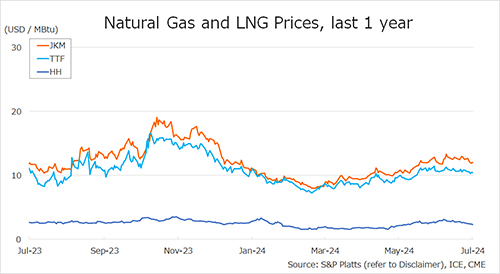

The Northeast Asian assessed spot LNG price JKM for last week (1 July – 5 July) fell to low-USD 12s on 5 July from mid-USD 12s the previous weekend (28 June).

JKM was on a downward trend due to low demand, as Japan and South Korea have already procured the required number of cargoes for the summer season, while India’s electricity demand has been significantly reduced by the monsoon.

METI announced on 3 July that Japan’s LNG inventories for power generation as of 30 June stood at 2.09 million tonnes, up 0.02 million tonnes from the previous week.

The European gas price TTF for last week (1 July – 5 July) fell to USD 10.4/MBtu on 5 July from USD 10.8/MBtu the previous weekend (28 June).

TTF was on a downward trend due to stable Norwegian gas supplies and forecasts of lower temperatures in northern and southern Europe in the following week, although there was a phase of increase in the middle of the week due to supply concerns caused by Russia’s attack on Ukrainian gas facilities and a decrease in wind power generation.

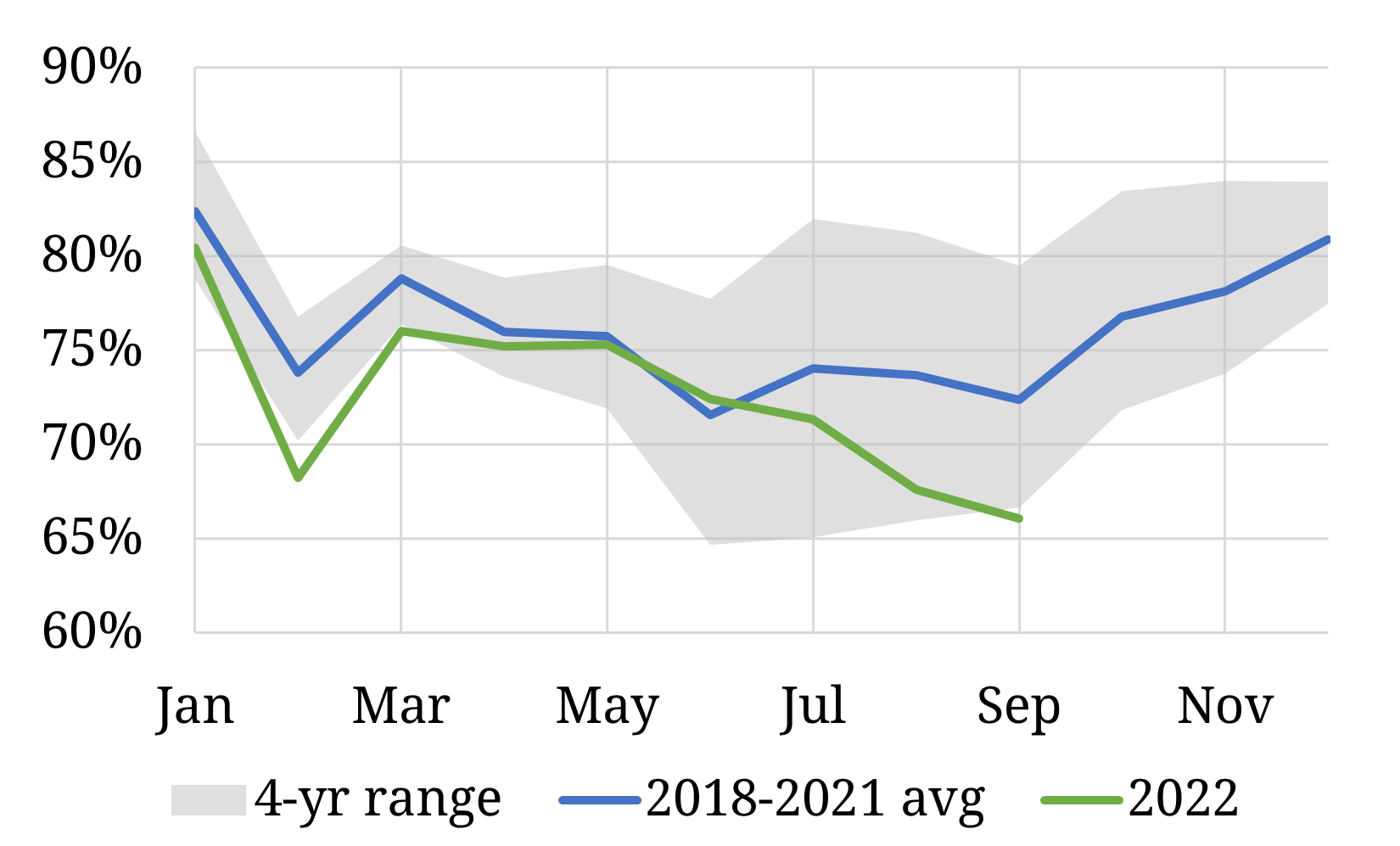

According to AGSI+, the EU-wide underground gas storage increased to 78.6% as of 5 July from 76.7% the previous weekend.

The U.S. gas price HH for last week (1 July – 5 July) fell to USD 2.3/MBtu on 5 July from USD 2.6/MBtu the previous weekend (28 June).

The EIA Weekly Natural Gas Storage Report released on 3 July showed U.S. natural gas inventories as of 28 June at 3,134 Bcf, up 32 Bcf from the previous week, up 9.6% from the same period last year, and 18.8% increase over the five-year average.

Updated: July 8

Source: JOGMEC