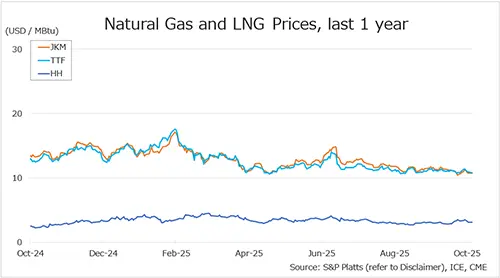

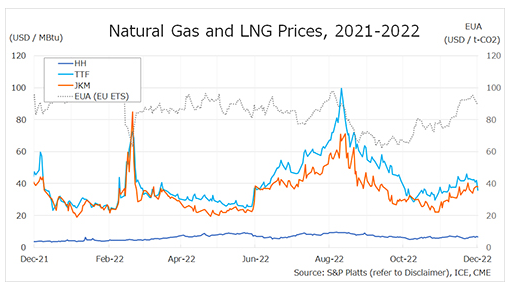

The Northeast Asian assessed spot LNG price JKM for the previous week (12 December-16 December) fell to USD 34/MBtu on 12 December from USD 36/MBtu the previous week as year-end trading slowed.

The price then rose for three consecutive days to hit USD 38/MBtu on 15 December due to cold weather in the Northeast Asia, increased buying interest from China due to the easing of its zero-covid policy, and rising demand for gas storage before the year-end holiday season.

It remained high at USD 38/MBtu on the following day, 16 December. According to METI, Japan’s LNG inventories for power generation were 2.68 million tonnes as of 11 December, up 0.05 million tonnes from the previous week, up 0.34 million tonnes from the end of the same month last year, and up 0.84 million tonnes from the average of the past five years, which remains a high level.

The European gas price TTF declined slightly to USD 41.8/MBtu on 12 December from USD 43.1/MBtu the previous week, and rose slightly to USD 42.5/MBtu on 13 December due to withdrawal of European underground gas storage and more active trading toward the year-end.

The price fell again to USD 41.0/MBtu on 14 December but rose to USD 42.9/MBtu on 15 December, supported by active trading ahead of the winter demand and the further drawdowns from the underground gas storage.

The following day, the price fell sharply to USD 35.9/MBtu on the back of the progress of new LNG import infrastructure, strong renewable energy generation, and other factors.

On 16 December, Deutsche ReGas announced the arrival of the FSRU tanker Neptune at the port of Lubmin. According to AGSI+, EU underground gas storage peaked at 95.6% on 13 November and began withdrawals, and as of 16 December at 84.6%, down 4.3% from the previous week.

The U.S. gas price HH rose for two consecutive days from USD 6.2/MBtu the previous week to USD 6.9/MBtu on 13 December. It then fell to USD 6.4/MBtu on 14 December, but rebounded to USD 7.0/MBtu on 15 December and then fell again to USD 6.6/MBtu on the following day.

According to the EIA Weekly Natural Gas Storage Report released on 15 December, the U.S. natural gas underground storage on 9 December was 3,412 Bcf, down 50 Bcf from the previous week, down 0.5% from the same period last year, and down 0.4% from the historical five-year average.

Updated 19 December 2022

Source: JOGMEC