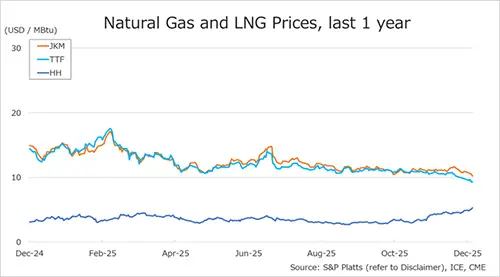

Global gas prices diverged last week as Asian and European benchmarks weakened on ample LNG supply and mild weather, while US Henry Hub climbed on stronger heating demand and rising LNG exports.

Asia – JKM (Northeast Asia)

The Northeast Asian spot LNG price JKM (January delivery) fell from the high-USD 10s to the low-USD 10s per MMBtu during 1–5 December, marking five consecutive daily declines. The drop was driven by strong supply, supported by increasing US LNG exports, while Chinese spot demand remained weak given steady domestic production and pipeline imports. South Korean inventories held stable, and Japan’s LNG stocks for power generation slipped slightly to 2.07 Mt as of 30 November.

Europe – TTF

The European gas benchmark TTF (January delivery) fell from USD 9.8 to USD 9.3/MMBtu over the week. Prices briefly firmed mid-week on lower LNG sendouts and reduced Norwegian flows, but the overall trend remained bearish due to milder-than-average temperatures, expectations of a sharp rise in German wind output, and continued storage withdrawals. EU storage stood at 72.8%, down from 75.9% the prior weekend and below both last year and the five-year average.

United States – Henry Hub

The US benchmark Henry Hub (January delivery) rose from USD 4.9 to USD 5.3/MMBtu, supported by increasing LNG exports and forecasts of colder weather across central and eastern regions. The EIA reported US gas inventories at 3,923 Bcf, down 12 Bcf week-on-week, slightly below last year’s level but still 5.1% above the five-year average. Heating demand for December is expected to reach its highest level in 15 years.

Source: JOGMEC