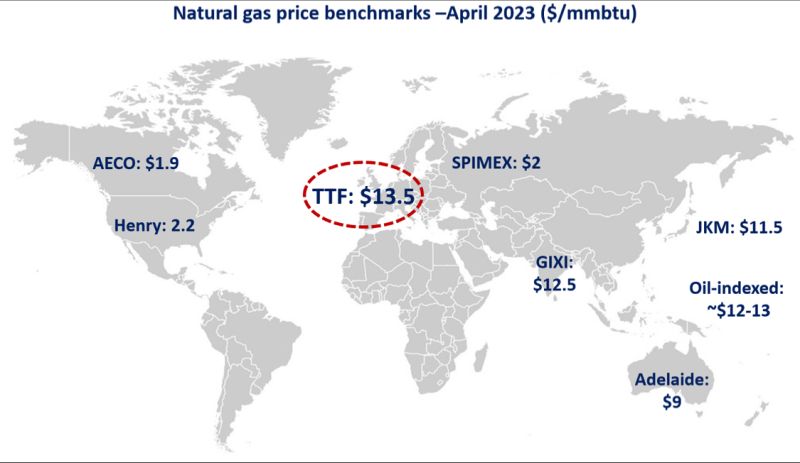

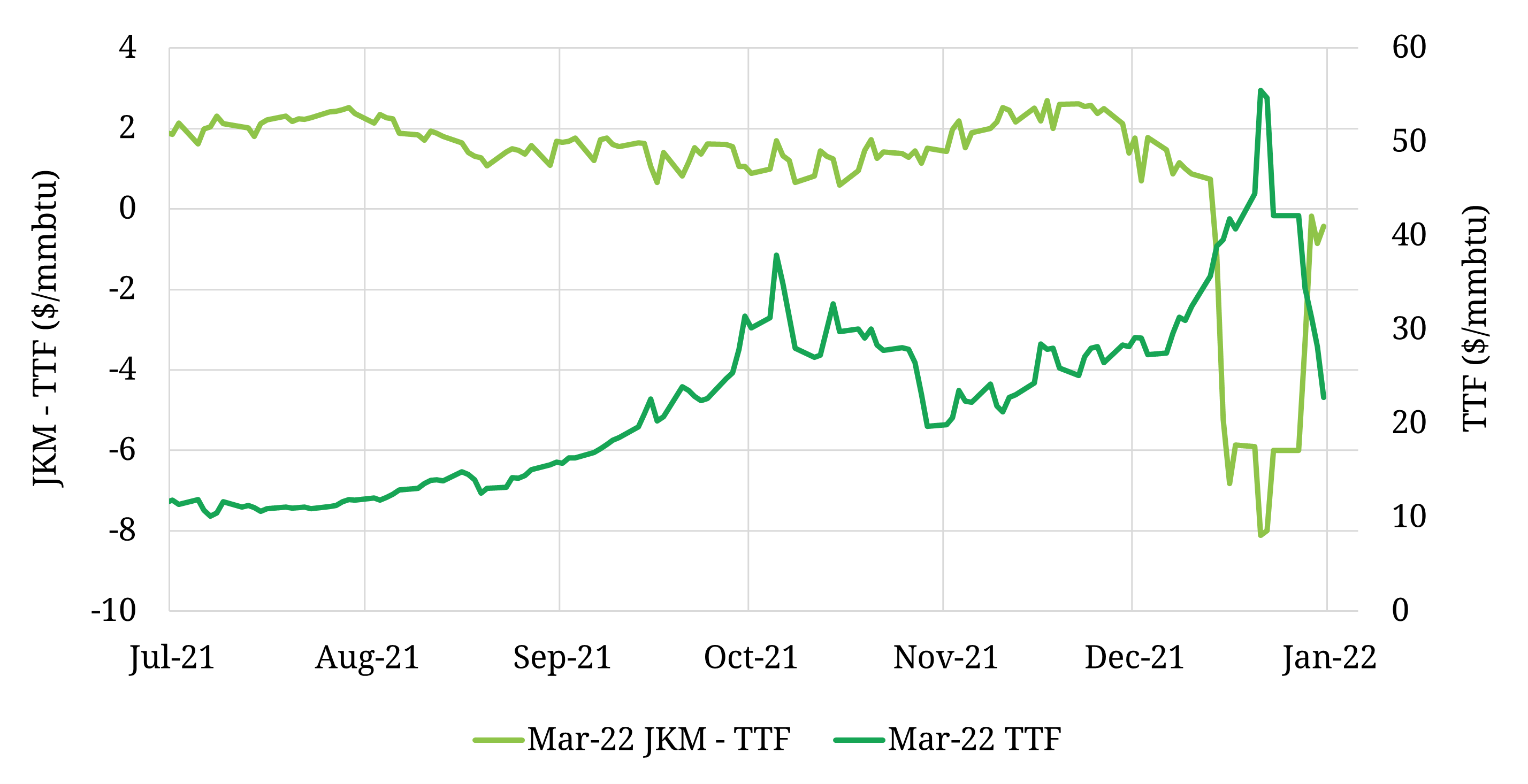

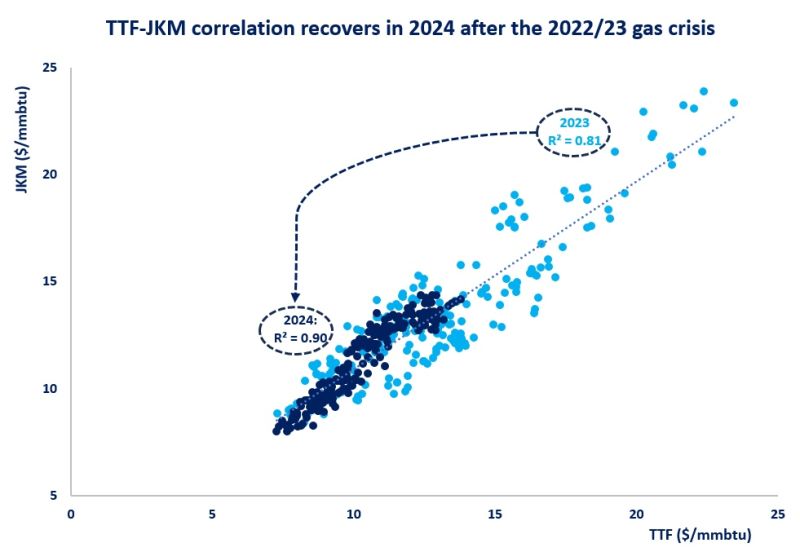

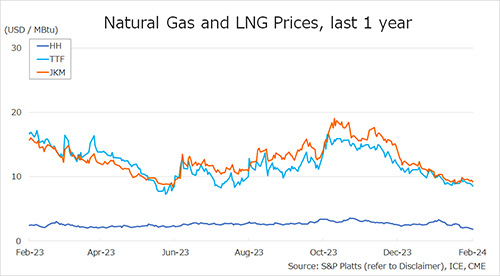

The Northeast Asian assessed spot LNG price JKM for the previous week (5 February – 9 February) decreased to low-USD 9s on 9 February from mid-USD 9s the previous week.

JKM fell as demand declined due to the Lunar New Year in China and Korea. METI announced on 7 February that Japan’s LNG inventories for power generation as of 4 February stood at 2.29 million tonnes, up 0.13 million tonnes from the previous week.

The European gas price TTF decreased to USD 8.6/MBtu on 9 February from USD 9.3/MBtu the previous week.

TTF fell due to weak demand and ample underground gas storage despite tensions in the Red Sea, unplanned outages at the Norwegian Troll gas field and Nyhamna gas processing plant, and uncertainty surrounding the operation of Freeport LNG.

According to AGSI+, the EU-wide underground gas storage declined to 67.2% as of 9 February from 69.4% the previous week.

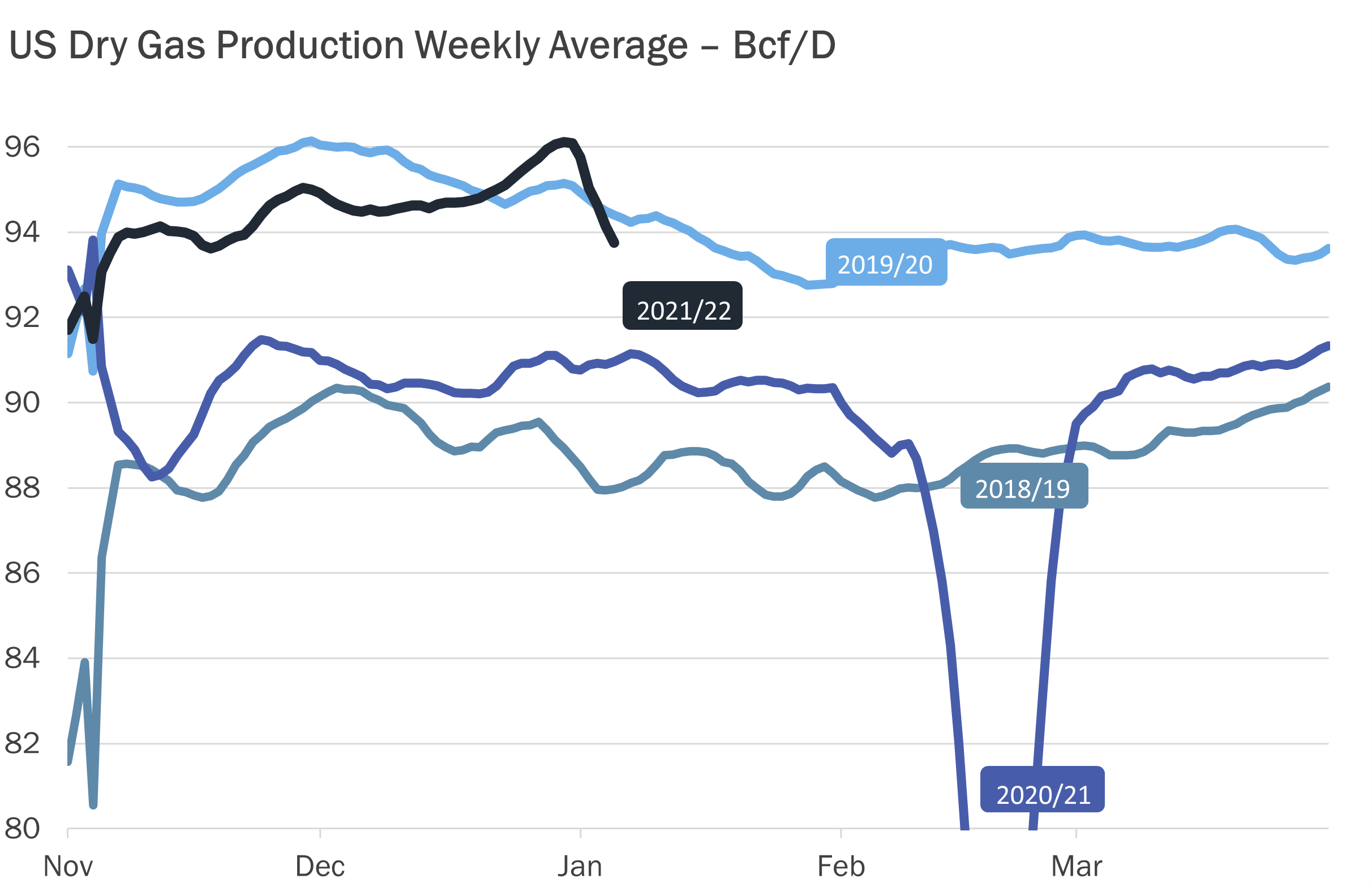

The U.S. gas price HH fell to USD 1.8/MBtu on 9 February from USD 2.1/MBtu the previous week. HH fell due to higher gas production and hitting the USD 1’s level since March 2023.

The EIA Weekly Natural Gas Storage Report released on 8 February showed U.S. natural gas inventories as of 2 February at 2,584 Bcf, down 75 Bcf from the previous week, up 7.8% from the same period last year, and 10.6% increase over the five-year average.

Updated: 13 February 2024

Source: JOGMEC