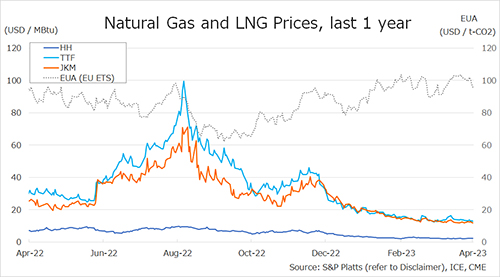

The Northeast Asian assessed spot LNG price JKM for the previous week (17 April – 21 April) rose from the late USD 11s the previous week to the late USD 12s on 19 April on the back of expectations of increased demand due to heat waves in India and Thailand and droughts in southern and eastern China, but amid high inventories and low purchasing interests in the market, JKM fell to USD 12/MBtu on 20 April and further to the late USD 11s the next day.

According to METI, Japan’s LNG inventories for power generation totaled 2.42 million tonnes as of 19 April, down 0.01 million tonnes from the previous week, up 0.46 million tonnes from the end of the same month of last year and up 0.47 million tonnes from the average of the past five years.

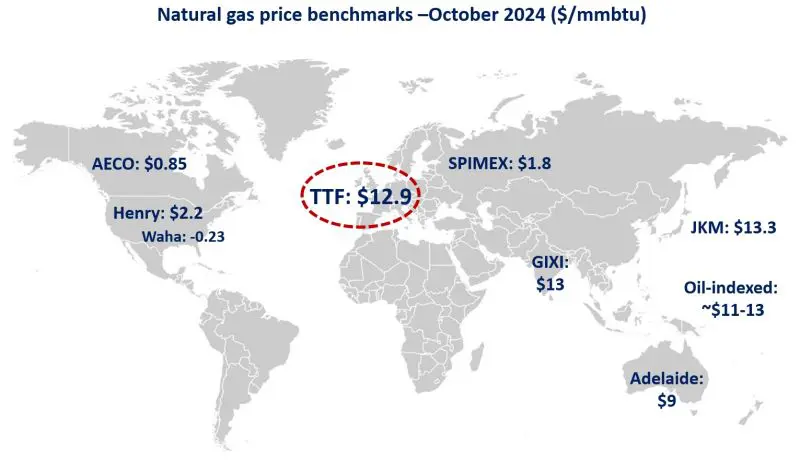

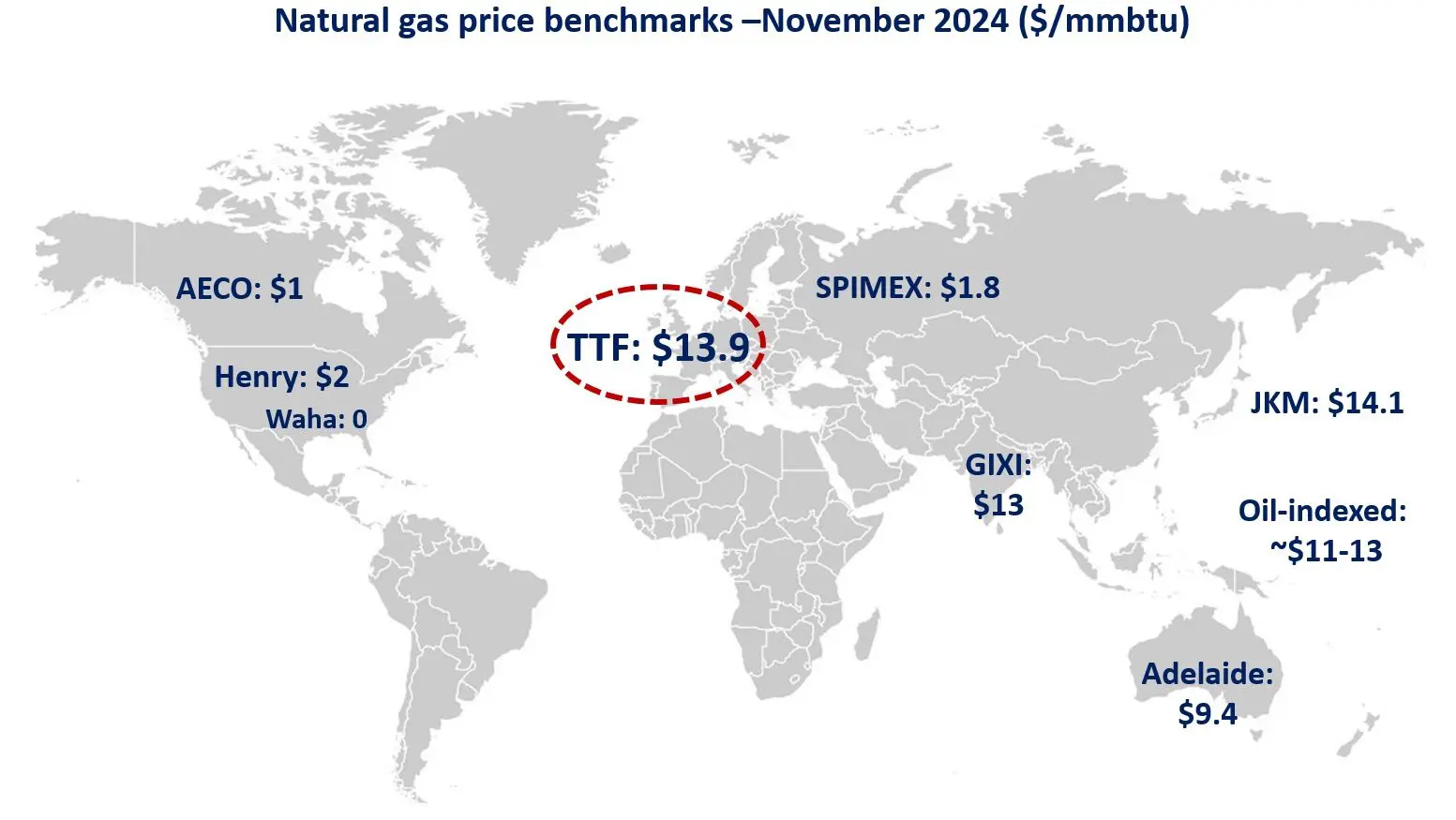

The European gas price TTF rose to USD 13.7/MBtu on 18 April from USD 13.3/MBtu the previous week due to the unplanned maintenance of the Njord gas field in Norway, in addition to the shutdown of the Eemshaven LNG terminal in the Netherlands that began last week.

On 19 April, TTF fell to USD 12.9/MBtu due to lower demand and higher-than-usual inventory levels (56%) as a result of warmer spring temperatures. On 20 April, TTF rose to USD 13.0/MBtu in response to unplanned maintenance at Norwegian gas fields and gas processing facilities, but fell slightly to USD 12.9/MBtu the following day.

ACER published the 21 April spot LNG assessment price for delivery in the EU at EUR 34.2/MWh (equivalent to USD 11.0/MBtu). According to AGSI+, the European underground gas storage rate as of 21 April was 57.3%, up from 56.2% the previous week.

The U.S. gas price HH rose for two consecutive days to USD 2.4/MBtu on 18 April, up from USD 2.1/MBtu the previous week. HH then fell, reflecting milder weather, to USD 2.2/MBtu on 21 April.

On 20 April, feed gas supplies to Freeport LNG reached a record level and exceeded 2 Bcf/d. According to the EIA Weekly Natural Gas Storage Report released on 20 April, the U.S. natural gas underground storage on 14 April was 1,930 Bcf, up 75 Bcf from the previous week, up 33.8% from the same period last year, and up 20.5% from the historical five-year average.

Updated 24 April 2023

Source: JOGMEC