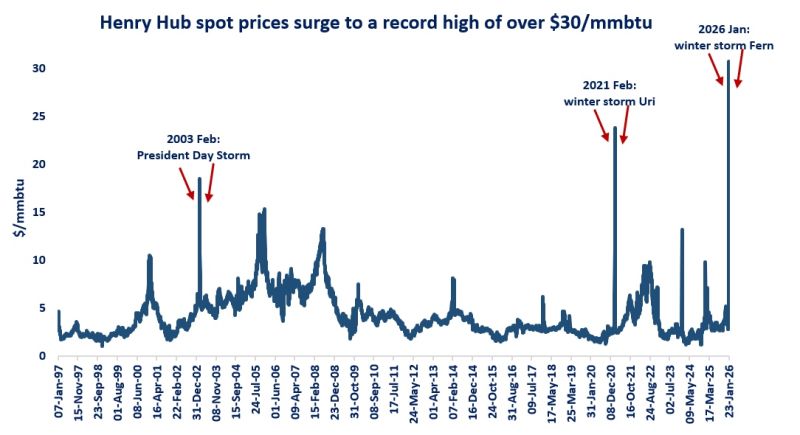

In the US, gas trading on Henry Hub fell by 6%, while the churn rate dropped to just 40 -its lowest since at least 2012. Trading and liquidity suffered particularly in the second half of the year, when gas prices rose to their highest since 2008.

And traded volumes sharply declined on the JKM as well, with a drop of 40%, amidst the reduced interest of Asian to procure LNG on the spot market.

What is your view? How will paper gas trading evolve in the coming years? The wild price swings and turnaround of seasonal spreads highlights that well-developed trading functions and accurate hedging strategies have never been important…

Source: Greg MOLNAR (LinkedIn)