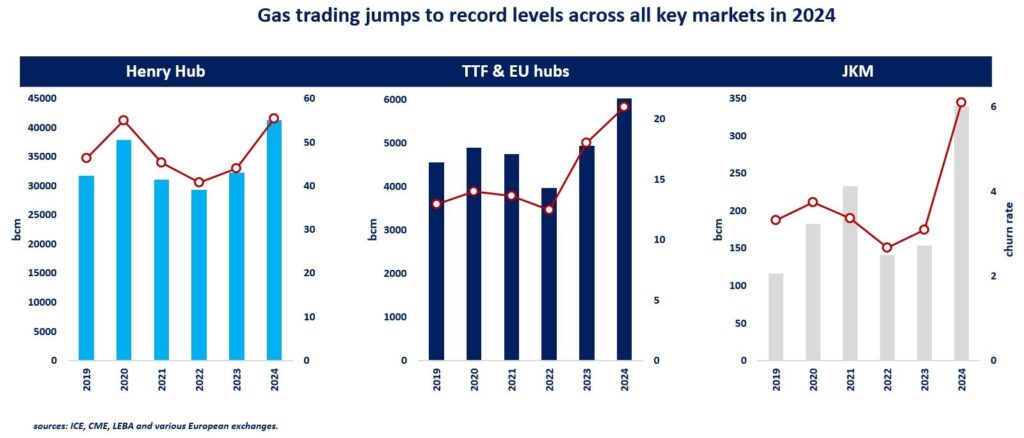

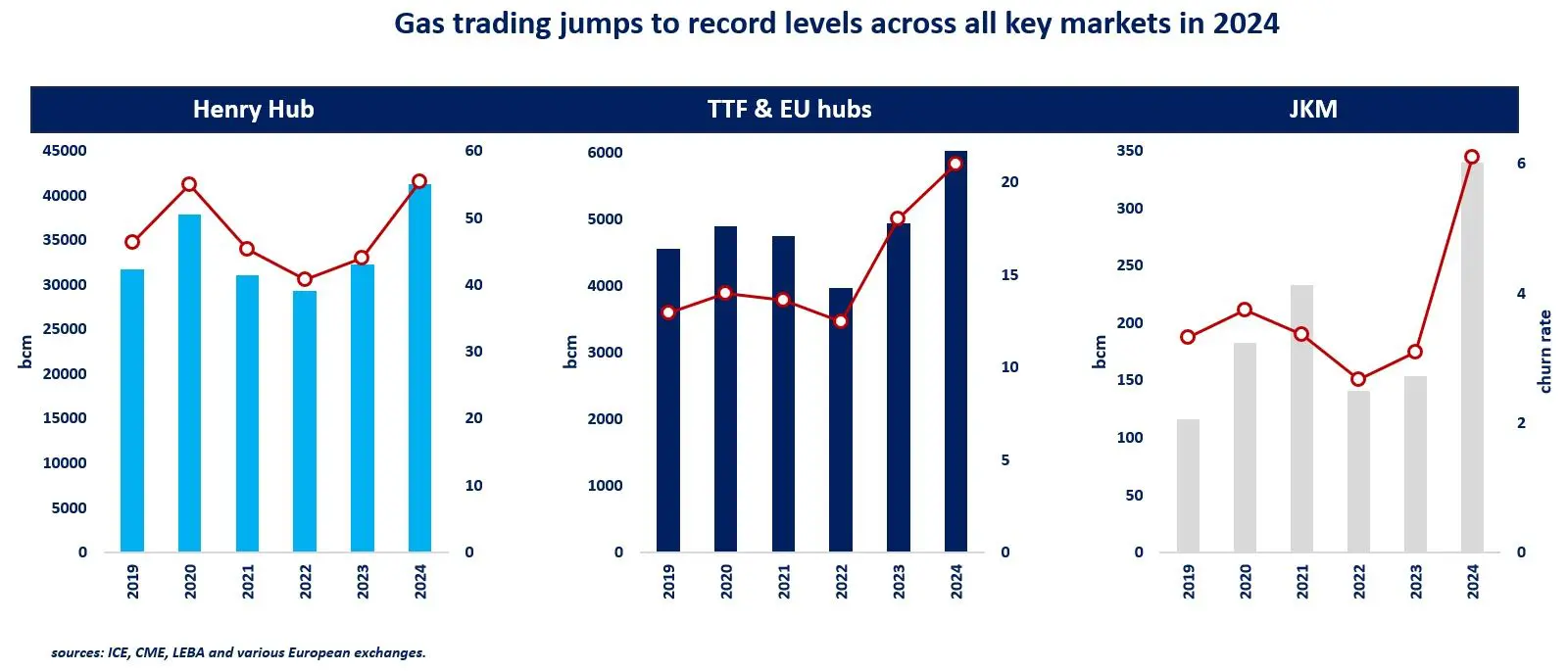

Natural gas trading soared to new all-time highs across all key markets in 2024, amid continued supply uncertainty, high volatility and AI enhanced algo trading.

In the US, Henry Hub traded volumes surged by 27% yoy in the first ten months of 2024 to a staggering record of 41 000 bcm (10 times the global gas demand). The churn rate, which measures liquidity, rose to an all-time high of 55 -topping the previous record in 2020 (when covid loosened up markets in an excessive manner).

Similarly, in Europe traded volumes rose by near 25% yoy to over 6000 bcm, with TTF now alone accounting for over 80% of total traded volumes. The combined churn for the EU+UK is now at just above 20, a steep recovery from 2022 -when the gas crisis squeezed trading volumes.

Very importantly, ICE JKM volumes more than doubled compared to last year, to near 350 bcm, which boosted the churn rate to around 6.

This reflects the growing liquidity of the northeast Asian spot LNG market – although remaining below the 10 churn threshold, above which a market can be considered liquid.

So what is driving this trading frenzy? Five key driving forces have emerged:

(1) lower margin calls: as the 2022/23 gas crisis is wearing off, margin requirements at exchanges have been significantly lowered, which naturally reduced the cost of holding positions and enabled players with less deep pockets to re-enter the trading business;

(2) continued supply uncertainty: tight supply fundamentals and the potential halt of Russian gas transit via Ukraine incentivised more hedging along the forward curve, especially through 2025 contracts;

(3) growing volatility: the rising flexibility requirements of increasingly wind/solar dependent power systems is driving up the volatility of gas-to-power demand, which in turn supports more short-term trading;

(4) globalisation of gas markets: the growing interconnectivity of regional gas markets is also supporting additional trading activity, with global portfolio players actively hedging outside of their region of physical delivery (for instance on Henry around 25% of trades originates now from outside the US);

(5) algo trading: AI-based technologies might have provided an additional boost to algo trading;

+(1) the financialisation of gas markets: greater price volatility, lower margin requirements and the availability of semi-automised trading tools is also attracting more financial players and is encouraging more speculation. and this is not necessarily a bad thing, as it feeds liquidity.

The record gas trading volumes are reflective of an increasingly complex gas world facing major supply side uncertainties in the short-term, which drives the need for more sophisticated hedging and risk-management strategies.

What is your view? How will gas trading evolve in the coming years? What is driving the growing trade volumes? Will JKM gain further liquidity?

hashtag#gas hashtag#LNG hashtag#TTF hashtag#JKM hashtag#HH hashtag#trading