Despite all the recent volatility, global gas price correlation continued to strengthen in Jan 26, highlighting the increasingly intertwined nature of regional gas markets.

2026 opened with explosive volatility, with Henry Hub swinging all around and recording an all-time high volatility of near 300%, while both TTF and JKM hit their highest price variability since the 2022/23 gas crisis.

Despite all the price swings, correlation among all three key benchmarks actually strengthened in January compared to last year.

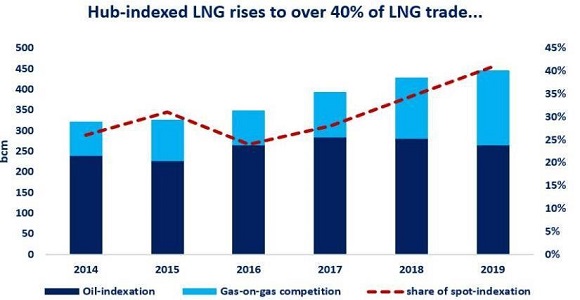

TTF and JKM displayed a correlation factor of 0.93, up from just 0.5 in Jan 25. This strong correlation seems to be structural, with both TTF and JKM now inter-linked with the growing volumes of flexible LNG. In addition, relatively low spot charter rates further contribute to the price correlation between the two benchmarks.

TTF seems to be in the driving seat at the moment, partly due to its liquidity and partly because of the stronger fundamental drivers present on the European market.

The TTF vs Henry Hub correlation rose from negative last January to just around 0.65 in Jan 26. This is partly driven by the coincidence of two cold spells hitting both the European and North American markets. But there are also more structural factors at play.

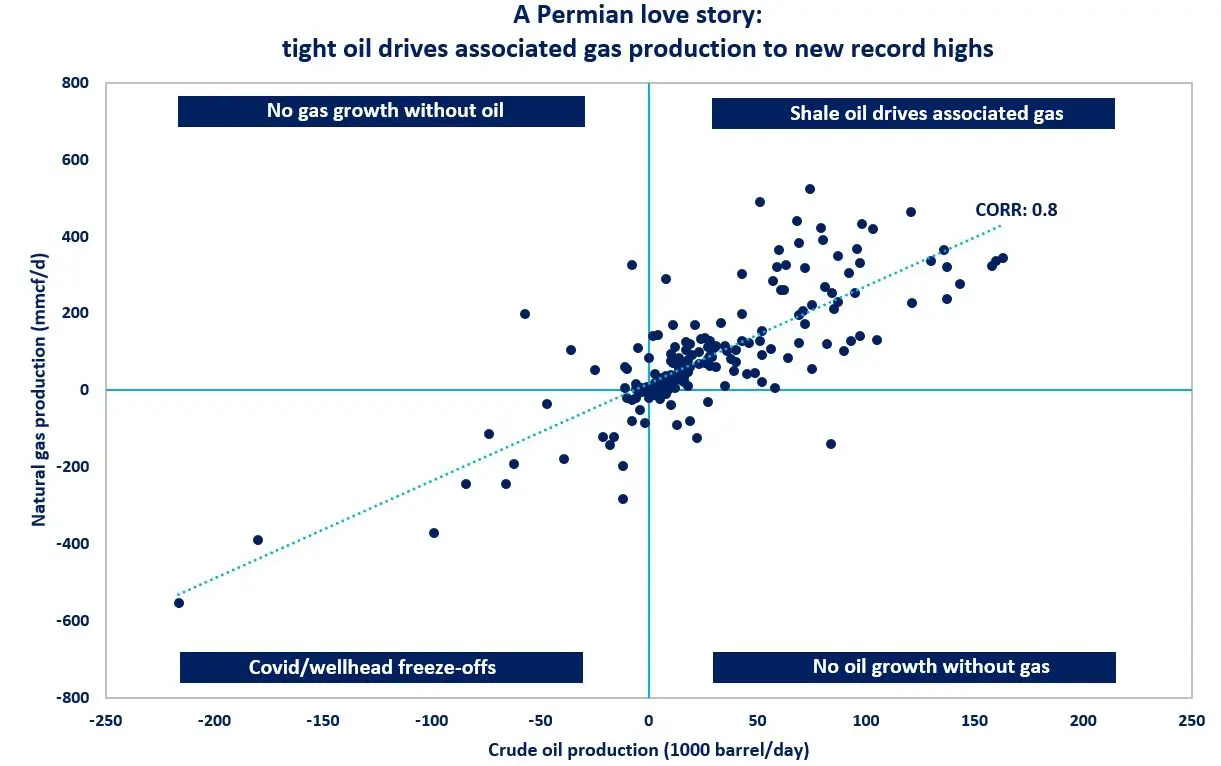

Storm Fern drove up sharply Henry Hub prices, while freeze-offs also impacted feedgas flows to US LNG terminals, plummeting by 40% through the worst days of the Arctic cold blast.

This steep decline, although short-lived, provided additional upward pressure on TTF prices.

This short episode highlights the increasingly important role played by US LNG in the European gas balance and hence the rising sensitivity of TTF to Henry’s mood swings.

What is your view? How will the correlation between global gas benchmarks evolve in the coming years? How do you see Henry’s growing influence? What does it mean for trading strategies and risk management practices?

Source: Greg MOLNAR