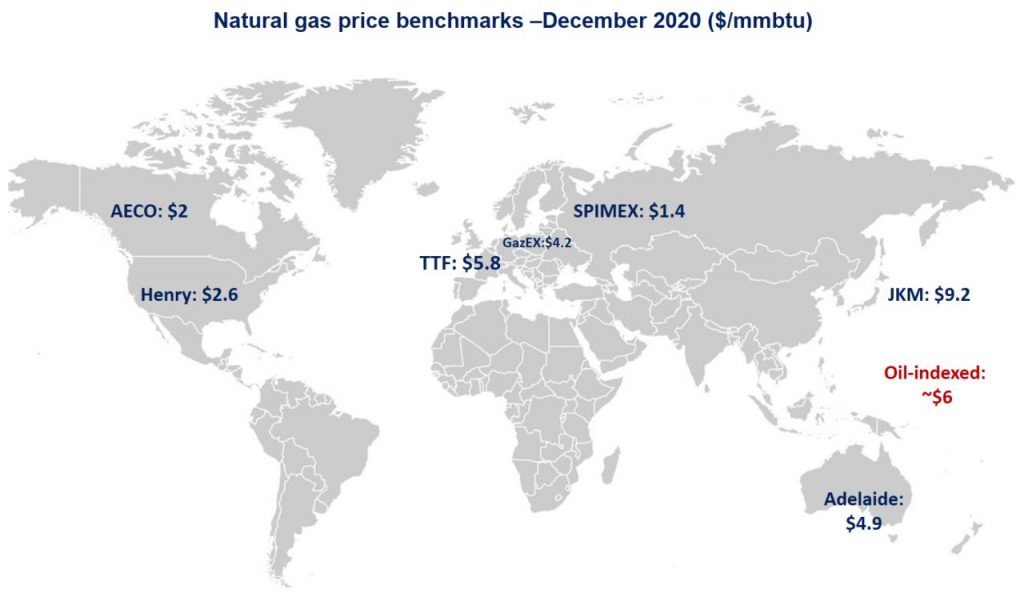

Natural gas benchmarks ended then year with a massive bull run in December, closing a difficult 2020 well above last year’s price levels.

The undisputed champion was of course JKM jumping by almost 70% yoy and closing the year at over $12/mmbtu -a six year high. colder winter temperatures in China combined with lower pipeline supplies from Central Asia prompted a massive buying spree on the spot market.

China’s LNG imports are now on track to overpass 8 MT – its highest level on record. nuclear outages in Japan and coal caps in Korea have also contributed to JKM’s strength, whilst LNG supply remained subdued due to outages.

As such, oil-indexed LNG prices are now about one-third below the spot level -sometimes it pays off having some JCC slopes in your contract portfolio.

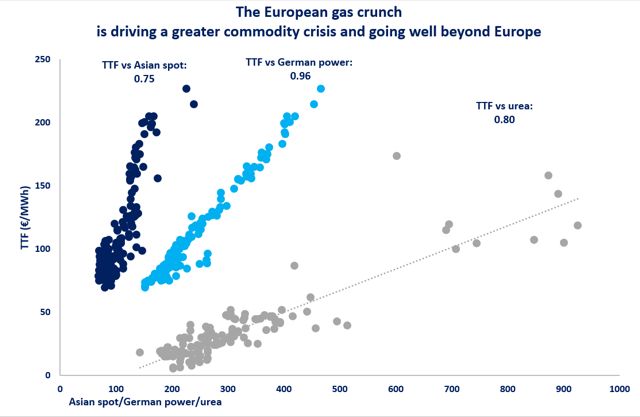

In Europe, TTF gained over 33% yoy, partly driven by higher demand (up by 2.5%), but most importantly by the drying up LNG inflow, down by 40% as cargoes have been increasingly diverted to Asia.

In the US, Henry gained 16% yoy despite lower domestic demand and driven by higher LNG export flows jumping by ~40% yoy and set to reach another record of over 6 MT.

What is your view? How will prices evolve in 2021? Will we see a strong yoy recovery as the market expects it?

Source: Greg Molnar

Connect with Greg on LinkedIn