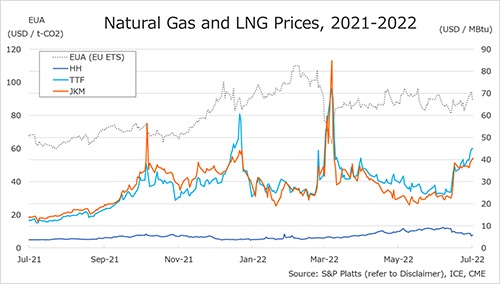

The Northeast Asian assessed spot LNG price JKM for the previous week (27 June-1 July) remained high due to supply concerns in Europe, which continued from USD 37/MBtu the previous week.

As trading in the Northeast Asian market became more active, JKM remained at USD 40s level, reaching USD 40/MBtu on 30 June and USD 41/MBtu on 1 July.

The European gas price TTF also remained high from the previous week at USD 36.9/MBtu and generally remained in the USD 40s due to supply concerns, stemming from lower flows to the Nord Stream gas pipeline.

On 30 June, Germany’s Uniper announced that it had received only 40% of its contracted volume from Gazprom since 16 June, and TTF rose to USD 44.7/MBtu and reached USD 45.1/MBtu on 1 July due to gas supply uncertainty.

Meanwhile, the U.S. gas price HH was USD 5.7/MBtu on 1 July, down from USD 6.2/MBtu the previous week.

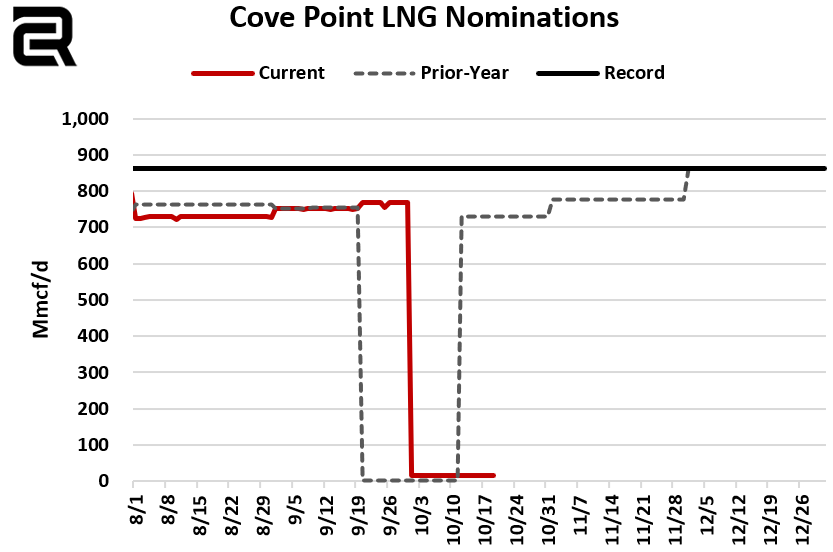

On 30 June, the Federal Pipeline and Hazardous Materials Safety Administration (PHMSA) indicated that several corrective measures need to be completed before operations can resume at Freeport LNG due to multiple instability conditions detected.

Updated 4 July 2022

Source: JOGMEC