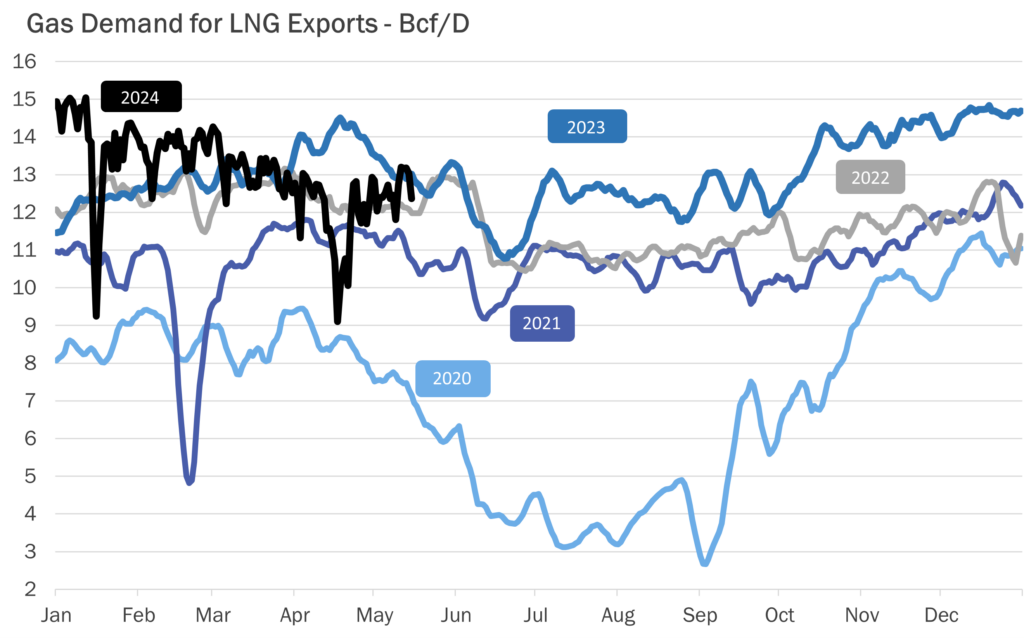

NYMEX natural gas futures are flat on the day, last trading at $2.37/MMBtu, slightly above last week’s high. We saw the expected Tuesday drop in production this morning to the tune of -0.9 Bcf/d, which left production levels at 99.1 Bcf/d. A -0.6 Bcf/d drop in LNG feedgas demand this morning brought the metric to 12.4 Bcf/d; this was driven almost entirely by a planned test at the Sabine Pass terminal, however, and that should be well recovered in the coming days.

Freeport is still running strong and is set to have over 2.1 Bcf of nominations today. Should later data confirm this, that would represent highs in daily nominations for the terminal not seen in around a year.

US midstream companies are optimistic about building a new greenfield natural gas pipeline from the Permian Basin by 2026, though no final investment decisions (FID) have been made, raising investor concerns about potential capacity constraints. Energy Transfer’s proposed Warrior pipeline and Targa Resources’ Apex pipeline are leading contenders, both aiming for FID by late 2023.

Kinder Morgan is also exploring options, though analysts speculate that the company remains tight-lipped due to competition. Brownfield expansions, like Kinder Morgan’s Gulf Coast Express, are being considered but the sheer volume of current and expected Permian gas means that they likely will not suffice to meet future needs.

Meanwhile, the 2.5 Bcf/d Matterhorn Express pipeline, set to begin service in Q3 2025, is expected to offer temporary relief for the supply-heavy region.

Source: Gelber & Associates