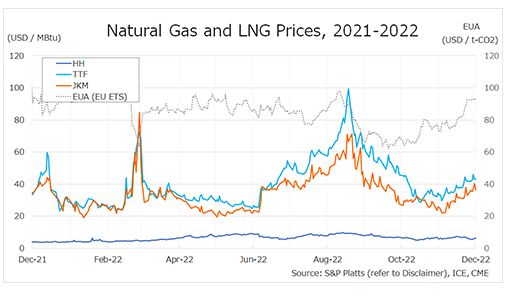

The Northeast Asian assessed spot LNG price JKM for the previous week (5 December-9 December) rose to USD 36/MBtu on 5 December due to emerging prompt demand due to cold weather in North Asia, from USD 33/MBtu the previous week.

It then fell to USD 35/MBtu on 6 December, supported by a mild weather forecast for the beginning of the year in Korea and high LNG inventories in Asian countries, but rose for two consecutive days to hit USD 40/MBtu on the back of rising demand in North Asia for the winter and relaxing zero-COVID policy in China.

On 9 December, it fell back to USD 36/MBtu due to high LNG inventories in Asian countries and weak end-user demand. According to METI, Japan’s LNG inventories for power generation were 2.63 million tonnes as of 4 December, up 0.11 million tonnes from the previous week, up 0.29 million tonnes from the end of the same month last year, and up 0.79 million tonnes from the average of the past five years, which remains a high level.

The European gas price TTF was almost unchanged at USD 41.8/MBtu on 5 December from USD 41.9/MBtu the previous week. It then rose for two consecutive days, hitting USD 46.1/MBtu on 7 December, due to the delay of nuclear power plant maintenance in France, improved trading liquidity from increasing the heating demand in Europe, lower offshore gas flows in Norway and the shutdown of a nuclear power plant in Spain.

It fell back to USD 42.8/MBtu on 8 December but rose slightly on 9 December due to delays in the operation of a nuclear power plant in Finland and European underground gas storage below 90%. According to AGSI+, EU underground gas storage peaked at 95.62% on 13 November and began to decline, standing at 88.92% as of 9 December.

The U.S. gas price HH fell for two consecutive days to USD 5.5/MBtu on 6 December from USD 6.3/MBtu the previous week. It then rose for three consecutive days to USD 6.2/MBtu on 9 December on the back of expected heating demand due to the forecast of cold weather in the next two weeks.

According to the EIA Weekly Natural Gas Storage Report released on 8 December, natural gas underground storage on 8 December was 3,462 Bcf, down 21 Bcf from the previous week, down 1.5% from the same period last year, and down 1.6% from the historical five-year average.

Updated 12 December 2022

Source: JOGMEC