Bullish prices entice LNG to Europe

In Europe:

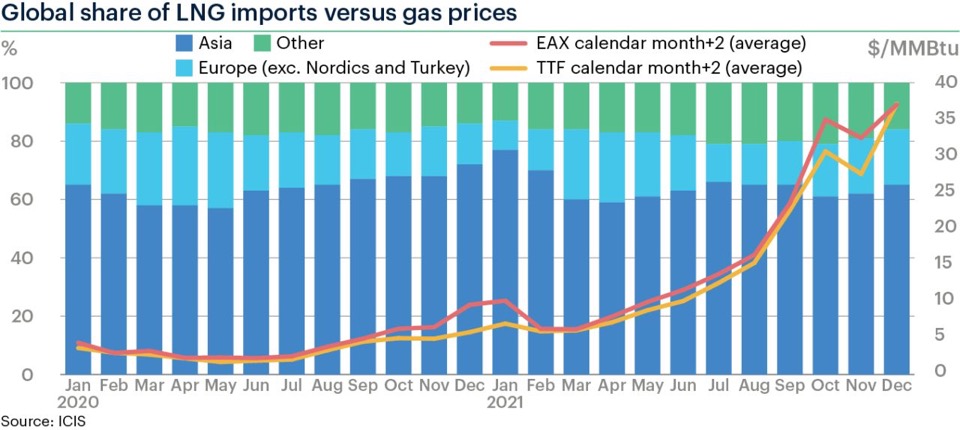

Imports reached 6.9m metric tonnes in December, a month-on-month gain of 14% and a yearly jump of 34%. The 2018-2020 average for the month is 6m tonnes.

Top importer was Spain with 1.9m tonnes with France and the UK joint second with 1.3m.

Europe accounted for ????????% of global LNG imports, unchanged from November, and the highest December share since 2019 when Europe was responsible for 23%

The ICIS TTF calendar month+2 averaged $37.42/MMBtu, up ????????% month on month and more than 5 times December’s average in 2020.

European and Asian markets were jostling for the highest price levels in December, with the former having to contend with low supply flexibility amid weakened natural gas stocks and continued uncertainty over Russian gas supplies.

Asia:

Imports for the top 5 buyers – China, Japan, South Korea, India and Taiwan – rose to ???????????? tonnes in May, a monthly gain of 14%.

Asia accounted for ????????% of global LNG imports in December, up 2 percentage points month on month but a yearly drop of 7 percentage points

China led the gains in regional imports, accounting for 8.3m metric tonnes in December up 14% month on month. Japan remained in second place with imports jumping 18% to 7.1m tonnes.

The ICIS East Asian Index (EAX) calendar month+2 averaged $37.32/MMBtu in December, up ????????% month on month and nearly triple December’s average in 2020.

Source: Christopher Rene (LinkedIn)