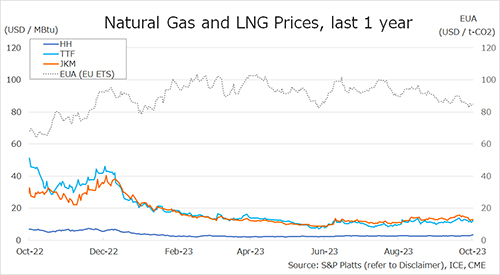

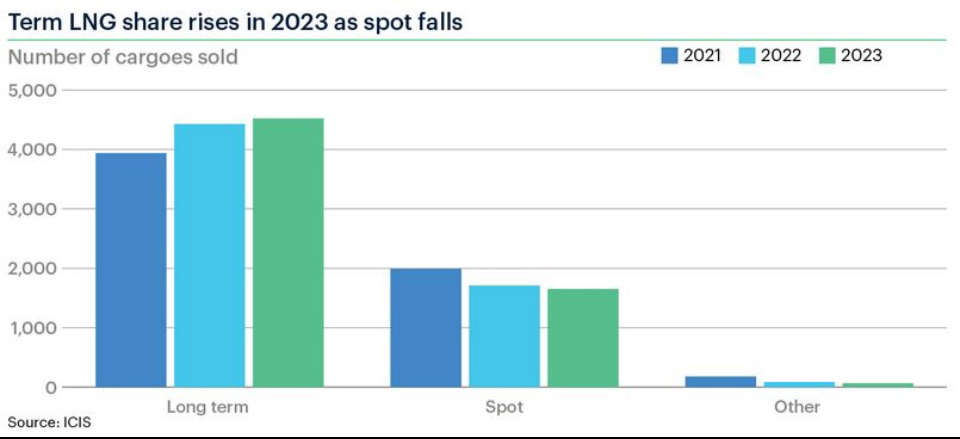

The share of spot LNG trade in the global market fell to a new low of 26% in 2023, down by 1 percentage point, according to ICIS analysis.

High spot vs contract prices supported long-term offtake with a 72% share – much of this linked to the price of oil – with a small share for short/ mid-term contracts.

China took just 22% of LNG as spot, unchanged from 2022, and down from 41% in 2021 with new term supply starting last year.

Europe’s spot share was more robust at just under 30%, very close to 2022

Early signs in 2024 are of a small rise in the share of spot trade with prices falling below prevailing oil-linked contract levels.

Further ahead, the large rise in US LNG production on a destination-free basis means the role of market-based pricing in Europe and Asia will be vital to pull in or push away supply.

What are you thoughts on the role of spot trade in 2024 and beyond?

Source: Ed Cox (ICIS Analysis)