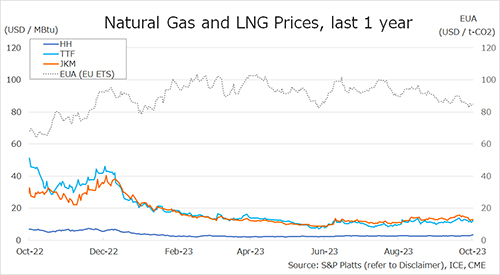

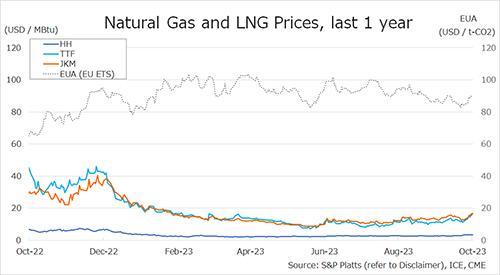

The Northeast Asian assessed spot LNG price JKM for the previous week (9 – 13 October) rose from the high USD 12s the previous week to high USD 16s on 13 October due to supply concerns over the dispute between Israel and Hamas, and the shutdown of the Baltic-Connector gas pipeline, although demand is weak.

METI announced on 11 October that Japan’s LNG inventories for power generation totaled 1.89 million tonnes as of 8 October, up 0.27 million tonnes from the previous week.

The European gas price TTF rose to USD 16.7/MBtu on 13 October from USD 11.8/MBtu the previous week following cold weather in Northwestern Europe, the resurgence of the Australian strike, the Israel-Hamas conflict and the shutdown of the Baltic-Connector gas pipeline.

According to AGSI+, the European underground gas storage rate as of 13 October was 97.7%, up from 96.7% the previous week.

The U.S. gas price HH fell slightly USD 3.2/MBtu on 13 October after some up and down from USD 3.3/MBtu the previous week.

According to the EIA Weekly Natural Gas Storage Report released on 12 October, the U.S. natural gas underground storage on 6 October was 3,529 Bcf, up 84 Bcf from the previous week, up 9.8% from the same period last year, and up 4.8% from the average of the past five years.

Updated: October 16

Source: JOGMEC