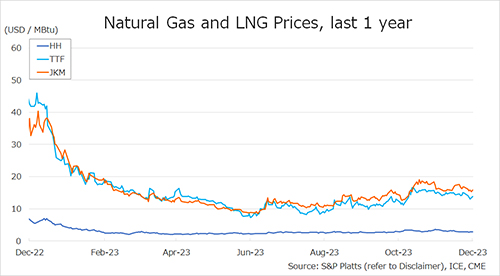

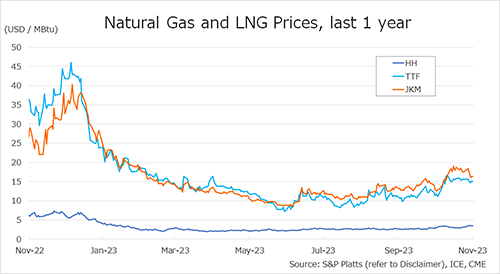

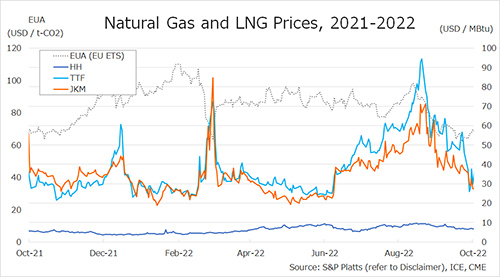

The Northeast Asian assessed spot LNG price JKM for the previous week (3-7 October) was on a downtrend due to high inventory levels and weak demand, falling to USD 29/MBtu on 5 October, from USD 37/MBtu the previous week.

Later, when a force majeure declaration was issued due to a gas pipeline leak in Malaysia and concerns about LNG supply were reported, the price rose to USD 33/MBtu on 6 October, but settled down to USD 28/MBtu on 7 October.

According to a 5 October METI release, LNG inventories for power generation were 2.67 million tonnes as of 2 October, up 600 thousand tonnes from the end of the same month last year and up 830 thousand tonnes from the average of the past five years, showing steady increase.

The European gas price TTF fell to USD 25.9/MBtu on 4 October from USD 46.0 the previous week. It then rebounded to USD 37.6/MBtu on 6 October, but fell to USD 29.7/MBtu on 7 October.

The underground natural gas storage level in Europe has remained above 90% of the fill rate for the week. In addition, LNG terminal berth slots are congested and European LNG prices are trending at a discount to TTF.

Meanwhile, Gazprom announced that the gas pipeline supply to Italy was suspended on 1 October, but resumed on 5 October.

The U.S. gas price HH fell slightly to USD 6.5/MBtu on 3 October from USD 6.8/MBtu the previous week. It then rebounded to USD 7.0/MBtu on 6 October, but fell to USD 6.7/MBtu on 7 October. According to reports, Cove Point LNG has been suspending shipments since 1 October for annual maintenance.

It will continue for approximately three weeks. Meanwhile, according to the EIA Weekly Natural Gas Storage Report released on 6 October, natural gas underground storage on 30 September totaled 3,106 Bcf, up 129 Bcf from the previous week, but still low, down 5.0% from the same period last year and 7.8% from the average of the past five years.

Updated 11 October 2022

Source: JOGMEC