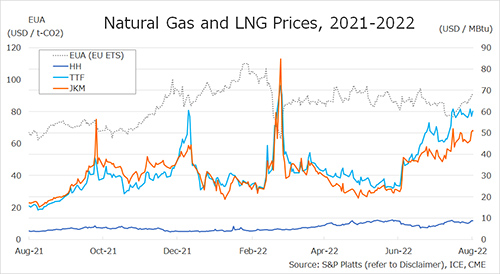

The Northeast Asian assessed spot LNG price JKM for the previous week (8 August-12 August) fell to USD 45/MBtu on 8 August from USD 47/MBtu the previous week due to TTF decline.

It then rose to USD 51/MBtu on 11 August on the back of demand from Korea and Japan and high temperatures in Northeast Asia. JKM remained at USD 51/MBtu on the following day, 12 August due to active trading for winter demand.

The Korean government was heard to instruct major companies to buy more cargoes from the spot market to increase domestic LNG inventories.

The European gas price TTF fell to USD 57.2/MBtu on 8 August from USD 58.6/MBtu the previous week due to lower liquidity caused by higher prices.

On 10 August, TTF rose to USD 61.2/MBtu as higher temperatures in Europe and lower water levels in Germany’s Rhine River hampered fuel transport and supported natural gas demand, but on 11 August it fell to USD 57.7/MBtu.

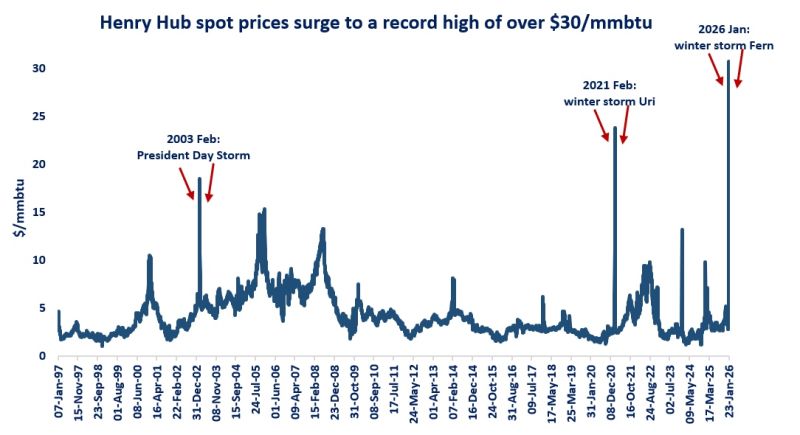

On 12 August, TTF rose to USD 60.2/MBtu. The U.S. gas price HH fell to USD 7.6/MBtu on 8 August from USD 8.1/MBtu the previous week.

It then rose to USD 8.9/MBtu on 11 August and declined slightly to USD 8.8/MBtu on 12 August.

According to the EIA Weekly Natural Gas Storage Report released on 11 August, U.S. natural gas underground storage inventories for the week of August 5 totaled 2,501 Bcf, up 44 Bcf from the previous week, down 9.7% from the previous year, and down 11.9% from the historical five-year average.

Updated 15 August 2022

Source: JOGMEC