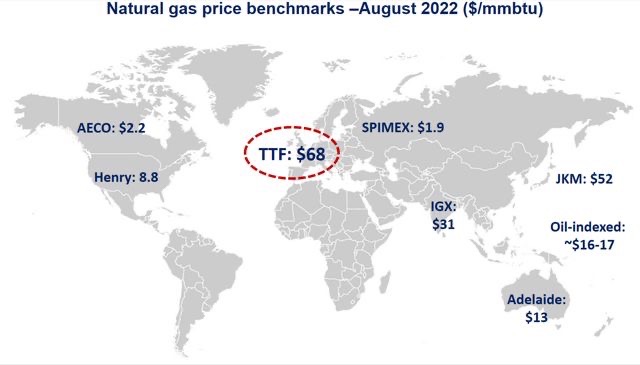

European and Asian prices exploded to new record highs in August amidst rapidly tightening Russian supply and fierce competition for LNG.

In Europe, TTF prices rose by 36% close to $70/mmbtu. Russian piped flows plummeted by 70% yoy, while gas-fired generation continued to rise amidst low hydro and nuclear output. gas demand was down by ~8%, largely driven by lower industrial gas consumption, which is now down by 25-30%.

In Asia, JKM prices jumped by 33% to a record high of $52/mmbtu, amidst fierce competition for spot LNG with Europe.

In the US, Henry Hub prices rose to $8.8/mmbtu -their highest August level since 2005. high cooling demand, low storage levels and muted upstream response all provided strong upward pressure on gas prices.

In contrast, Canadian gas prices plummeted, falling in some days into negative territory amidst strong upstream output, high storage levels and emerging pipeline bottlenecks.

What is your view? What is next for gas prices? Winter is coming, although TTF plummeted by 30% in the last 3 days. volatility is here to stay…

Source: Greg MOLNAR