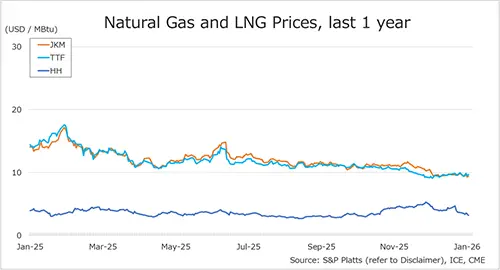

Global gas prices softened across Asia and Europe last week amid weak spot demand, easing weather risks and ample LNG availability, while US prices moved lower as mild winter forecasts weighed on heating demand expectations.

The Northeast Asian spot LNG price JKM (February delivery) eased to the mid-USD 9s/MMBtu on 9 January, down from the high-USD 9s the previous weekend. Prices came under pressure as weak spot demand persisted across Northeast Asia, with limited buying interest from China and South Korea amid comfortable supply conditions. JKM briefly firmed mid-week on the back of higher European gas prices and some spot cargo purchases, but gains proved short-lived. Japan’s LNG inventories for power generation stood at 2.30 million tonnes as of 4 January, down 0.13 million tonnes week on week.

The European gas benchmark TTF (February delivery) declined to around USD 9.7/MMBtu on 9 January, from USD 10.0/MMBtu the previous weekend. Prices moved lower overall despite mid-week volatility linked to shifting temperature forecasts, as expectations for easing cold weather reduced near-term demand concerns. EU gas storage levels continued to draw down, with inventories at 55.5% on 9 January, down from 61.0% the prior week, and well below both last year’s level and the five-year average.

The US benchmark Henry Hub (February delivery) fell to around USD 3.2/MMBtu on 9 January, down from USD 3.6/MMBtu the previous weekend. Prices weakened as forecasts for milder temperatures across much of the US reduced heating demand expectations, outweighing earlier mid-week price support from colder outlooks. The EIA reported US natural gas inventories at 3,256 Bcf as of 2 January, down 119 Bcf week on week, 3.6% below last year’s level and 1.0% above the five-year average.

Updated 12 January 2026

Source: JOGMEC