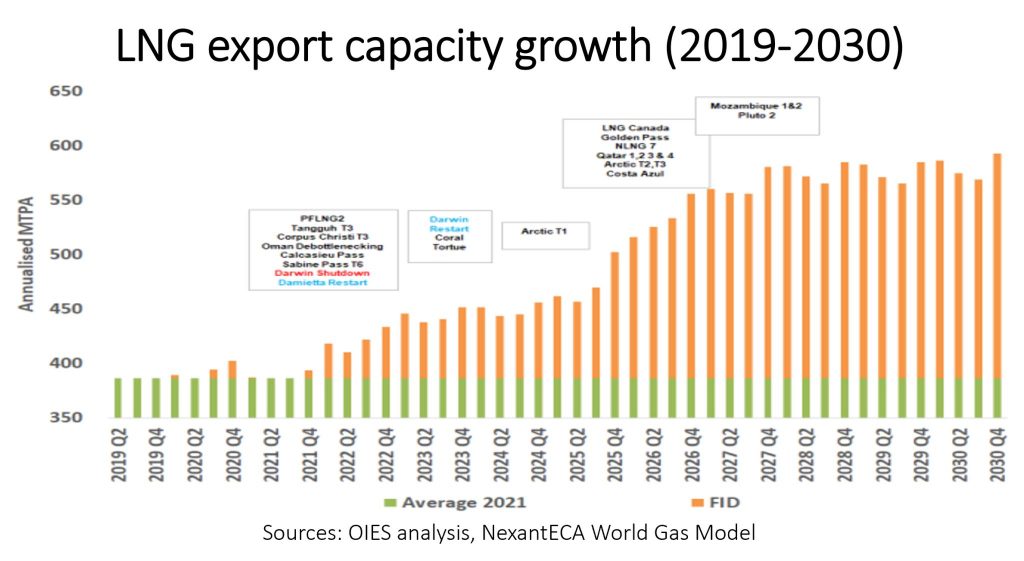

The constraints on LNG supply were a key factor driving the rising wholesale gas prices in 2021 and the healthy margins generated have raised the prospect of more FIDs for new LNG projects

After the wave of FIDs in 2019, the approval of new projects dried up as prices fell and the COVID-19 pandemic hit. A significant increase of LNG export capacity is expected in 2022, but then the additions in 2023-2024 should be limited, raising the prospect of a continuing tight LNG market over the next 2-3 years

From late 2024 onwards, the earlier wave of FIDs is expected to bring some respite. The total amount of additional capacity between now and 2027 -for the projects which have taken FID- is about 150 mtpa (for reference, the global nameplate capacity at the end of 2021 was about 460 mtpa)

An interesting question is whether more FIDs are likely to be taken in 2022, which would be adding to supply possibly as early as 2026? There are already a number of candidates, with a total capacity close to 100 mtpa, though the FIDs may not be taken until 2023 or even 2024

The key factor in determining the taking of a FID is whether there are sufficient contracts in place to enable the financing of the project (especially for developers that need third-party finance). But a further consideration is that if the rise in global temperature is to be limited to 1.5 degrees C, then even abated gas demand may need to peak and decline at some point.

As a result, the next few years could be the last chance for a significant number of FIDs to be taken before the push towards decarbonization takes hold.

Source: OIES (LinkedIn)