Republican candidate Trump’s defeat of Democrat Kamala Harris had spurred discussions amongst Europe’s energy industry professionals about the possible implications of his second presidency on regional security of supply, with some fearing it could give Russian leader Vladimir Putin “free reign”.

“I think it will ultimately lead to greater LNG availability for the UK and EU at a lower price, but before we get to that point the global energy markets will be more volatile,” said Alan Whitefield, head of research and risk management at Mitie Plan Zero.

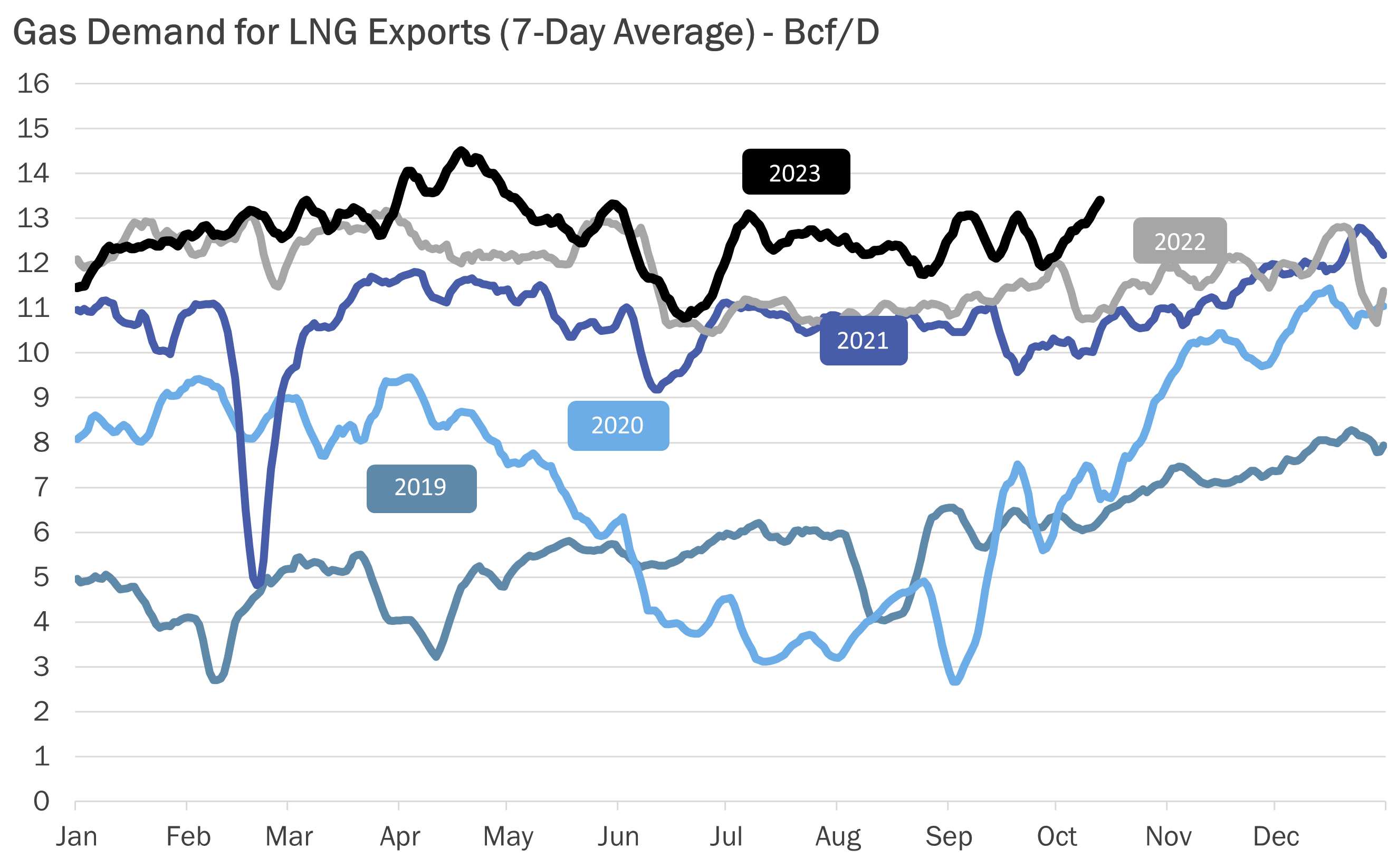

The US is already Europe’s largest supplier of LNG, shipping 32m tonnes (43.5bcm) to European destinations, excluding Turkey, so far this year, which accounts for 45% of total supply (71.3m tonnes), according to data from ship-tracking firm Kpler.

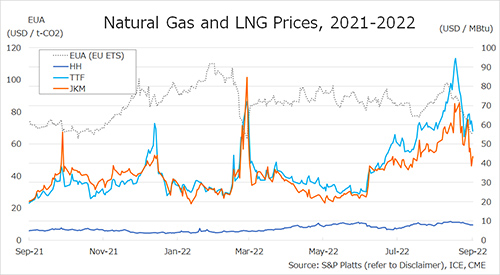

Europe has become increasingly reliant on LNG since Russia’s invasion of Ukraine in early 2022, as it attempts to wean itself off gas from the former.

Russia-Ukraine issue

In terms of the conflict, the president elect had said previously he would prioritise ending the war, which could impact Russian piped gas flows, Anne-Sophie Corbeau, global research scholar at the Centre on Global Energy Policy at Columbia University, told Montel.

Peace in Ukraine could lead to a return of Russian gas flows via Ukraine, she added, though observers remained sceptical about Trump’s claims he could end the Ukraine war in “one day” or deliver meaningful peace.

While some European countries were unlikely to ever revive gas imports from Russia, others – such as Austria, Hungary, Slovakia – might want to reinstate a “status quo”, said Corbeau, adding the market could therefore “return to the present situation”, with just a supply hiatus in early 2025.

“The contradiction is that more Russian pipeline gas to Europe means less imports of LNG, all other things being equal.”

However, others highlighted potential geopolitical threats from a Trump presidency.

“If Trump breaks up Nato and leaves [Russian president Vladimir] Putin with a free reign, eastern Europe and associated energy flows will be at risk,” Whitefield said, adding this could mean more US LNG was shipped to Poland, Lithuania and possibly Germany.

“Trump’s foreign policy may also result in stronger military and financial actions against Iran’s energy facilities which would cause further instability in the region and be volatile for gas and oil prices.”

Pro oil and gas

Kpler analyst Alexis Ellender, meanwhile, told Montel a second Trump presidency would “be focused primarily on US domestic political priorities” but that there would be “implications for European energy markets”.

The new president was expected to be strongly pro oil and gas development, he added.

“He approaches this from a US energy security angle but is also likely to support the export of surplus supply.”

In January, president Joe Biden’s administration imposed a temporary freeze on the approval of LNG export licences to countries without a free trade agreement, while it reviewed the economic and environmental impact of proposed LNG plants.

Trump has said previously that he would push pending authorisations through, should he become president.

No restrictions

“The signal is clear for oil and gas producers, that there will be no restrictions from the White House,” said Ignacio Urbasos, energy and climate researcher at the Elcano Royal Institute.

“We are heading towards a scenario with much more LNG, it will increase significantly until the end of the decade.”

Spain was poised to be one of the key beneficiaries of the expected pause on LNG permits due to its abundant regasification capacity and experience in signing supply agreements with US LNG companies, said Urbasos.

The country’s six regasification plants have a combined storage capacity of 22.7 TWh connected to the gas grid, with an additional 2 TWh at the El Musel gas storage facility. As such, Spain makes up 44% of the EU’s tank capacity, according to TSO Enagas data.

“The rhetoric of “drill, baby, drill” should lead to higher shale production and lower priced exports for US oil and LNG,” said Mitie’s Whitefield, referring to a previous Trump rallying cry for oil exploration.

At the time of writing, Trump’s election victory was made official amid the winning of swing state Wisconsin, seeing him surpass the threshold of 270 electoral college votes needed to seal his return to the White House.

Source: Montel