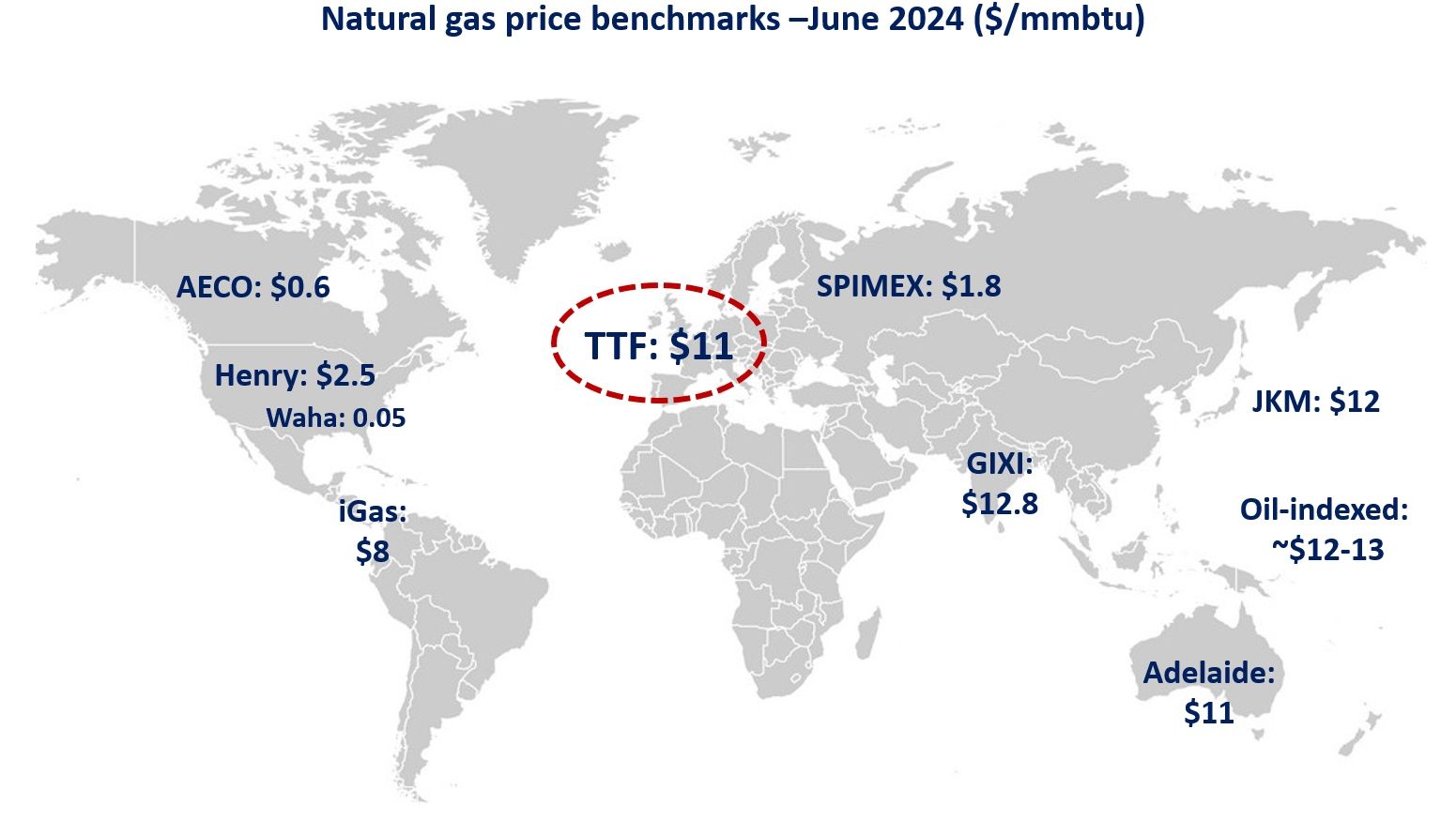

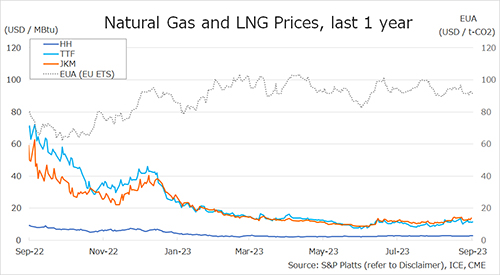

The Northeast Asian assessed spot LNG price JKM for the previous week (28 August – 1 September) rose from the low USD 12s of the previous week to the high USD 13s on 31 August due to concerns over the scheduled repairs of the Norwegian gas processing plant, in addition to strikes starting on 7 September at the Gorgon and Wheatstone liquefaction facilities in Australia.

METI announced on 30 August that Japan’s LNG inventories for power generation totaled 2.01 million tonnes as of 27 August, up 0.19 million tonnes from the previous week, down 0.74 million tonnes from the end of the same month of last year and down 0.01 million tonnes from the average of the past five years.

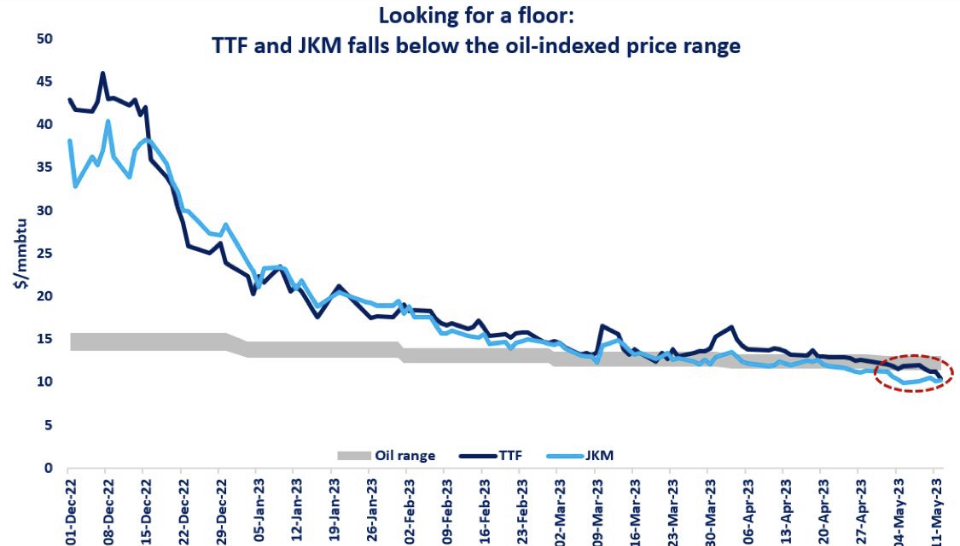

The European gas price TTF fluctuated slightly from USD 11.0/MBtu the previous week to USD 11.3/MBtu on 1 September. Despite planned strikes in Australia, abundant gas storage and stagnant demand put downward pressure on European gas prices, which remained in the low USD 11s.

ACER published the 1 September spot LNG assessment price for delivery to the EU at EUR 35.7/MWh (equivalent to USD 11.3/MBtu). According to AGSI+, the European underground gas storage rate as of 1 September was 92.9%, up from 92.1% the previous week.

The U.S. gas price HH rose to USD 2.8/MBtu on 30 August from USD 2.5/MBtu the previous week and remained at the same level until 1 September. Hurricane “Idalia” made landfall in Florida, damaging power infrastructure and causing power outages.

According to the EIA Weekly Natural Gas Storage Report released on 31 August, the U.S. natural gas underground storage on 25 August was 3,115 Bcf, up 32 Bcf from the previous week, up 18.4% from the same period last year, and up 8.7% from the average of the past five years.

Updated: September 4

Source: JOGMEC