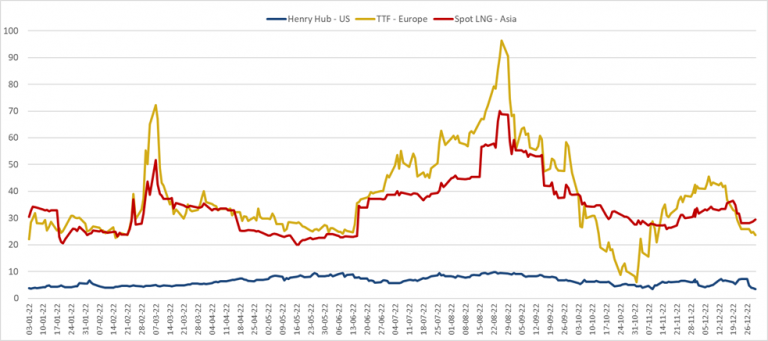

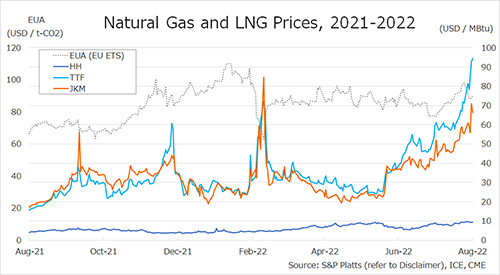

The Northeast Asian assessed spot LNG price JKM for the previous week (22 August-26 August) rose to USD 61/MBtu on 22 August, following a rise in European gas prices from USD 55/MBtu the previous week.

The price then dropped to USD 56/MBtu on 24 August as current demand was limited, but it rose significantly to a record USD 71/MBtu on 25 August due to soaring TTF prices. On 26 August, JKM fell to USD 67/MBtu due to thin trading in Japan and China as they have adequate spare inventory.

According to a 24 August METI release, LNG Inventories for power generation totaled 2.46 million tonnes, up 30 thousand tonnes from the same month last year and up 580 thousand tonnes from the average of the past five-year.

The European gas price TTF rose to USD 81.6/MBtu on 22 August from USD 71.2/MBtu the previous week as supply concerns increased due to an announcement of Nord Stream’s scheduled maintenance.

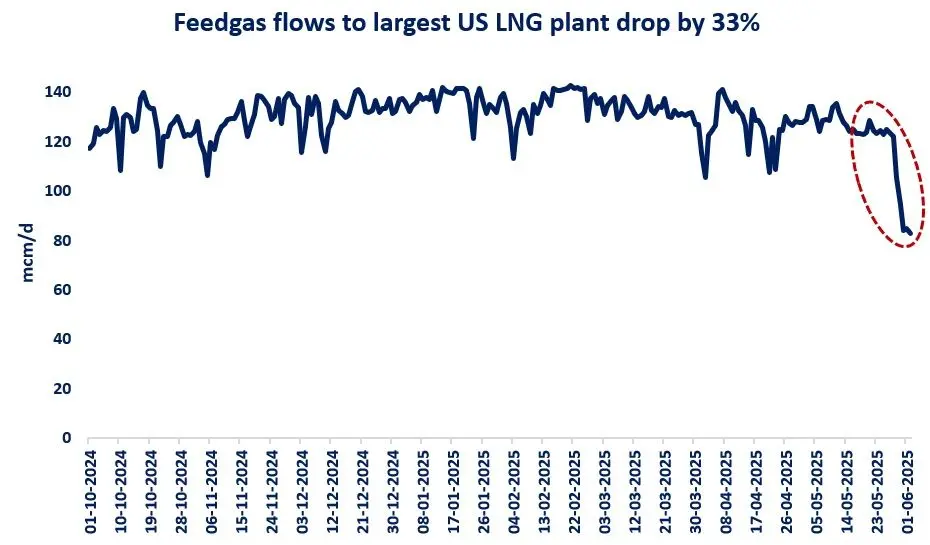

The price subsequently fell to USD 78.3/MBtu on 23 August as European traders remained quiet on the market due to high prices, but rose to USD 92.6/MBtu on 25 August after the announcement of the postponement of the restart of production at Freeport LNG in the United States, which made further concerns over tight the market in the winter.

An announcement of a planned maintenances at three Norwegian gas fields (Karsto, Oseberg and Kristi), which are scheduled from 26 August to 7 September also supported the price surge.

On 26 August, an announcement that unplanned maintenance at Norway’s Kvitebjorn gas field would be extended from 27 August to 31 August pushed the price to USD 94.4/MBtu. The maintenance work on Nord Stream’s only operating turbine is scheduled from 31 August to 2 September, during which the gas supply to Germany will be completely shut down.

The U.S. gas price HH rose to USD 9.7/MBtu on 22 August from USD 9.3/MBtu the previous week. It fell to USD 9.2/MBtu on 23 August but rose to USD 9.4/MBtu on 25 August. HH fell again to USD 9.3/MBtu on 26 August. Freeport LNG issued an update on 23 August regarding the resumption of operations.

The company has postponed its initial production restart from early October to early to mid-November and expects to reach up to 85% of the facility’s export capacity by the end of November and 100% by March 2023.

Updated 29 August 2022

Source: JOGMEC