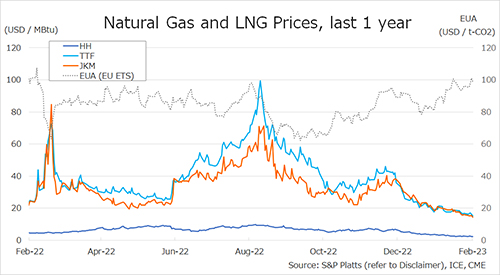

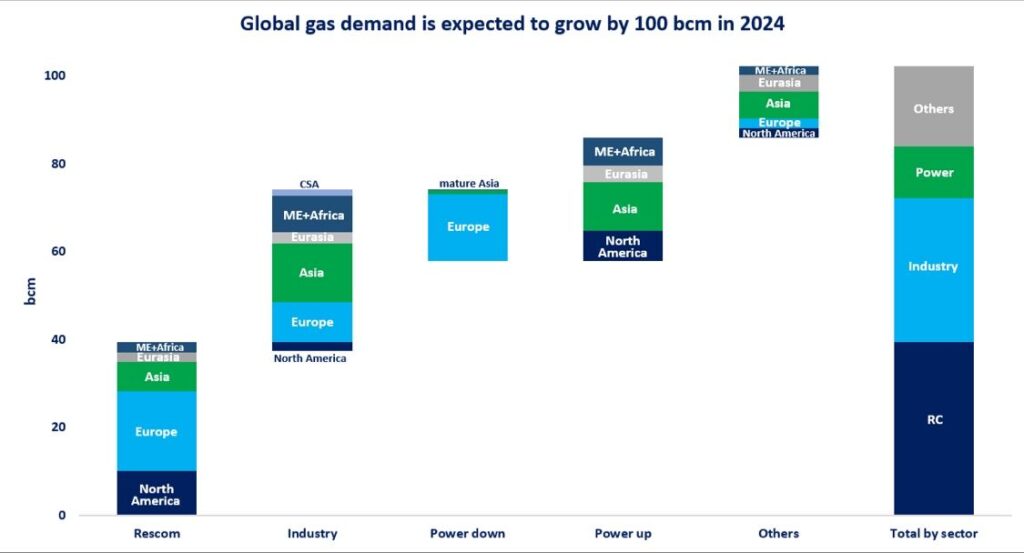

After rebalancing in 2023, global gas demand is expected to expand by 2.5% (or 100 bcm) in 2024. all regions are set to contribute to this growth, with Asia alone accounting for almost 40% of incremental demand.

Our 2.5% forecast is pretty close to the average growth rate displayed during 2010-21, the Golden Decade of Gas. however, not all of that growth is structural:

(1) The assumed return to average weather conditions is alone accounting for over one-third of the demand growth in 2024;

(2) Price-driven recovery in industry and power accounts for 15-20% of incremental gas demand in 2024;

Hence only half of the expected demand growth in 2024 is really structural, the other half is weather and recovery.

Nevertheless, the return to a more pronounced growth rate indicates that gas markets are getting over the 2022/23 gas supply shock, when the market lost ~120 bcm of supply in just two years.

Source: Greg Molnar