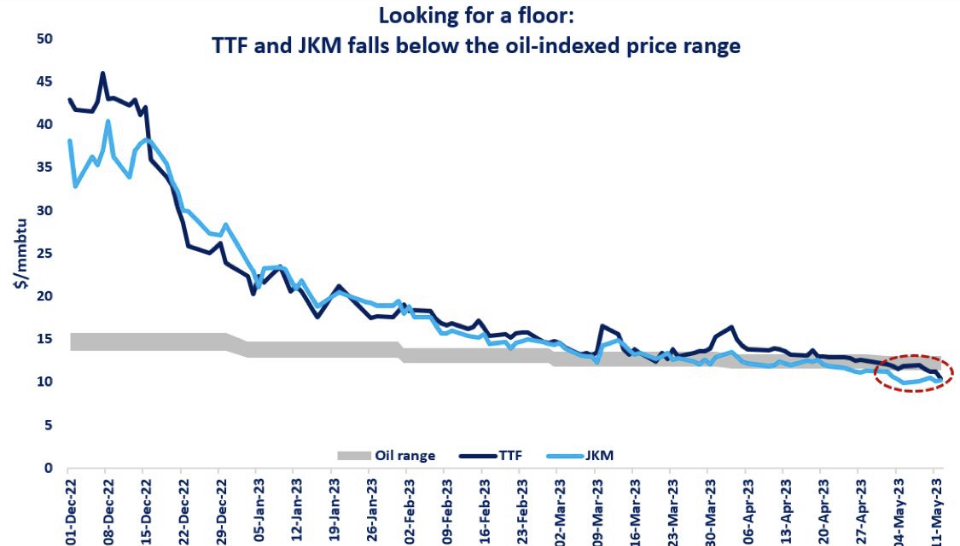

Both JKM and TTF fell below the oil-indexed price range, marking a significant shift in market fundamentals.

TTF and JKM prices dropped by over 70% since mid-December to their lowest levels since early July 2021.

Mild winter weather, sluggish demand combined with improving LNG availability (Freeport return) and high storage levels are putting downward pressure on gas prices.

In Europe, TTF is now trading well within the coal-switching price range, meaning that gas-fired generation is more competitive than coal-based generation.

And JKM is now trading essentially below the oil-indexed price range, meaning that Asian players might be incentivised to return to the spot market – as part of their portfolio optimisation strategies.

The next price shift might be the return of the Asian premium.

As European storages are gradually filled and injection demand moderates, TTF prices could drop once again below JKM – which would incentivise stronger LNG flows towards the Asian markets.

What is your view? How will gas prices evolve in the coming months? Could we see TTF dropping below JKM?