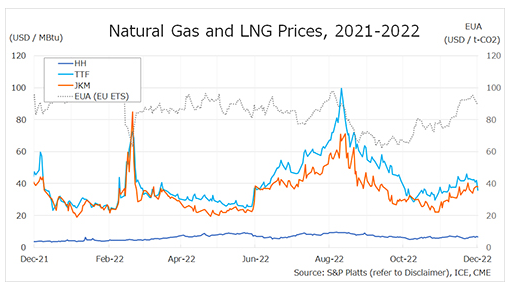

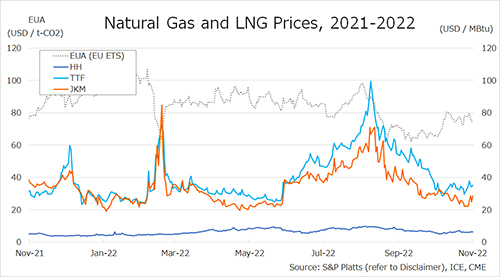

The Northeast Asian assessed spot LNG price JKM for the previous week (14 November-18 November) remained flat from USD 22/MBtu the previous week, but then rose for two consecutive days to USD 29/MBtu on 16 November due to higher European gas prices and heating demand in Asia for the winter season.

On 17 November, it fell back to USD 25/MBtu due to high LNG inventories in Asia and mild weather. On 18 November, the market strengthened and JKM rose to USD 29/MBtu on a glimpse of winter heating demand.

According to METI, Japan’s LNG inventories for power generation were 2.52 million tonnes as of 13 November, up 0.36 million tonnes from the end of the same month last year and up 0.57 million tonnes from the average of the past five years, which remains a high level.

The European gas price TTF rose to USD 34.4/MBtu on 14 November from USD 29.6/MBtu the previous week, despite continued mild weather and continued high levels of underground gas storage. On 15 November, TTF rose further to USD 37.8/MBtu due to increased demand associated with cooler temperatures.

The price fell to USD 34.8/MBtu on 16 November, due to downward pressure on prices from low gas prices in Egypt and Algeria and other factors, and fell further to USD 34.0/MBtu on 17 November, but rebounded to USD 35.1/MBtu on 18 November. According to AGSI+, the EU average underground gas storage on 18 November was 95.25%.

The U.S. gas price HH rose for three consecutive days after remaining flat from USD 5.9/Mbtu the previous week, reaching USD 6.4/Mbtu on 17 November. On 18 November, it turned around and slightly declined to USD 6.3/MBtu.

On the same day, Freeport LNG postponed the resumption of the initial production from mid-November to mid-December, subject to regulatory approval.

The market focused on strong heating demand and HH was on the rise. According to the EIA Weekly Natural Gas Storage Report released on 17 November, the US natural gas underground storage on 11 November was 3,644 Bcf, an increase of 64 Bcf from the previous week, up 0.1% from the same period last year and down 0.2% from the historical five-year average.

Updated 22 November 2022

Source: JOGMEC