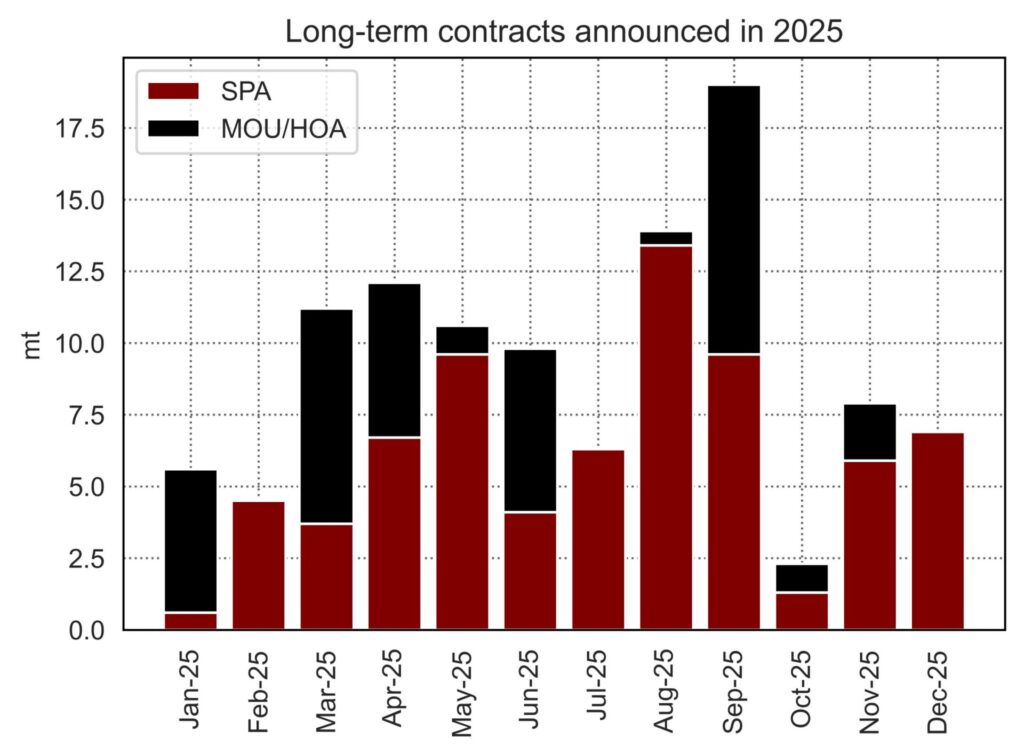

Long-term LNG contracts accelerated sharply in 2025, driven by a wave of US-linked deals and a surge in pre-FID project commitments, before activity slowed markedly toward year-end.

Over 100 long-term LNG contracts were announced in 2025, with about half of the total contracted volumes coming from pre-FID projects, mostly in the US. Activity was mainly concentrated between April and September and culminated with over 70 mtpa of new liquefaction capacity taking FID.

Contracting activity however reduced in Q4, especially from pre-FID projects, with only one SPA from such a project announced in the last three months. This is likely to remain the case in the next year, as only projects that are already close to the offtake commitments required to reach FID or that see sponsors taking a large share of the volumes on their books being likely to add further FIDs.

Among buyers, JERA was among the most active players in 2025. Almost all of its new offtake commitments came from the US, with this being likely driven in part by a need to ensure a more diversified and flexible portfolio, but also by the geopolitical factors that attracted many buyers to US LNG volumes.

Notable was also the activity by ADNOC, which was the player that announced the largest volume of sales under long-term contacts, as it secured destinations for its rapidly growing portfolio mainly to Asian buyers.

Source: Giovanni BETINELLI