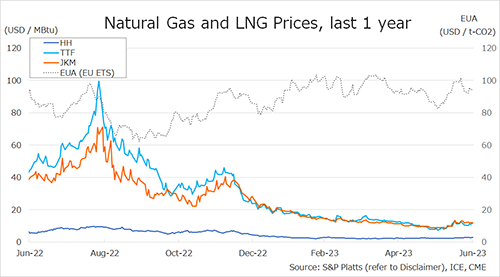

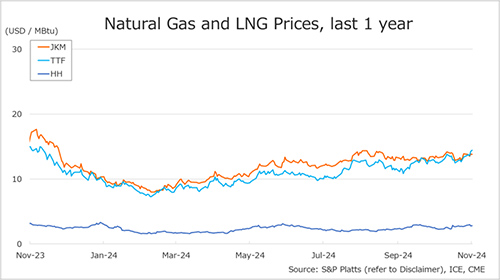

The Northeast Asian assessed spot LNG price JKM (December delivery) for last week (11 – 15 November) was almost unchanged at high-USD 13s on 15 November from high-USD 13s the previous weekend (8 November).

In the first half of the week, high inventory levels led to weak buying interest and the price fell slightly to the mid-USD 13s, but in the second half of the week, following the rise in European gas prices, it recovered to the high-USD 13s. TTF rose sharply, but the impact on JKM was limited due to sufficient supply capacity.

METI announced on 13 November that Japan’s LNG inventories for power generation as of 11 November stood at 2.21 million tonnes, up 0.09 million tonnes from the previous week.

The European gas price TTF (December delivery) for last week (11 – 15 November) rose to USD 14.4/MBtu on 15 November, the highest level since November 2023, from USD 13.4/MBtu the previous weekend (8 November).

TTF moved modestly during the first half of the week due to stable supplies from the Norwegian continental shelf and the withdrawal of underground storage against cold temperatures, but rose sharply on 14 November following the announcement of a possible gas supply cut-off from Russia by the Austrian OMV late in the evening on 13 November.

According to AGSI+, the EU-wide underground gas storage was 91.3% on 15 November, down from 93.8% at the end of the previous weekend. Withdrawals from underground gas storage continued throughout the week.

The U.S. gas price HH (December delivery) for last week (11 – 15 November) rose to USD 2.8/MBtu on 15 November from USD 2.7/MBtu the previous weekend (8 November).

The EIA Weekly Natural Gas Storage Report released on 31 October showed U.S. natural gas inventories as of 8 November at 3,974 Bcf, up 42 Bcf from the previous week, up 4.1% from the same period last year, and 6.1% increase over the five-year average.

Updated: November 18

Source: JOGMEC