Another big jump in natural gas prices today, as the prompt month for NYMEX Henry Hub trades up more than six cents near $2.85/MMBtu.

The entire forward curve is also moving higher, with 2021 contracts up an average four cents and 2022 contracts up an average of two cents.

The onset of seasonal natural gas demand, and, more specifically, power demand which sits at 26 Bcf/D, is starting to be represented in front month prices.

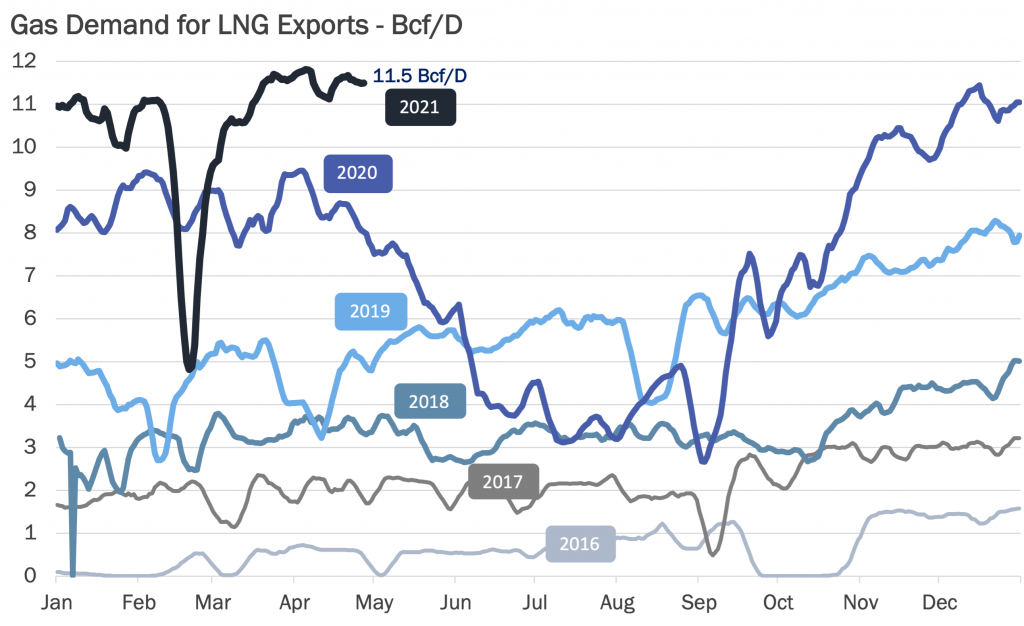

As gas production volumes continue to remain under 91 Bcf/D while LNG exports remain strong, upward momentum on prices can be expected.

However, this momentum could quickly slow should production volumes return and cooler weather that would suppress the onset of rising seasonal demand.

The market seems to be ignoring the anticipatedly low and bullish upcoming storage injection in comparison with the five year average for the week ending April 23rd, which G&A anticipates to be in the mid-teens.

Source: Gelber & Associates

Follow on Twitter:

[tfws username=”GelberCorp” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]